Introduction

The concept of private equity may be opaque, but the clarification of the idea of private equity transactions opens it up. Buyout and growth investments, as well as secondary transactions within private equity, demonstrate tactical monetary movements over the business cycle. Primary investments bring new money into firms, whereas secondaries bring liquidity through the sales of existing interests by different investors. The two dimensions have been discussed in this article, providing a sharp and comprehensive baseline to debunk the mysterious essence of the use of such complex financial tactics in driving growth and optimization of portfolios in the current dynamic markets.

Behind the Scenes of a Private Equity Transaction

Awareness of the ecosystem in the field of private equity transactions implies the identification of the unique roles that each participant undertakes in the realms of strategy and capital, to execution and value creation:

They are the decision makers for investments. GPs set up and operate the fund, originate transactions, do due diligence, examine conditions, and monitor portfolio companies. GPs are most often the lead or sole sponsor in approximately 84 percent of the buyout deals. Compensation consists of a management fee and carried interest, which depends on fund performance.

The deal capital is funded by LPs. They are composed of institutional investors such as pension funds, endowments, insurance companies, and high-net-worth individuals, among others, who are passive. Their role: investing capital, evaluating performance, and trusting the GP on the strategic implementation in the partnership agreement.

-

Portfolio Executives & Operating Partners

Operating partners who are usually former CEOs or industry leaders work with the portfolio companies to enhance their operations, ESG adoption, digital transformation, and efficiency once invested.

-

Analysts, Associates, and Deal Teams

Investment bankers begin in deal teams as analysts and junior associates who model, research, and write investment memos. Senior associates and VPs handle diligence, small interactions, and aid in portfolio oversight. Directors, principals, and managing directors develop strategy, originate transactions, and develop LP relationships above them.

Types of Private Equity Transactions

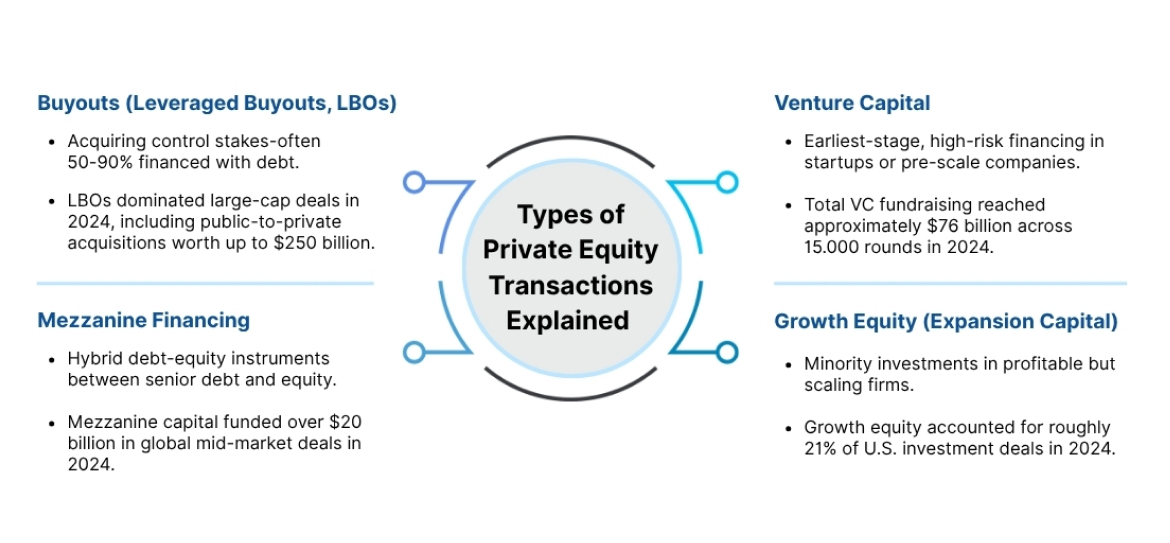

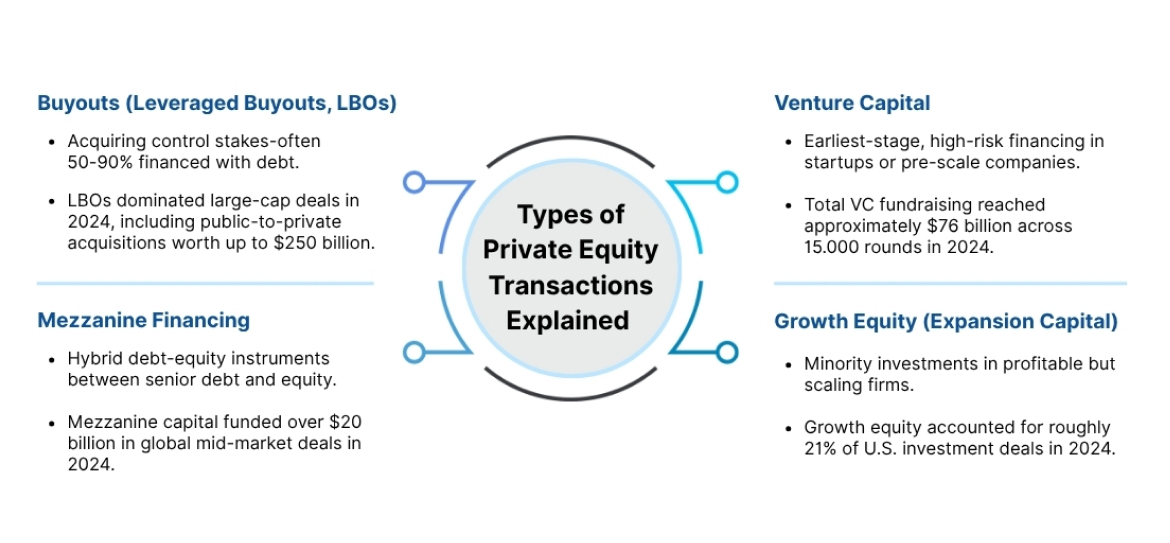

The structure and purpose of the transaction of private equity can serve as a source of light in understanding the creation of value in firms. The types of investment that are classified under private equity are varied, and each has its corporate lifecycle phase, as well as the intended result:

-

Buyouts (Leveraged Buyouts, LBOs)

They include buying control interests, typically 50-90% where debt is used to finance the acquisition of existing and cash-generating companies to make changes. In 2024, LBOs predominated several large-cap transactions, including public-to-private acquisitions valued as much as US$ 250billion.

-

Growth Equity (Expansion Capital)

Minority investments in profitable firms that are scaling up typically have no change in control. The growth equity was present in about 21% of investment deals in the U.S. in 2024 and allowed companies to finance market entrance, acquisition, or restructuring.

High-risk financing in startups, or pre-scale companies. Although the number of funds fell by 22% in 2024, the overall VC fundraising amounted to around US$ 76billion in 15,000 rounds.

Hybrid debt-equity securities, between senior debt and equity, are usually combined with buyouts or growth transactions. Mezzanine capital is expensive and unsecured, and provides flexibility on growth or acquisition financing.

-

Club Deals (Syndication Investments)

Several PE investors have come together in an attempt to purchase bigger targets. Larger-scale investments are possible with club deals, which decrease the concentration of each firm. In the past, they were also linked to a relatively lower pre‑bid premium.

Secondary Transactions in Private Equity

Secondary transactions in private equity have become a critical part of the investment environment, providing liquidity options to investors and creating a more flexible option to operate the portfolio. Those are purchases and sales of existing stakes in private equity funds, which enable the investor to tailor the portfolio without the need to await more conventional exits such as an IPO or an M&A.

It recorded US$152 billion in the secondary market in 2024, almost double what it was compared to prior years. This increased as LP and GP-led transactions contributed about half of the total, with the former contributing to slightly higher volume as compared to the latter. LP-led transactions were based mainly on liquidity needs and rebalancing of the portfolio, whereas in GP-led transactions, the continuation funds were mostly involved, and an attractive option for general partners to prolong the lifespan of a fund and maintain quality assets.

The development of the secondary market has been stimulated by several reasons:

-

Increased liquidity needs: Institutional investors wanted to find a way of releasing the capital locked up in illiquid investments.

-

Market volatility: Economic instability caused investors to manage their portfolios more actively.

-

Attractive pricing: Secondary transactions were made more attractive due to better valuations.

Moving forward, the secondary market will likely proceed on its upward trend as it is projected to yield a possible growth of up to US$ 220 billion in 2025. This expansion highlights the growing significance of secondary transactions in private equity as a strategic option of flexibility and liquidity in a complex market environment before investors.

Real‑World Examples of Transaction Structures

The typical leveraged buyout (LBO) portrays a dramatic change through operations revamping and financial engineering. For instance:

-

The purchase of HCA (Hospital Corporation of America) by KKR, along with Bain and Merrill Lynch in 2006, which was 90% debt-financed and only had 10% equity, financed development through junk bonds, with the assets of the target serving as the collateral.

-

In 2007, Blackstone acquired Hilton Hotels in an LBO of US$ 26 billion financed by US$ 20 billion in debt and US$ 5 billion in equity. The company went public again in 2013, with about US$ 14 billion of equity gains after intensive renovation and expansion worldwide.

Now shift to growth equity investment:

A tech-software startup that received growth capital increased scale through strategic capital infusion, and the founders retained equity. In one recent case, a mid-sized software platform has raised hundreds of millions of minority equity, which has catalyzed global growth and productivity infrastructure that has grown revenues at a triple-digit rate in two years (120% CAGR).

Finally, a secondary stake sale scenario:

A large pension fund with a limited-partnership interest in a middle-market buyout fund sells the interest in a secondary led by the limited-partnership to get liquidity. In the meantime, a GP-led continuation fund will enable the private equity firm to sell the best assets it has, redeploying this capital into new pools of investors.

This combination of leveraged buyouts, growth capital, and secondary routes points to the way that private equity deals, particularly secondary private equity deals, are designed to match liquidity, control, and long-term value.

Conclusion

The need to comprehend the entire range of private equity transactions, including conventional buyout, as well as more sophisticated secondary private equity transactions, is core to the contemporary investment environment. All these types are used with different strategic aims, and risk, control, and returns are different. In a changing market, knowledge of transaction structures, regulatory changes, and new trends in deal-making empower investors, fund managers, and stakeholders to make more informed, data-driven decisions in the private equity market.