Returns are truly becoming green and humanizing for the Private Equity industry.

Sustainable funds garnered record investments this year, and many also outperformed broader markets. Larry Fink, the CEO of BlackRock, set in stone firm’s commitment to ESG (Environmental, Social, and Governance) standards by promising integration of 100% of the firm’s portfolios with ESG metrics.

While leading firms’ pursuit for impact investing and sustainable investing is not surprising, what was different this year is the growing number of private equity firms standing up for impact investing. What has led to this change in investment behavior? What are these ESG trends pegged on? We take a dig at the big forces leading to rising allegiance for responsible investing and investigate their implications for the private equity professionals.

Four Major Trends Promoting Impact Investing in Private Equity

Private Equity firms are fourth-largest employers in the world and, thus, are best positioned to drive growth in the economy and society at large, says Anna Grotberg, an associate partner at EY-Parthenon. These developments are leading to hardening support for ESG principles and responsible investing in the industry.

1.The Pandemic boost to the ESG cause.

ESG approach to investing was already coming off a banner year before COVID-19. Early in this year, the fears were that the responsible investing agenda will take a backseat due to the crisis as portfolios struggle to keep up and investors scrape to stay afloat. The opposite proved true. The pandemic fanned the flames of responsible investing.

COVID-19 crisis underscored the relevance of ESG for company performance as well as investment returns – proving the financial worth of humanization of business moves.

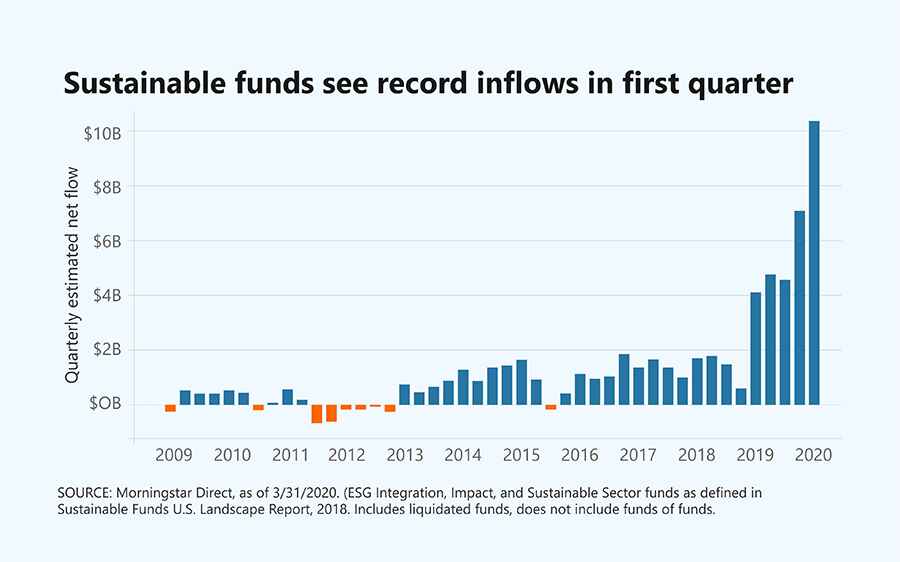

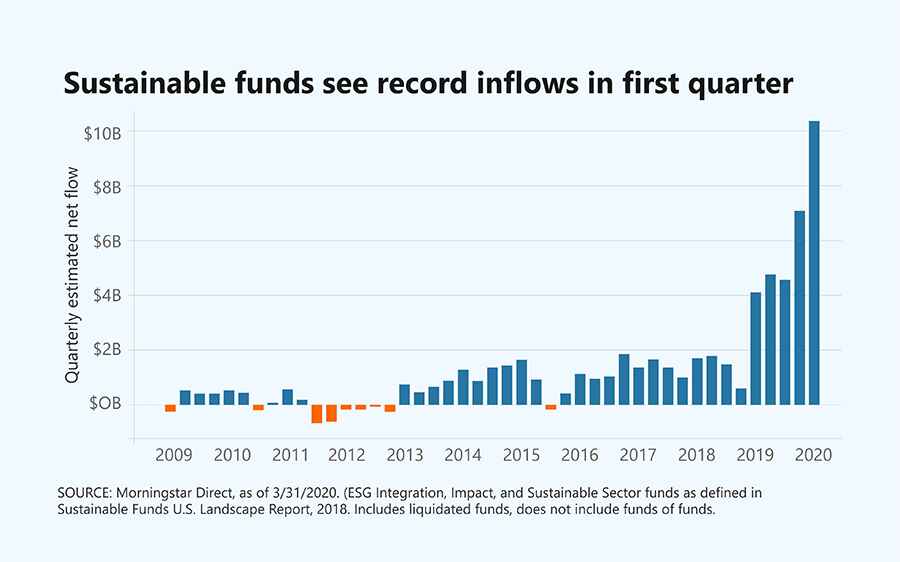

The results? Despite the turmoil, the first half of 2020 saw record net inflows in the ESG funds in the US, which crossed $21 billion, equaling 2019’s total amount (Morningstar). It is expected that the pandemic will further accelerate this trend in 2021 and beyond. Investors will remember how companies rose to the occasion and responded to the crisis. The focus will move from earning profits at all costs in the short-term for the shareholders to long-term goals.

2.Regulatory, Institutional, and LPs’ support.

Voices are coming in the support of companies that are living up to the ESG values from all quarters.

The single biggest momentum perhaps came from the European Union’s recent regulatory reforms. Effective from March 10, 2021, according to the amendments to MiFID II, it will be mandatory for financial advisors to take sustainability risks and clients’ preferences for impact investing into account.

Investors aka Limited Partners (LPs) are vouching for sustainable measures, taking note of the value of socially conscious investing. According to the 2019 PEI Alternative Insight report, while around 8% of LPs expressed interest in including ESG factors in investment, only 19% of the GPs strongly reflected similar sentiments for ESG policies. The increased consideration of LPs for purposeful and responsible investing will be a strong factor in 2021 for the GPs and PE firms to come on board with ESG. A sign of the same is the rising number of signatories to the United Nation’s Principles for Responsible Investment (UNPRI) programs, which have risen from 63 asset managers and $6.5 trillion in AUM at the launch in 2006 to over 3,000 and $100 trillion in AUM now

Institutional investors including pension funds, REITs from many countries are especially aware of ESG and making strides toward tapping such investments via UN-backed PRI programs. In Japan, the Government Pension Investment Fund clearly lays its backing for ESG.

The demand for responsible, transparent, and accountable investing from strong sectors is bringing impact investing to the mainstream.

3.The performance factor.

Social consciousness is a given in impact investing. Other than that, these funds are also evidentially able to offer comparable financial returns – by improving company performance, stability, and reducing volatility. The NULG fund, for instance, gave 10% returns in 2020, when the S&P 500 was down by 1% (CNBC, June 2020). In a similar vein, the largest fund of its kind, ESGU, led 0.6% returns by that time. In Q1 2020 sustainable funds outperformed their counterparts (Blackrock).

This short period of time may not make for a trend, but the resilience shown by sustainable companies amid COVID-19 seriously put these funds to test, and they held just fine.

Companies with below-median ESG scores saw higher downward EPS revisions in 2020. – Bank of America Analysts

Downside risk for sustainable funds has been significantly lower than their counterparts in the years of turbulent markets – say 2008, 2009, 2015, and 2018. – Morgan Stanley

Return potential is one of the big reasons for LP’s motivation for ESG (discussed in previous pointer), other than regulatory compliance, risk management, making a difference, and others.

4.Going beyond ‘E’ of ESG.

Along with companies’ efforts toward environmental sustainability aspects, social and governance attributes are gaining in importance for the investors. This is especially trending now as businesses respond to the pandemic crisis – and prove their viability for the market. While the environment will continue to remain crucial, the war with pandemic has highlighted the importance of increasing the focus on ‘S’ and ‘G’ factors. Social and governance will continue to remain vital.

Challenge for the future

A low level of adoption by the GPs is the biggest challenge for impact investing in the private equity industry. One of the inherent reasons for this is the tall task of ESG reporting. Many managers have reportedly delayed their adoption of ESG in portfolio assessment due to the problems of reporting on ESG metrics, and rating opportunities on the basis. Data inconsistencies are common due to the lack of a clear method. The data on ESG is generally supplied by five types of providers:

Generalist data providers, i.e. Bloomberg, MSCI, Morningstar, etc.

Credit rating agencies

ESG specialist firms

Asset managers with ESG expertise

Stock exchanges

It is an emerging field – and going forward determining the type, characteristics, analysis, storage, and mining of ESG data will become crucial skills.

Implications for Private Equity Professionals

Currently, GPs are ill-prepared to handle this transition and meet the rising demand for ESG from LPs, regulators, and asset managers.

They require help at all stages of the ESG investment lifecycle - from devising strategies, understanding ESG investments, developing evaluation metrics and benchmarks, data reporting, to analysis.

The chase for ESG talent acquisition will intensify. Given the new developments, PE firms will increase their ESG recruitments and open designated sustainable investing positions with several incentives requiring ESG skills in data, rating, and analytics.

A new set of top talent is required in Private Equity with a finance brain and a philanthropist heart. A unicorn, do you think? Not so much. The expertise is emerging in the novice stage helping GPs to navigate the ESG space. Join the league of new Chartered Private Equity Professionals (CPEP™) with modern skills and be that much-needed unicorn for the PE industry.