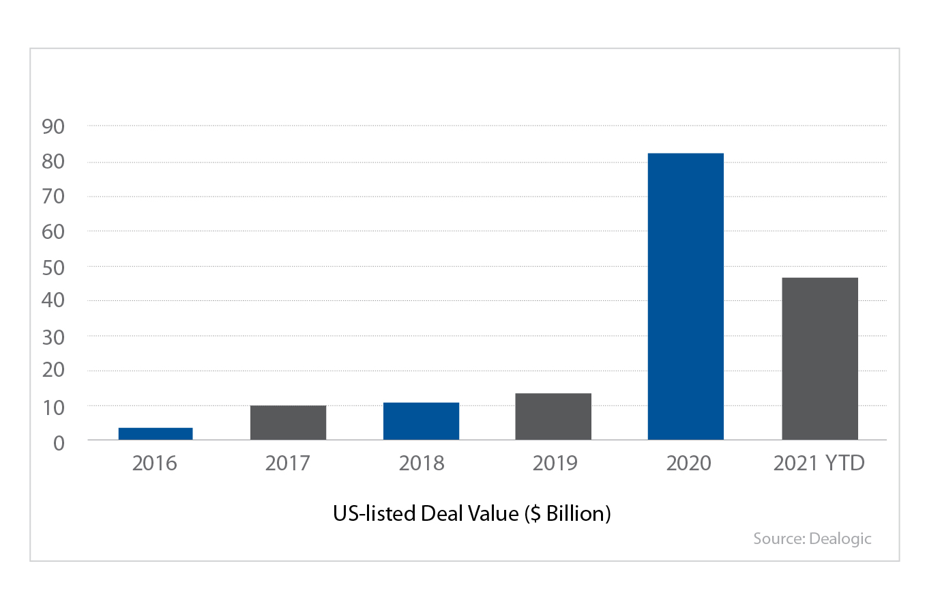

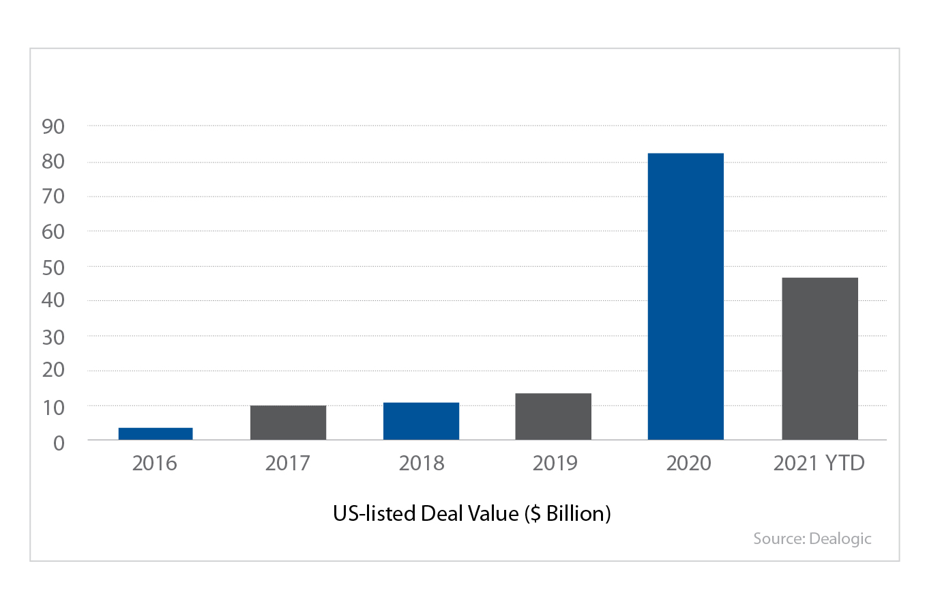

2020 was a record year for SPACs in the US, and it has continued into 2021. The deals completed so far are already upstaging previous records. As the trend catches up in the UK, Germany, Paris, and the rest of the world, USPEC takes a deep dive into this new investment trend.

Unprecedented is the word that best describes last year, referred to the many challenges it posed. It is also the word that defines the new trends that have emerged since. Special Purpose Acquisition Company (SPAC) is one such old financial fashion that saw a revival during these unprecedented times of 2020 and 2021.

SPACs are an alternative way of going public, which lets companies bypass the long-drawn and cumbersome process of Initial Public Offering (IPO). They boomed in the past year and the pace of SPAC deals continues to grow at a breakneck speed.

The Financial Times reported that in just the first six weeks of 2021, SPACs raised USD 42.7 billion (crossing USD 100 billion today), more than half of the amount it raised in all of last year.

As these new companies cum funds (SPACs) lookout for the firms to buy, we bring you up to speed on their history, working, and the implications for venture capital and private equity industry - A primer.

Table of Contents:

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a blank check company, which is publicly traded and created for acquiring or merging with other company or companies. After going public itself, SPAC acquires or merges with an operating company (or companies), which also becomes a publicly listed company in lieu of the SPAC’s public status.

The SPAC trend has become a giant experiment of taking firms public. With private companies delaying their IPOs, and COVID-led battered global economy impacting investments, the uptick in SPACs was well-timed. That said, it’s not the first time SPACs are introduced to the financial market.

They first emerged in the 1990s but gained extraordinary popularity only recently with the support from high-profile entrepreneurs, banks, celebrities, and blue-chip investors & private equity firms, which has in turn attracted more private companies to go public.

The total value from SPAC deals rose by 400% between 2019 and 2020 (Dealogic).

PE giants in SPAC

The potential and possibilities of SPACs have led some of the biggest PE firms to incorporate it in their investment toolkits. Most recently, Blackstone, a PE giant outshined its best of times by raising an operating profit of USD 1.75 billion in Q1 2021 – its biggest quarterly profit to date.

Many well-known PE firms like NYSE listed Apollo Global Management (AGM) have launched their SPAC strategy. In 2020, AGM launched a USD 750 million SPAC, and the firm has already registered another SPAC in 2021 named Apollo Strategic Growth Capital II targeting USD 400 million.

KKR is another private equity player to join SPAC trend raising USD 1.2 billion in US IPO. The latest wave of SPACs involves major investment groups like Goldman Sachs and TPG Capital. Many Asia-based sponsors are also chipping in from China, Singapore, Japan and Hong Kong.

SPACs offer a lucrative exit option for the portfolio companies of private equity firms despite the increased regulatory scrutiny. - Jonathan Gray, President, Blackstone

SPACs vs traditional investment structures

The current SPAC boom builds on the existing pattern of steady growth led by tangible advantages of SPACs over traditional investment methodologies. Though their management structures are not much dissimilar to regular PE and VC acquisitions, SPACs offer many advantages over conventional fund structures, including:

-

Limited risk and certainty of returns

The funds held in SPAC can be withdrawn in case it fails to complete the acquisition, or if an investor doesn’t wish to participate.

-

Easy exits

With SPACs, PE managers get easy exit options for their portfolio companies, and investors get the add-on ability to control the timing of exit.

-

Better incentives

SPACs do not mandate cash compensation pre- acquisition for the management teams and go a step beyond to tie their reward to the success of the acquisition.

-

Added flexibility for investors

With additional securities like warrants, investors get the right to purchase shares at pre-determined strike price over IPO price in a later date. In case the decided price isn’t reached, investors can take back their investments.

-

Combined fund and Bidco

SPAC operates as a fund and acquisition vehicle in one, and may even offer the feature of corporate structuring, thus saving a lot of legal, and administrative costs.

-

Emphasis on forward looking projections

Target companies usually don’t provide future projections with as much enthusiasm as in SPACs due to the liability risks.

How SPAC mergers work?

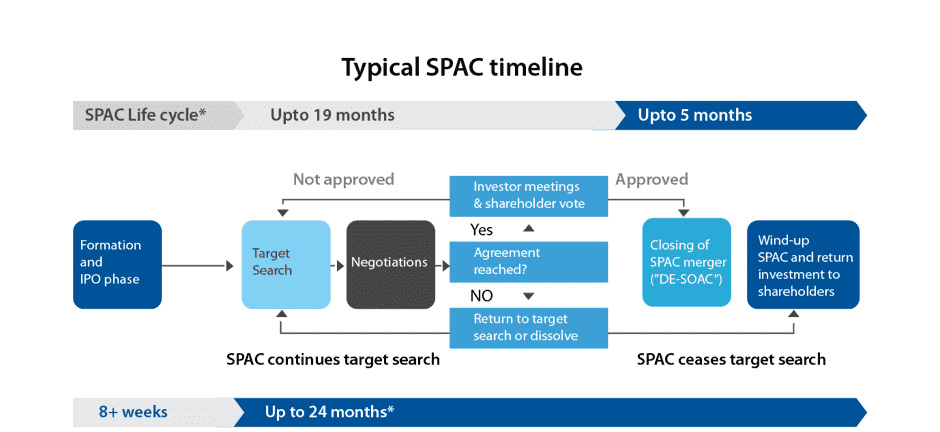

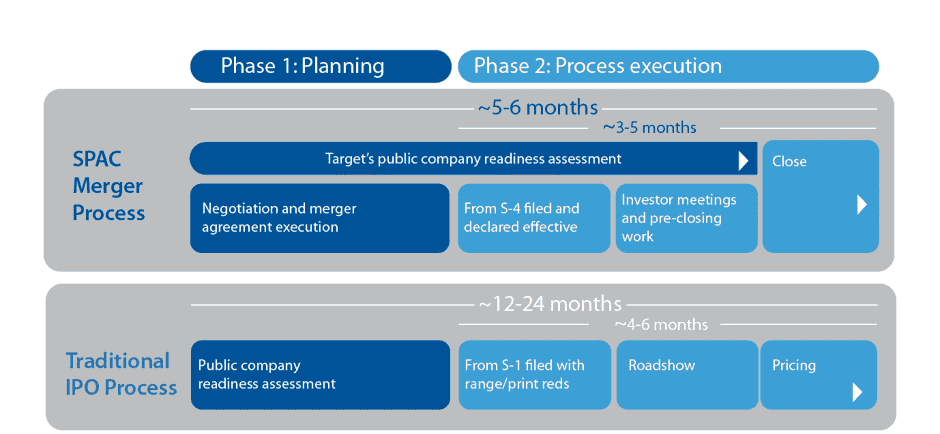

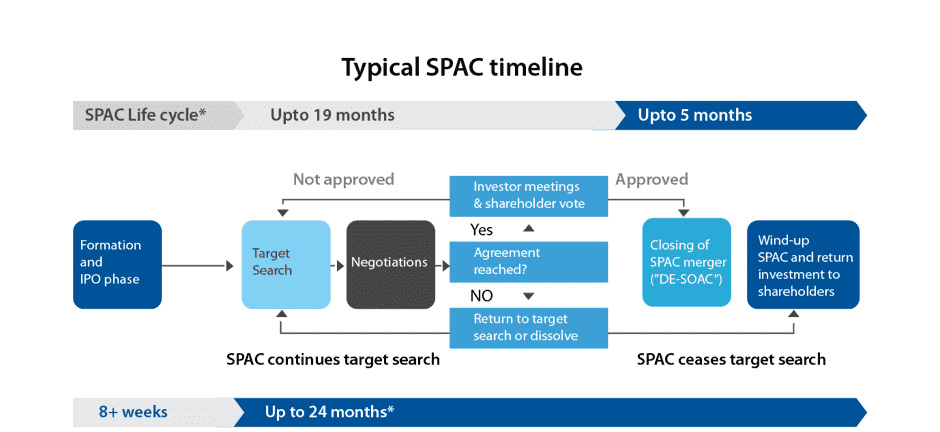

The SPAC merger process, which is also the period of public debut for the target private companies, is completed in as less as three to five months against the yearlong slogging of a typical IPO timeline. Check how the specifics work out.

Source: PwC

Formation of a SPAC

An experienced management team or a sponsor makes a SPAC with basic investment capital, which commonly translates to about 20% interest, also known as founder shares. The rest of the 80% interest is held by public shareholders, which is offered in an IPO. Every unit constitutes a common stock and a SPAC warrant.

Both public and founder shares have similar voting rights, except that SPAC directors can only be elected by those with founder shares. Warrant holders don’t have any voting rights but enjoy greater investment protection.

Attraction for SPAC investors

Investors don’t typically know the companies a SPAC is going to acquire. Then how do the investors determine if they should invest? The answer lies in the sponsor team.

Investors look at the quality of the sponsors and founding team who is setting up the SPAC. An entrepreneurial track record, experience of financial industry, or previous involvement of some or all sponsors in leading listed companies act as a real confidence booster. Investors believe these people can execute a winning strategy.

SPAC IPOs may also be based on pre-determined investment propositions focusing on a specific sector or geography, say a tech company in Silicon Valley, which can appeal to more investors.

Counter against risks

What happens when the target merger plans of a SPAC fail? After the IPO, a SPAC typically has an 18 to 24 months’ period to identify and complete the intended acquisition. If the plan doesn’t pan out in this timeframe, it liquidates, and investors redeem their capital.

The 24-month window period has actually strengthened investors’ resolve in SPACs in the US and led to its unprecedented growth.

Furthermore, after the target company for acquisition is identified, public shareholders may also vote against the transaction and choose to redeem their shares, following which SPAC may raise more funds through debt or additional shares in PIPE deal, short for private investment in public equity.

In Snapshot: How SPAC works?

A group of sponsors raises funds for a SPAC with no underlying business model. Once it goes public, it hunts for the private companies to acquire or merge with. When additional funds are needed to complete an acquisition, the SPAC along with the target company get outside investors through PIPE deals, also called private investment in public equity.

The proceeds from PIPE are reflected on the acquired company’s balance sheet and in exchange, a significant equity stake is given to the investors who get stock in the acquired company, which trades publicly through the SPAC.

Why companies are choosing SPAC over IPO?

SPACs are increasingly galloping IPO market. In 2021 so far, over 84 companies have declared they will float via SPAC versus 123 in IPOs.

Their enthusiasm for SPAC over IPO can be captured under three sets of reasons.

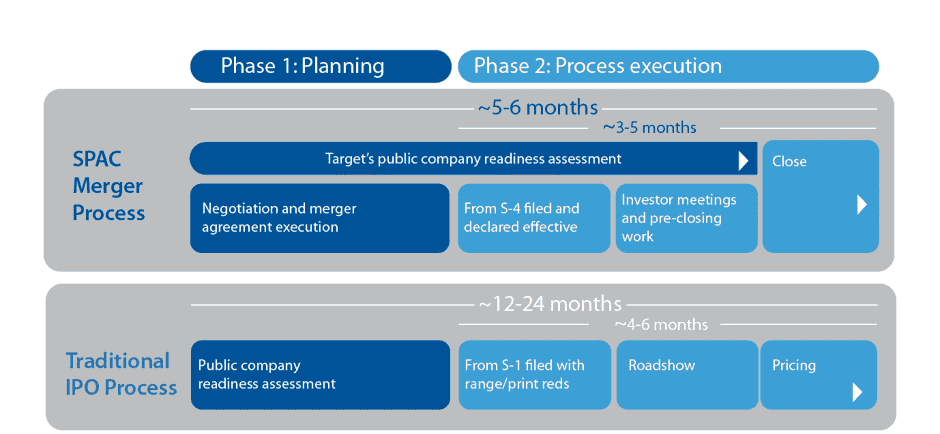

1. SPAC route is quicker

Going public through initial public offering is an intensive undertaking, which involves roadshows to drum up investors’ interest, media spotlight, enormous legal responsibilities, and possibly a trip to the stock exchange. This entire process can last anywhere between a year or two. SPACs let private companies go public in a way lesser time (just three to five months) and without having to go through the IPO process.

SPAC Lifecycle vs IPO Process

Source: PwC

2. Nature of the business

Private companies in the early stage or operating in a sector where proof of concept is yet not fully accomplished or is difficult for the layperson to fathom, opt for and benefit from the SPAC route. It allows these companies hidden among the crowd or in nascent phase to share their vision with the investors, forward their plans and projections, and raise capital publicly.

Aloke Gupte, a senior JP Morgan banker explains.

All of us know that by 2030 there will be more electric vehicles than today. The question is, whose EVs will they be? It’ll be Tesla’s, but who else? SPAC route helps niche and not so branded companies to pitch their plans to investors and go public.

That said, it is not uncommon for well-established high-growth companies as well to choose the SPAC route (perhaps due to its sheer simplicity). Some of them are 23andMe, SoFi, Matterport, and Desktop Metal.

3. Other advantages

SPAC offers other benefits compared to IPO, like access to capital even during market volatility, which may limit liquidity, lower transaction fees, greater flexibility in terms of the deal, etc.

Challenges for SPACs

Given the unparalleled returns from SPACs in the public market, the regulatory scrutiny riding over them is also very high. Post-March 2021, fund managers and investors have grown a slight conscious of treading in the blank cheque waters (evident by the pace of SPAC deals).

Some concerns among regulators include the proneness of SPAC route to manipulation. There are currently a few rules for managing SPACs. For instance, the guidelines to prevent the SPAC executives from keeping a big slice of equity for themselves, detrimental to the outside investors who usually spend much higher, are missing. Limited partners have also raised concerns about fund managers and management team’s ability to deploy other capital from the main buyout funds due to stiff competition from SPACs. Regulators as well as investors are also anxious over the lack of due diligence in taking target companies public through SPAC as it doesn’t include enough gatekeepers that expose investors to risks.

For the target companies, the challenges in SPAC center around becoming ready for the public market in time (3-5 months), and efficiently handling the complex accounting and financial requirements.

Skepticism isn’t always damaging. It’s rather a sign of a maturing market.

Many investors are optimistic that the 2021 SPAC wave will be more durable and lasting. Though still relatively young, SPACs are expected to evolve with the rules and regulations.

Implications for PE Fund Managers

Like the growing support for ESG investing, SPAC is a new investment trend that’s sweeping the VC and PE industry, and professionals must pace themselves for the change. Though the review process for a SPAC in the US isn’t much different from the IPOs, when planning for SPAC transactions PE fund managers must demonstrate expertise to navigate these deals. They must:

-

Garner the necessary SPAC know-how to get sponsors onboard, select target companies, and negotiate the most optimal deal.

-

Seek ways to maintain the trust of institutional investors in PE firm’s ability to deploy other funds, as well as the new SPAC skill.

-

Have project management capabilities to execute the merger in a compressed SPAC timeline, while reducing the costs, and increasing efficiencies.

-

Work with target company through accounting for the transaction.

-

Understand the SEC review process for SPACs in the US, and regulatory protocols of other countries.

-

Be able to assist in securing additional funding via PIPE financing among others.

In Closing

Not all companies going public through SPAC may succeed, but its existence as an alternative route to floating companies is a welcome move; exhibited by the heavyweight institutional investors and PE firms joining the club.

Strengthen your position as a private equity professional in the changing PE space with a world-class, industry-curated professional qualification – Chartered Private Equity Professional or CPEP™.

For more information on PE learning opportunities, ongoing trends, and insights, visit USPEC.