Investing in a private equity fund means investing in a fund managed by a private equity firm, also known as the adviser. Similar to mutual funds or hedge funds, a private equity fund pools money from multiple investors, which the adviser then uses to make investments on behalf of the fund. However, unlike mutual funds or hedge funds, private equity firms typically focus on long-term investment opportunities with an investment horizon of 10 years or more, often on assets that require time to sell. These funds commonly employ a strategy of acquiring a controlling interest in operating companies, also known as portfolio companies, and actively participating in their management to increase their value.

The key forms of private equity include:

- Venture Capital: Supports early-stage companies with high growth potential.

- Growth Equity: Targets established companies seeking expansion.

- Buyouts: Involve acquiring significant ownership in a company, often by purchasing existing stakes from investors to gain control.

Venture capital carries risk due to investing in unproven ventures, while growth equity focuses on mature companies aiming for further growth. Overall, private equity strategies vary but share the goal of generating returns by actively participating in the growth and development of privately held companies.

Note: While the adviser of a private equity fund may be registered with the Securities and Exchange Commission (SEC), the private equity funds themselves are not registered with SEC. Consequently, they are not subject to regular public disclosure requirements.

What is the Investment Process?

Private equity, an alternative investment, diverges from traditional assets like stocks and bonds, operating outside standard regulatory oversight. You can access this either through Direct Investment or ETFs.

-

Direct investment involves engaging with private equity firms, purchasing shares in their portfolios, and pooling capital for strategic investments in other companies. Notably, accredited investors, meeting income or asset thresholds, typically commit substantial amounts ranging from USD 10 million to USD 25 million. Although potentially lucrative, direct investment carries high risks, requiring careful risk assessment.

-

Alternatively, exchange-traded funds (ETFs) offer a more accessible avenue for private equity exposure. These funds track private equity firms' performance through diverse strategies, providing a diversified portfolio without the high entry barriers of direct investment. However, ETFs may not replicate the high returns of direct investment.

Ultimately, you must consider your qualifications, preferences, and risk appetite when choosing between direct investment and ETFs. Both options offer unique advantages and considerations, shaping the dynamic landscape of private equity investing.

Understanding the Private Equity Fund Structure

Private equity funds operate as closed-end investment vehicles with a finite period to raise funds. Once this window closes, no further capital can be raised.

These funds typically adopt either a Limited Partnership (LP) or Limited Liability Company (LLC) structure, comprising four main parties:

- General Partner: Responsible for managing the funds, they hold significant control over investment decisions and management of the fund.

- Limited Partnership: The fund itself is structured as a Limited Partnership. This structure offers tax benefits, as taxation occurs only at the investor level, avoiding double taxation that would occur with a corporate entity.

- Limited Partners: Investors who contribute capital to the fund become Limited Partners. They delegate control to the General Partner and benefit from limited liability, limiting their potential losses to the amount of their investment.

- Companies: Private companies that fit the fund's predetermined investment strategy are the recipients of investments from the fund.

It's common for private equity firms to structure themselves as Limited Liability Companies (LLCs) as it offers several advantages for investors:

- Limited Liability: Investors benefit from limited liability, shielding their assets from potential risks such as bankruptcy or lawsuits. They are only at risk for the capital they have committed to the fund.

- Pass-through Taxation: LPs and LLCs are structured as pass-through entities for federal income tax purposes. This means that instead of the fund paying taxes, profits and losses are passed through to investors, who then report them on their tax returns.

Who Is Eligible to Invest in a Private Equity Fund?

Private equity investment is typically limited to institutional investors and high-net-worth individuals due to high investment minimums, illiquidity, and complexity. Here's who can typically invest in a private equity fund:

- Retail Investors: There's a recent trend of making private equity more accessible to retail investors through avenues like Private Equity ETFs, online crowdfunding platforms, and direct investment in Special Purpose Acquisition Companies (SPACs).

- High-Net-Worth Individuals (HNWIs): Individuals with significant wealth can participate in private equity due to their ability to engage in more complex and sophisticated investments.

- Family Offices: These are specialized wealth management firms catering to ultra-high-net-worth individuals and families. They possess the expertise and resources needed to assess and invest in private equity opportunities.

- Institutional Investors: This category includes pension funds, endowments, foundations, insurance companies, and other large financial institutions with the resources to meet the substantial investment requirements of private equity funds.

- Secondary Market Investors: These investors purchase existing shares of private equity funds from other investors, often at discounted rates.

Overall, private equity investment demands careful consideration of its potential rewards and risks.

Advantages and Drawbacks of Private Equity Funds

Before making any investments in funds, it is crucial to carefully weigh the pros and cons:

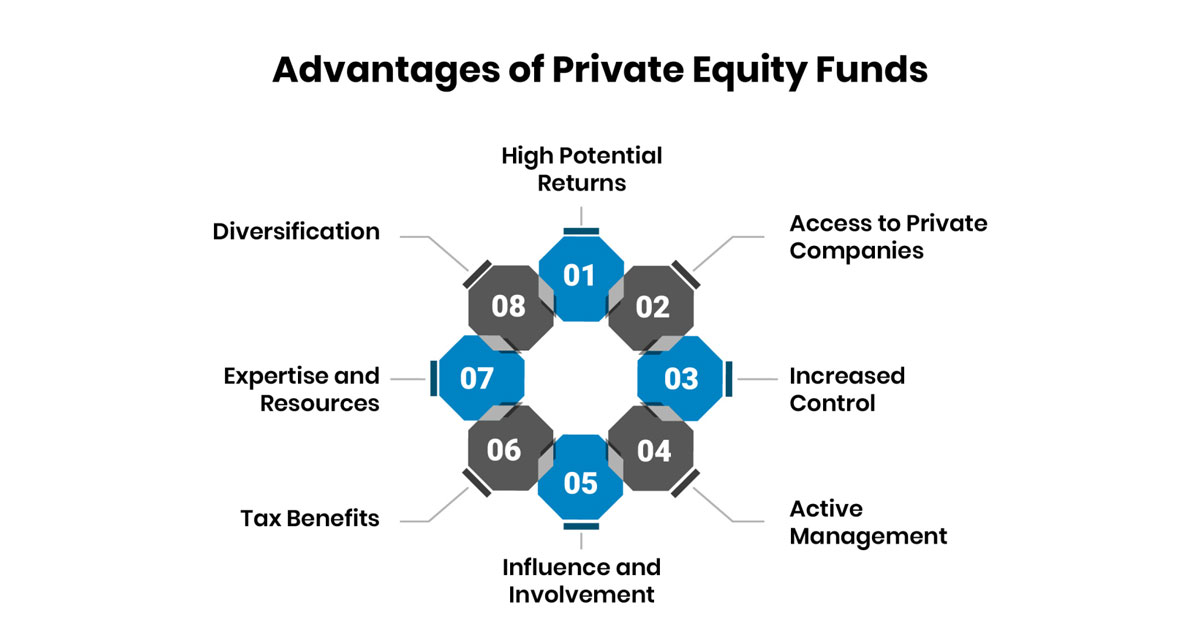

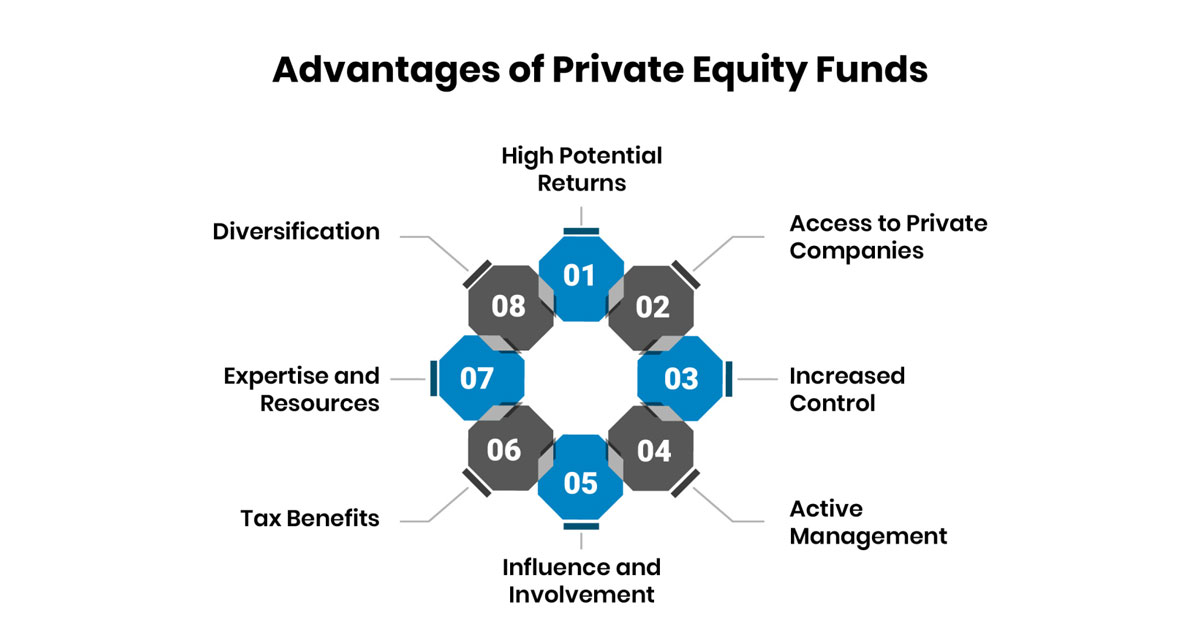

Advantages of Private Equity Funds:

-

High Potential Returns: Private equity investments often target companies with significant growth potential, offering the possibility of higher returns compared to public market investments.

-

Access to Private Companies: Investors gain access to private companies with high growth potential, providing opportunities for substantial success.

-

Increased Control: Investors have more control over their investments in private equity, actively participating in the management decisions of the invested companies.

-

Active Management: PE firms actively manage invested companies, aiming to enhance their performance and increase returns for investors through strategic interventions.

-

Influence and Involvement: Investors may actively participate in the growth and development of invested companies, offering both financial and professional rewards.

-

Tax Benefits: Some PE investments may offer tax advantages to investors, enhancing overall returns.

-

Expertise and Resources: Private equity firms bring expertise and resources to manage portfolio companies, leveraging industry experts and financial analysts to guide them toward success.

-

Diversification: Private equity investments provide exposure to different industries, diversifying risk and enabling investors to capitalize on opportunities outside of publicly traded markets.

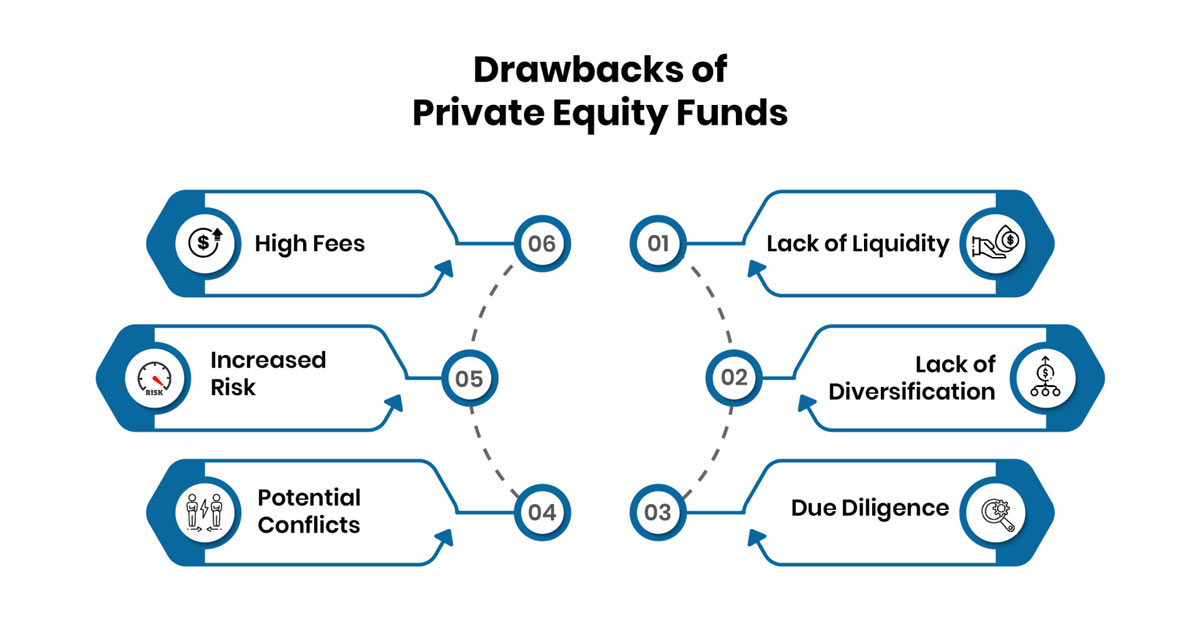

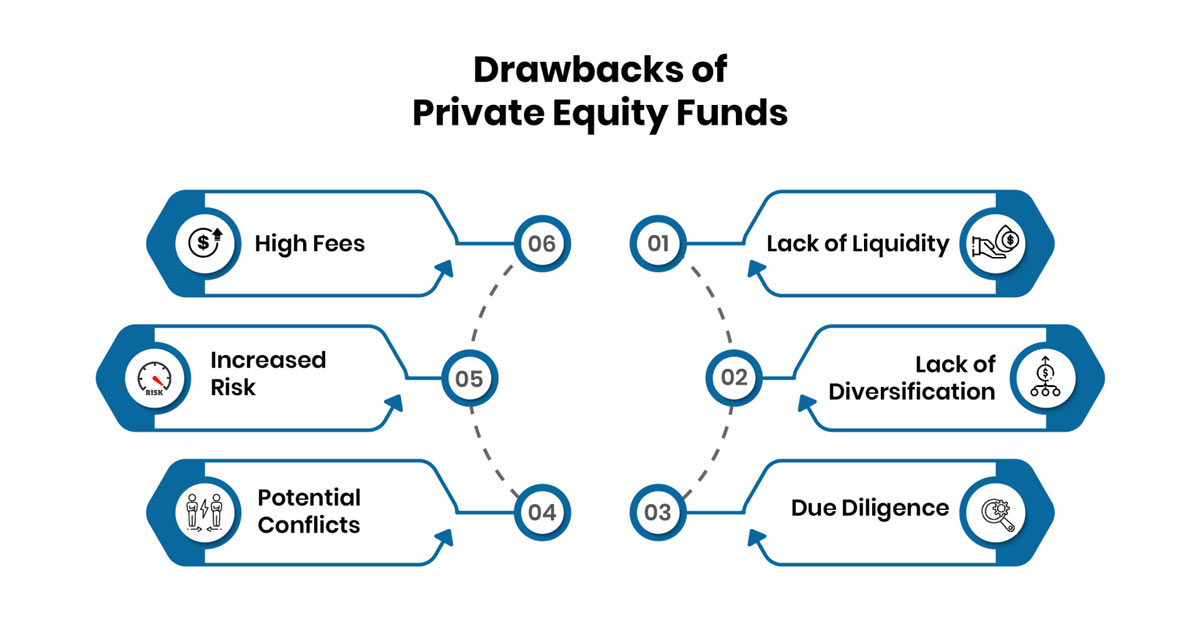

Drawbacks of Private Equity Funds:

-

Lack of Liquidity: These funds are typically illiquid, meaning they cannot be easily bought or sold, potentially limiting exit options.

-

Lack of Diversification: Concentrating a significant portion of the portfolio in a single startup or a few companies can lead to concentration risk.

-

Due Diligence: Evaluating the potential of a startup requires thorough due diligence on aspects like the business model, management team, market opportunities, and financials.

-

High Fees: Private equity firms charge management and carry fees, potentially reducing profits for investors.

-

Increased Risk: Private companies disclose less information about their financial health and operations, increasing investment risk compared to publicly traded stocks.

-

Potential Conflicts: There may be conflicts between maximizing shareholder value and decisions benefiting employees or customers of acquired companies.

Private Equity Fund Terms and Fee Structure

Private equity funds typically adopt a fee structure similar to hedge funds comprising— a management fee and a performance fee. Annual management fees hover around 2% of the committed capital fund.

Say, there’s a USD 1.5-billion private equity fund that charges a 2% management fee, equating to the firm earning USD 30 million annually, regardless of the fund's investment outcomes. Particularly for bigger funds, such management fees can spark debate over whether managers earn excessively, irrespective of their investment performance.

The performance fee, commonly known as carried interest, typically amounts to around 20% of profits generated from investments. The allocation of capital between investors and the general partner is divided, that specifies the carried interest percentage for the general partner.

Additionally, it outlines a minimum preferred return rate that must be achieved before the general partner can receive any carried interest profits.

Key Takeaways:

-

Before investing in private equity, consider exploring various investment structures like venture capital funds, private equity funds, or direct investments.

-

Ensure alignment with your goals and risk tolerance and conduct a comprehensive review of the investment product.

-

Indirect investment in private equity funds is possible through participation in pension plans or ownership of insurance policies, as these entities often allocate a portion of their extensive portfolios to such funds.

The Bottom Line

Private equity is a dynamic and influential sector within finance and investment. While direct investment in private equity is typically restricted to accredited investors, individuals can gain exposure to this market through publicly traded ETFs. This is possible, provided reasonable regulations are in place.