Private Equity and Hedge Funds guys typically come into a situation of mediocrity, where rapid change may result in a profit.

- Austin Ligon

Hedge fund and private equity a high-risk, alternative investment funds, which invest in marketable securities and private organizations. However, they vary depending on the investment structure, horizon, expense ratio and taxation.

What is Private Equity?

Private Equity (PE) is a kind of financing where money, or capital, is invested into an organization. Investments are made into mature businesses in traditional industries in exchange for equity, or ownership stake. It is a greater subset of a more complex piece of the financial landscape called the private markets.

What is a Hedge Fund?

Hedge fund is an institutional investment whose main focus is on high-risk and high-return investments. It is another name for Investment Partnership. They are subject to less regulation, unlike Mutual Funds. The word ‘hedge’ stands for protecting oneself from financial losses. It is best for pooling funds which consists of several strategies to earn high returns for the investor.

Hedge Fund vs. Private Equity

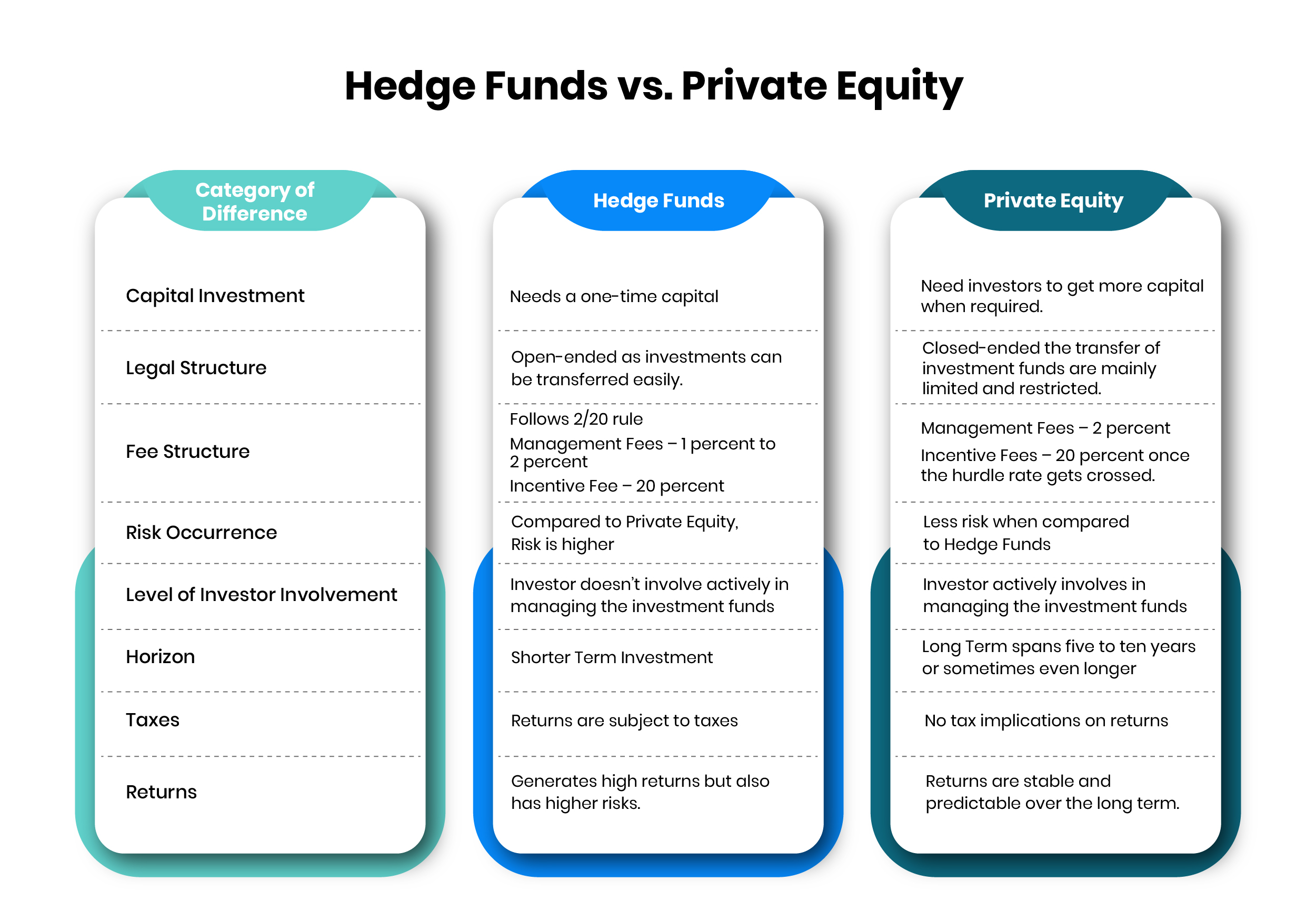

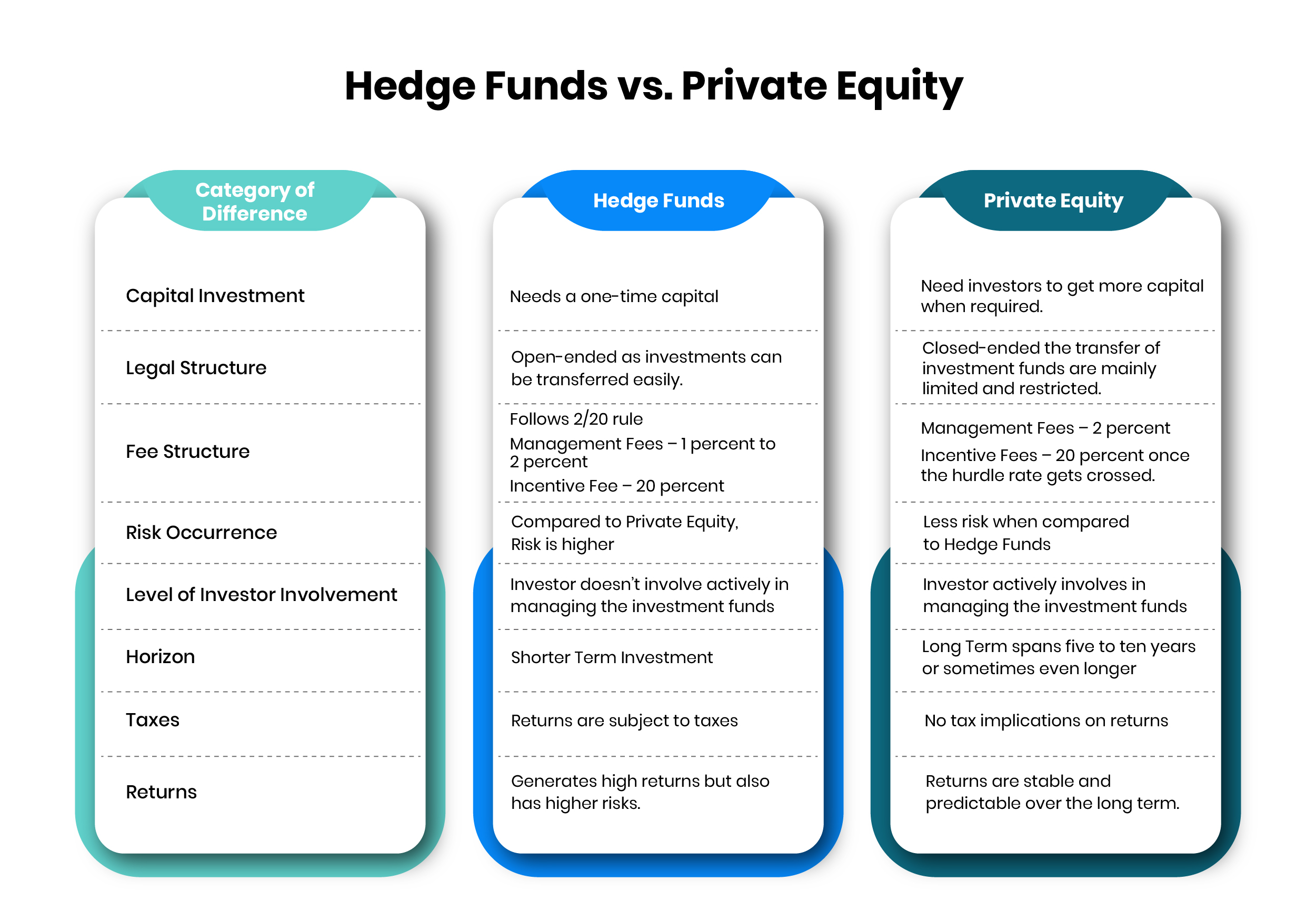

The following table gives an in-depth detail related to Hedge Funds vs. Private Equity:

Exploring the Contrasts between Hedge Funds and Private Equity

Hedge Funds and Private Equity are a kind of investment funds, but they vary in their investment strategies, target assets, structure, and investor profiles. The essential differences between both are:

- The private equity fund structure is usually focused on enhancing the performance of portfolio organizations. Whereas, the hedge funds adopt a variety of quantitative strategies.

- Hedge funds take long or short positions in publicly traded securities without looking for direct ownership. But in PE funds get significant ownership stakes in portfolio organizations, usually taking a controlling or influential position.

- In the PE the illiquidity and longer investment horizon are balanced by the potential for substantial returns via value creation in portfolio organizations. While a few of the hedge funds get absolute returns with less volatility, others may get higher risks in the look-out of higher returns.

- Hedge funds level of regulation can changes depending on various aspects, which include fund size and investor types. PE is highly focused on securities regulations and compliance.

Structural Differences in Hedge Fund vs. Private Equity

Understanding these structural differences is very important for investors when considering their investment preferences and risk-return objectives. The Hedge Fund vs. Private Equity has distinct roles in terms of investment landscape, giving the investors various opportunities and risk perceptions.

The private equity fund structure usually has longer lock-up periods, where investors commit their capital for the entire life of the fund. Liquidity events, like exits from portfolio organizations, occur over an extended period. However, hedge funds give more frequent liquidity approaches, offering the investors to redeem their investments periodically, usually on a quarterly basis. But certain redemption terms can alter among the hedge funds.

-

Investment Sizing and Concentration

Investment Sizing is completely based on how massive a fund is. The larger funds invest more capital (from a dollar amount perspective) in every investment. The concentrated fund is in every investment is based on the risk tolerance of the founder(s).

The concentration of PE and hedge funds are based on the parameters set by investors when the fund gets raised. Concentration can be highly risky if the organization has no zero inputs about what they are doing. The portfolio managers at these organizations do not make concentrated bets since the risk limits are tighter and the whole team might let go if one loses a certain amount of money. The portfolio manager investor won’t invest more than 2-3 percent of allocated capital in a single investment.

-

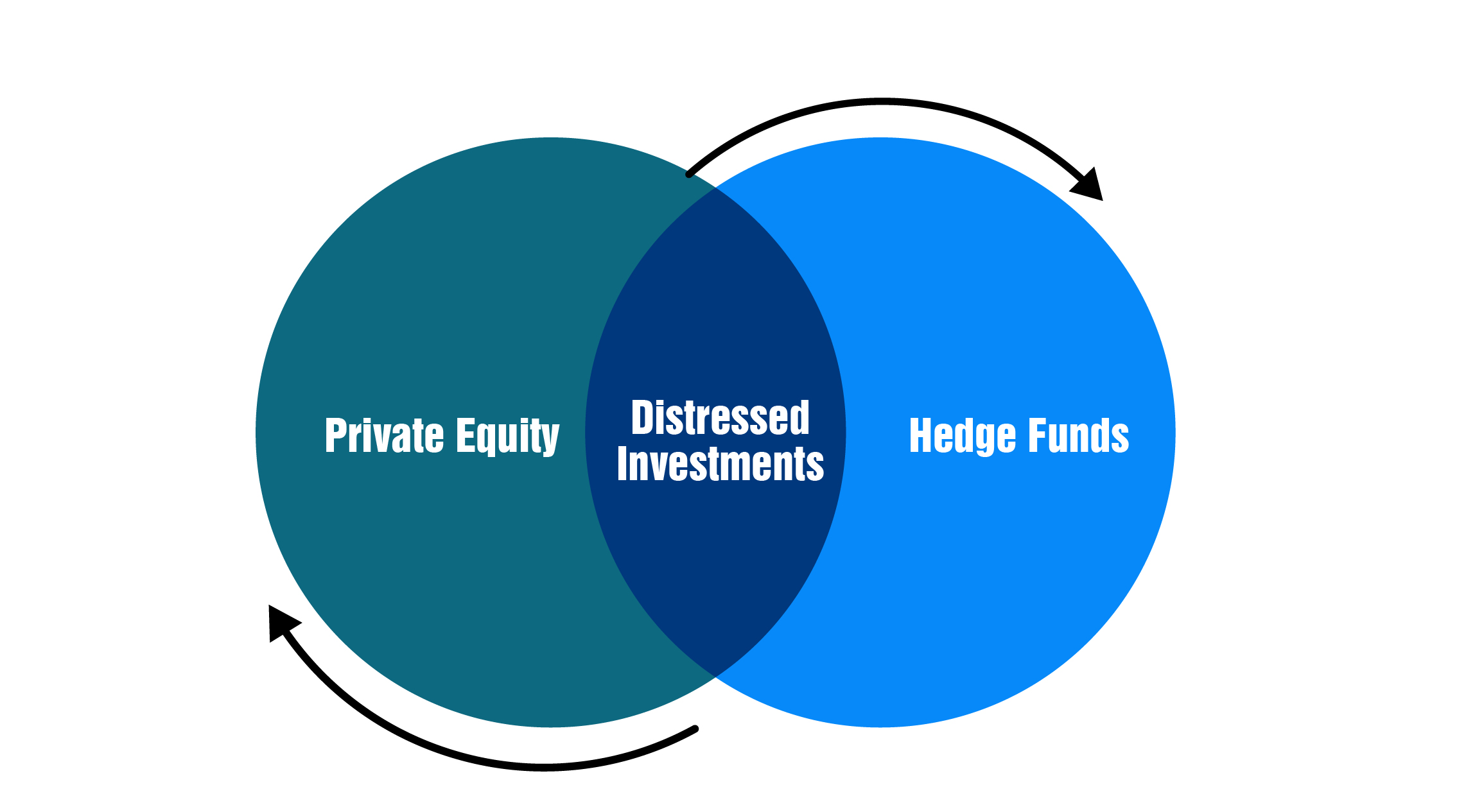

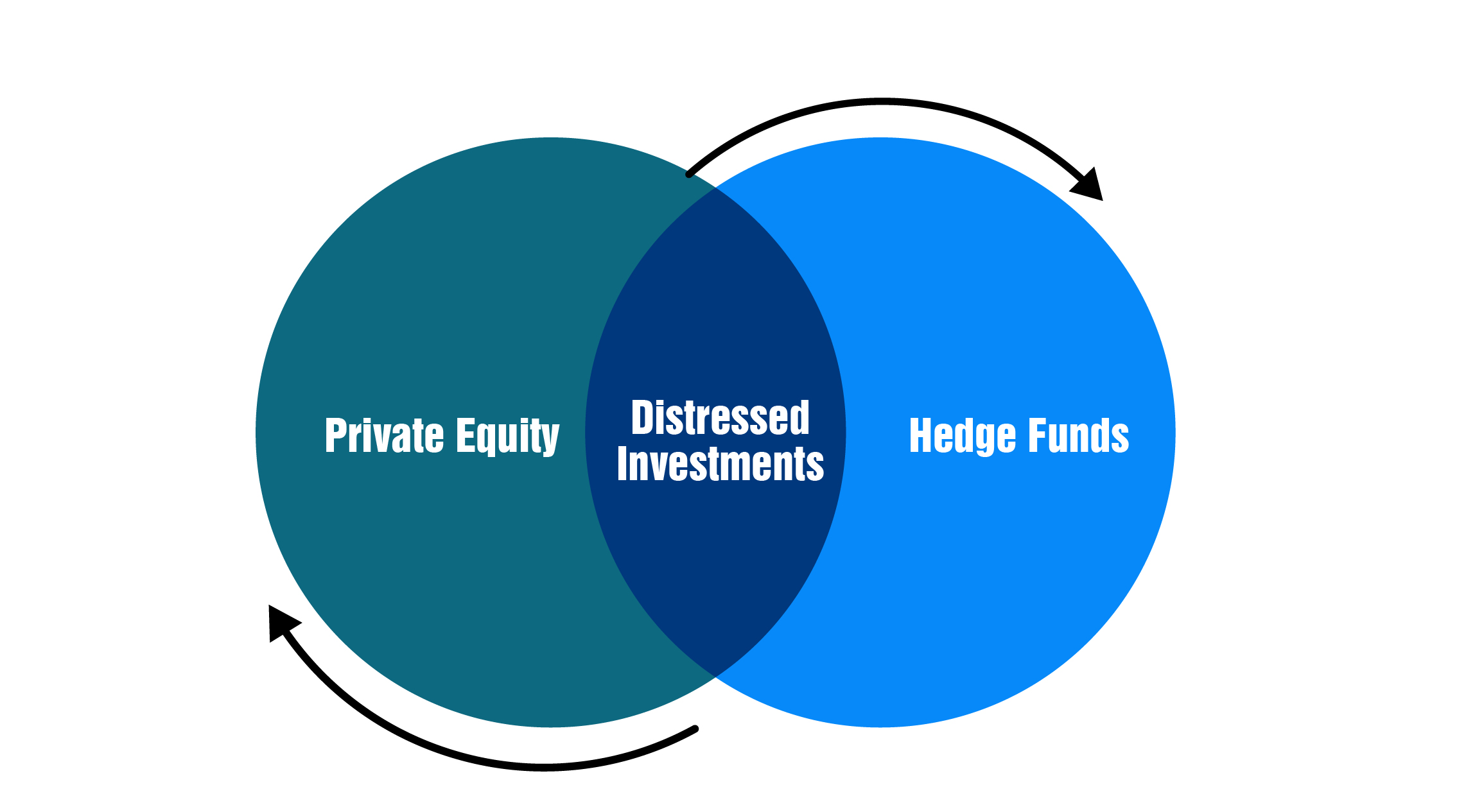

Distressed Investments

Distressed investments are a kind of category where there is an. In this both Hedge fund and private equity could invest in a distressed organization that is public. The hedge fund usually purchases the securities of distressed organizations if there is a chance of reselling these securities at a profit in the near term.

The PE might obtain the shares of a target, delist it, transform management, introduce measures related towards enhancing financial performance, and then be patient for at least a couple of years before exiting the investment in the form a sale or a new listing.

To sum it all up

Private equity best fits for those who want to get involved with their investments from a strategic or operational way of approach and the hedge funds are best fits for those who love reading about the market and analyzing stocks. Therefore, between the two investments, the investor has to evaluate all the necessary factors before choosing anyone and investing in it.