Private equity and venture capital are often mixed up, given their common goal of investing in companies for profits. However, their approaches differ significantly.

So, if you're contemplating your professional path or seeking insights into these dynamic fields, this blog is your guide. Read along to explore the key differences and unique characteristics of Private Equity and Venture Capital.

What is Private Equity (PE)?

Private equity is an investment avenue focused on non-publicly traded companies. In essence, it involves investing money and acquiring control in private companies. PE firms, or private equity firms, execute these investments. The nature of PE firms varies based on their specific investment activities. Some specialize in buy-outs, gaining majority stakes and control over companies. Notably, venture capital is a subset of private equity.

Private equity career path involve diverse tasks, from marketing pitches and asset evaluation to deal sourcing and client relationship management, progressing from analyst to partner.

What is Venture Capital (VC)?

Venture Capital revolves around injecting funds into startups and early-stage companies, drawing resources from sources like investment banks and private equity firms. The primary VC objective is to pinpoint promising startups, offering financial backing, strategic counsel, mentorship, and networking opportunities to foster growth. VC firms may specialize in particular industries, investment stages, geographical regions, or startup types. Investment strategies vary, adapting to diverse industry and company phases such as seed or expansion stages.

The venture capital career path involves activities like deal sourcing, due diligence, portfolio support, networking, and fundraising. The career trajectory mirrors that of private equity, progressing from entry-level analysts to esteemed partner roles.

Key Takeaways of private equity vs venture capital—

-

Private Equity

- Focus: Heavily deal-oriented.

- Pros: Better financial rewards, especially in a shorter timeframe.

- Cons: Longer working hours (60 – 80 hours).

-

Venture Capital

- Focus: Relationship-driven.

- Pros: Better work-life balance (50 – 60 hours).

- Cons: Relatively lower financial rewards compared to private equity.

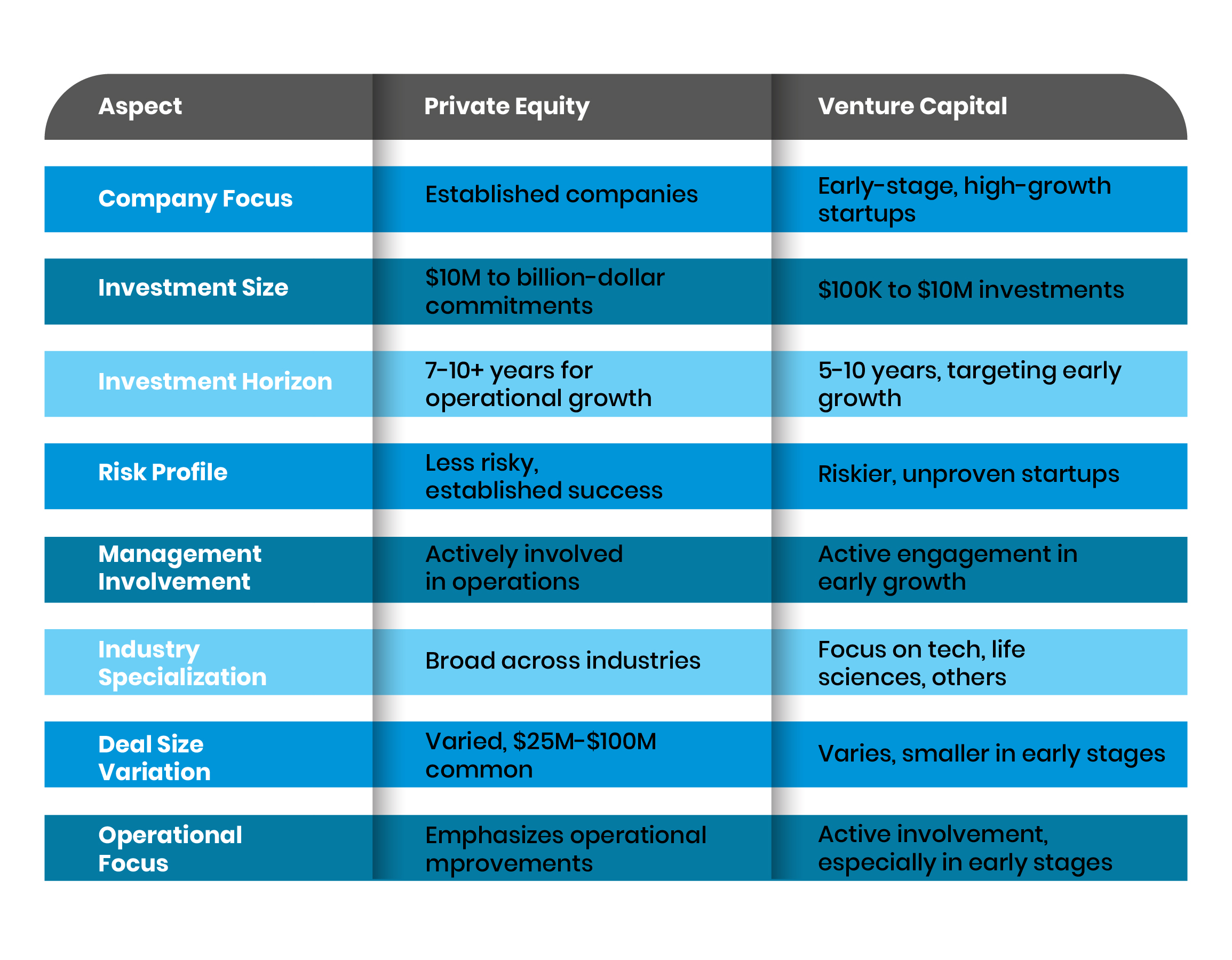

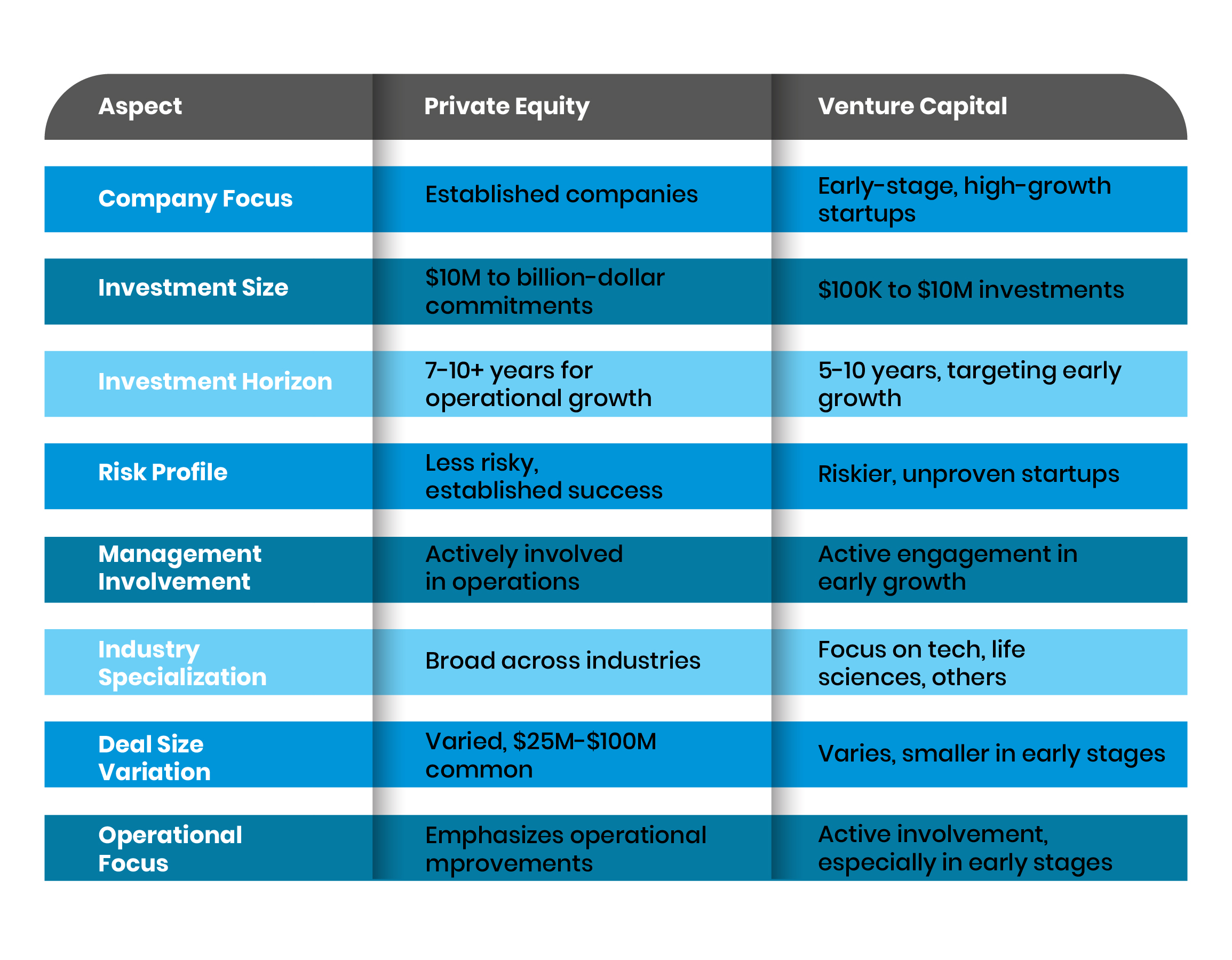

Navigating Distinctions: Private Equity Vs. Venture Capital

There is a significant difference in the way firms involved in these two types of funding conduct business.

-

Company Focus

- Private Equity: Targets established companies for expansion or restructuring across various industries.

- Venture Capital: Invests in early-stage companies, particularly in technology and life sciences, emphasizing high growth potential.

-

Investment Size

- Private Equity: Dives substantial commitments, spanning from $10 million to well beyond the billion-dollar mark, to fuel the growth of firmly established companies.

- Venture Capital: Traditionally channels smaller investments, fluctuating between $100,000 to $10 million, to fuel the ambitions of startups and early-stage ventures.

-

Investment Horizon

- Private Equity: Commits for 7-10+ years, actively enhancing operations for maximum profits.

- Venture Capital: Targets a swift return in 5-10 years, concentrating on early-stage growth.

-

Risk Profile

- Private Equity: Deemed less risky, leveraging established success and profitability, with thorough risk assessment before investment.

- Venture Capital: Perceived as riskier due to investments in unproven startups lacking a track record of success.

-

Management Involvement

- Private Equity: Actively involved in operations, focusing on enhancing efficiency, revenue growth, and overall performance.

- Venture Capital: Actively engages in managing companies, offering guidance, especially in early-stage growth.

-

Industry Specialization

- Private Equity: Casts a broader net across industries but may avoid certain sectors due to regulatory constraints.

- Venture Capital: Focuses on technology, life sciences, and diverse sectors like media, entertainment, energy, and consumer products.

-

Deal Size Variation

- Private Equity: While average deals are substantial, a significant percentage falls in the $25-$100 million range, with variations across markets.

- Venture Capital: Deal sizes vary, with smaller amounts common in early stages and larger amounts in subsequent funding rounds.

-

Operational Focus

- Private Equity: Emphasizes operational improvements but varies widely among firms.

- Venture Capital: Some VC firms are actively involved in a company's operations, providing support in areas like recruiting, sales, and marketing.

Making the Right Choice

The decision to choose private equity or venture capital ultimately boils down to your preferences and career goals.

-

Private equity is suitable for those envisioning transformative roles, focusing on established firms' expansion and restructuring. Venture capital, on the other hand, caters to the fervor of individuals keen on fostering early-stage growth for high-potential startups.

-

The recruitment journey diverges between these realms. Private equity's meticulous process, spanning on-cycle and off-cycle phases, prioritizes prestige, deal experience, and modeling tests. Off-cycle recruiting takes precedence in Venture capital, featuring qualitative interviews spotlighting networking, deal sourcing, and market acumen.

-

Work culture nuances emerge as PE leans towards technical intricacies, deal coordination, and portfolio vigilance, while VC pivots to qualitative tasks, founder collaboration, and active deal review with a perceived lower technicality.

-

Considering risk tolerance, PE charts a course through established companies, meticulously assessing risks. Conversely, VC's inherent riskiness is rooted in unproven startups.

-

Compensation reflects the divergence, with PE commanding attention with substantial pay ranging from USD 275,000 to 390,000, while VC offers a comparatively lower scale from USD 80,000 to 293,001, contingent on fund size and role.

-

Exit opportunities unfold uniquely. PE offers a spectrum, often involving mid-career transitions or pursuing an MBA for advancement. VC, with more specialized exit paths, allows transitions to PE, albeit challenging, especially in later career stages.

Key Takeaway

-

Choose private equity if you thrive in intensive deal environments and prioritize financial gains.

-

Opt for the venture capital career path if you value relationships, envision starting your venture, and seek a more balanced work-life equation.

-

Ultimately, the right choice aligns with your aspirations and the work environment that resonates with your professional ambitions.

Final Thoughts

Knowing the distinctions between private equity and venture capital is vital for navigating your career in finance. These realms offer distinct yet compelling opportunities. Finally, your career goals and risk appetite become decisive factors in choosing the right path, ensuring a fulfilling and successful professional journey.