Introduction

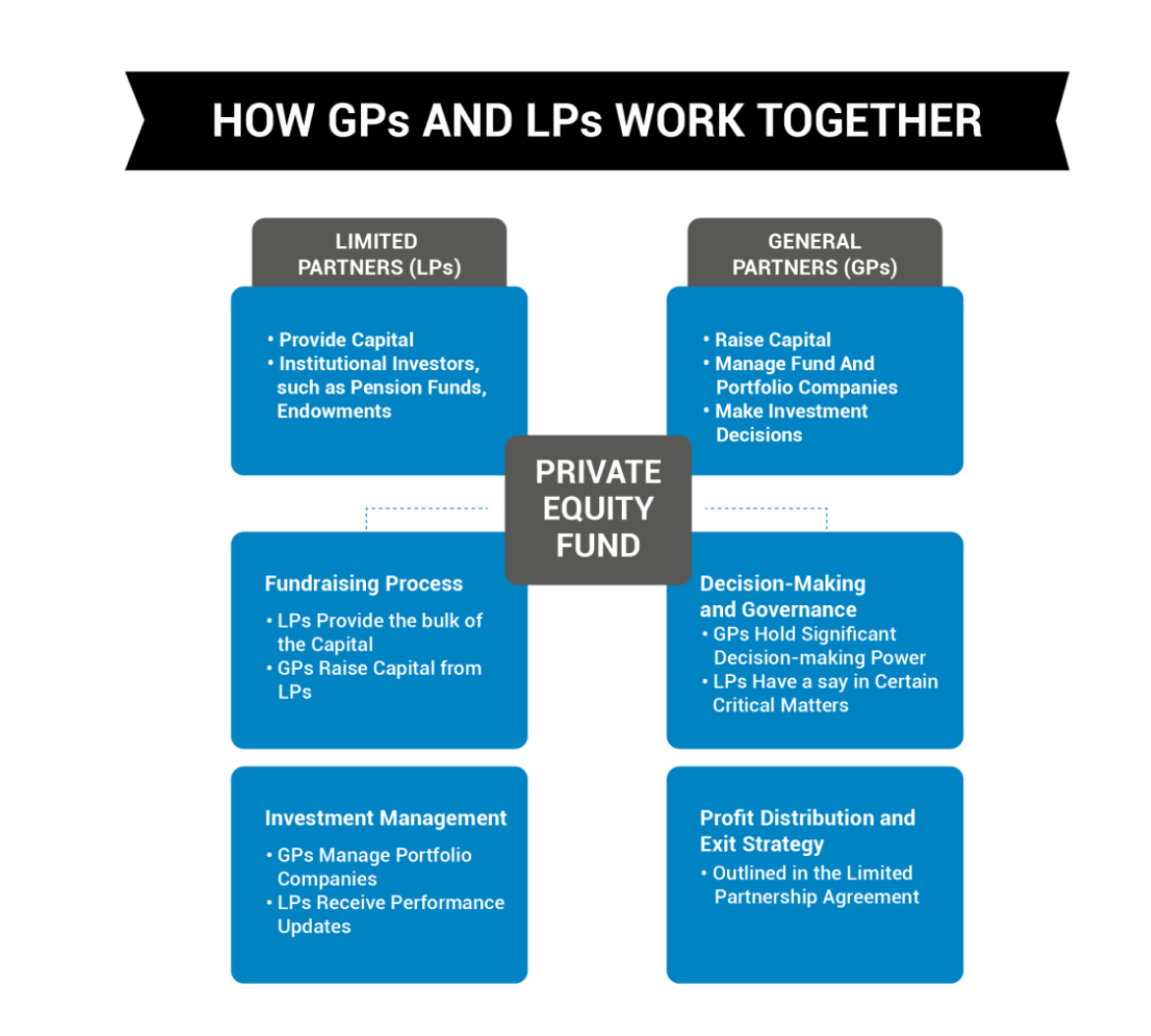

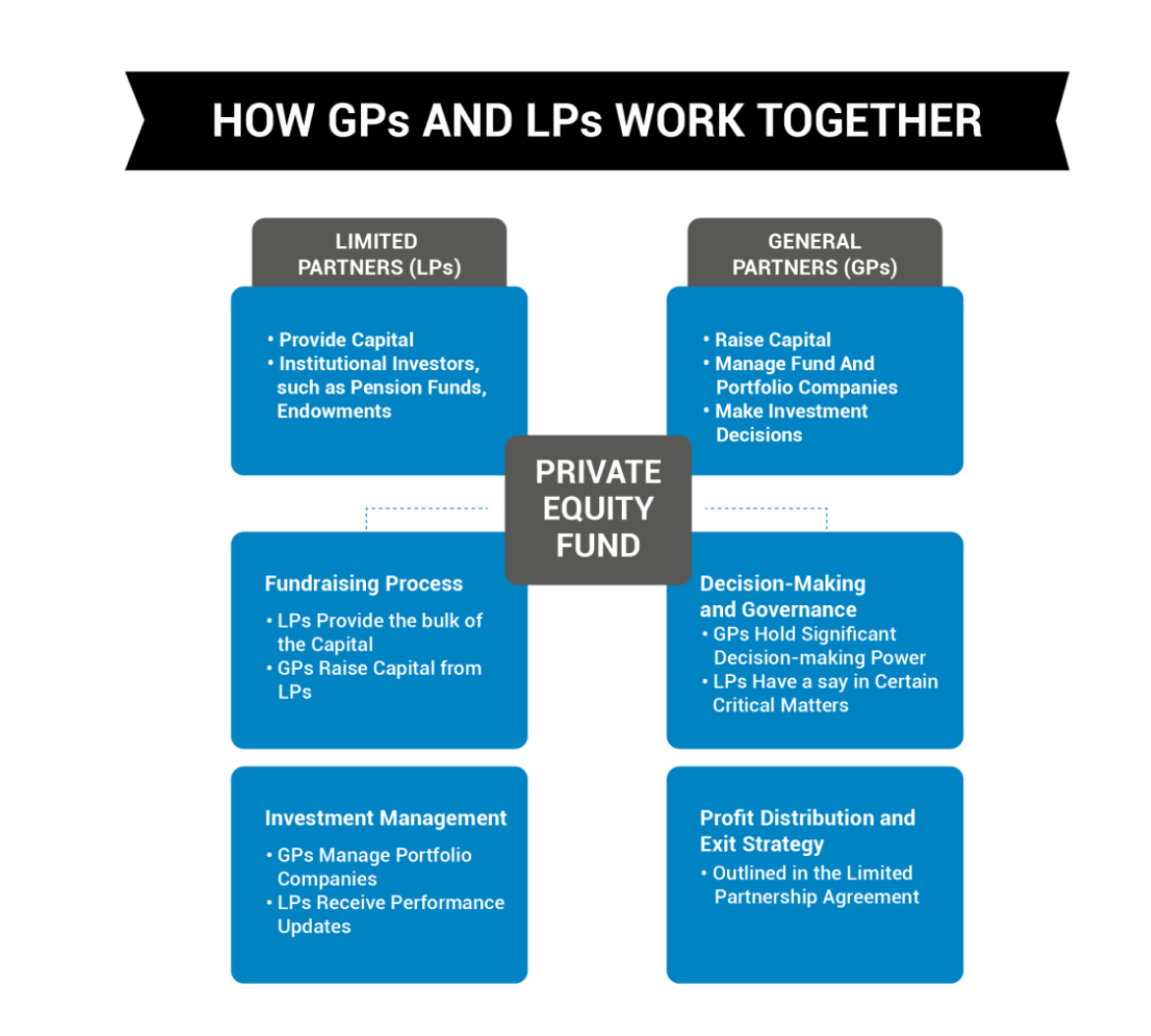

Recognizing the differences in roles between General Partners (GPs) and Limited Partners (LPs) is essential when handling investments in private equity. While GPs deal with things like how the fund is run, what it buys and sells, and how it is invested, LPs simply put in money and hope to get some returns, with less responsibility if things go wrong. This division makes up how most private equity funds are set up. The differences between GPs and LPs help you understand how risk is managed, how things are run, and how much profit is made in private equity.

Defining the Roles: General Partners (GP) vs Limited Partners (LP)

The responsibilities of General Partners (GP) and Limited Partners (LP) in private equity are different but complementary. These differences are essential to understanding the mechanics of private equity in operations.

General Partners (GP):

The GP is in charge of running the private equity fund on a day-to-day basis. They are at the forefront of planning, growth, and investment in the fund’s portfolio. Their duties include:

-

Investment decisions: GPs decide on companies or projects to invest in, conduct due diligence, and structure deals.

-

Fundraising and relationship management: GPs raise capital from LPs, build good relationships with investors, and meet the fund's performance expectations.

-

Operational oversight: GPs offer tactical advice and oversee the portfolio of corporations to ensure they attain financial performance and operational deadlines.

-

Risk management: GPs reduce risks and maximize returns, thus making crucial operations and financial decisions.

Limited Partners (LP):

LPs usually are institutional or individual investors who invest capital in the fund without having any role in the fund's management. They have limited liability and are only focused on the fund's performance. The significant roles of LPs include the following:

-

Financial contribution: LPs supply most of the capital used for investments, but their risk exposure is not greater than the amount they invest.

-

Passive role: LPs are not involved in the fund's daily decision-making process and operation.

-

Expected returns: LPs receive returns based on the success of investments handled by the GP, and they usually get profits through a pre-defined distribution model.

Private Equity Fund Structure: How GPs and LPs Work Together

The private equity fund structure is based upon the partnership firm of General Partners (GPs) and Limited Partners (LPs). The ability of these two groups to work together will determine the fund's success, as they have different roles to play in the investment strategy and operations. Their dynamics are critical in understanding how private equity funds operate and realizing the returns they generate.

Fundraising Process:

-

LPs make up most of the fund's capital and are passive investors. They are usually institutionalized investors, such as pension funds, endowments, and family offices.

-

GPs responsible for the fund also raise capital from the LPs and make strategic investments. They identify sources, assess, and maintains a portfolio of companies.

Investment Management:

-

GPs are the daily decision-makers about investments, with expertise in handling portfolio companies, enhancing performance, and leaving at the right time for returns.

-

LPs are further removed from the operating side, but they usually have some rights to learn about the fund's performance, such as regular updates and reports from the GP.

-

Decision-Making and Governance:

GPs are in a position to exercise considerable power in decision-making, and the LPs can participate in some critical issues. Such issues involve approval for significant investments or structural changes to the fund. Other funds also use the LPs as members of the advisory panels so that they can have their say in non-operational matters.

-

Profit Distribution and Exit Strategy:

Profits are usually shared based on the private equity firm’s structure as stated in the Limited Partnership Agreement (LPA). Under this agreement, GPs share in the profits (carried interest) once a specific return level is achieved for LPs. The exit strategy usually entails an option to sell, an initial public offering (IPO), or recapitalizing the portfolio company.

The Financial Dynamics: GP vs LP Private Equity

In a private equity fund, the financial burden and outcome are delegated differently between the General Partners (GPs) and Limited Partners (LPs). This division is key to understanding the private equity fund's economic incentives and risk-sharing mechanisms.

-

Capital Contribution

GPs usually provide 1–5% of the fund’s money, leaving LPs to give the rest, 95–99%. As a result, LPs gradually take the lead as investors, but stay away from actively managing the business.

-

Fee Compensation vs. Return Expectation

GPs manage the fund on behalf of investors and receive a 2% management fee every year. Meanwhile, LPs usually require returns that fit their level of risk, often seeking an internal rate of return (IRR) of 15% or more.

-

Incentive Structure: Carried Interest

GPs get carried interest (mostly 20% surplus profits after an 8% hurdle rate), encouraging them to help the fund succeed. LPs are not awarded carried interest but enjoy first preference on LP returns before the GP gets paid.

-

Risk Exposure and Downside Protection

LPs are protected by specific features, one of which is limited liability. Performances by GPs expose them to risk and damage their reputation, so they must do well to attract funds future investors.

Risk and Reward: Who Bears What?

A significant focus of a private equity fund is understanding how GPs and LPs manage risk and rewards together. These roles ensure the company’s performance is rewarded, and investors are protected from too much risk.

While LPs provide the most significant share of the capital, they are only liable for the amount they agreed to invest in. There is the risk of their assets affecting their net worth, but they do not handle daily fund management. On the other hand, GPs participate actively in business decisions and execution, resulting in exposure to many risk elements and possible gains.

-

GPs take on both operational and strategic risk. Their role is to find potential deals, supervise the companies they back, and plan how to exit each one. Inadequate management can result in a company losing its reputation and ability to raise funds over time.

-

LPs risk losing their investment, with exposure limited only to participation funds. They rely on the strengths of their GPs and the overall market to obtain the targeted results.

-

The GP’s 20% of profits is rewarded only after LPs have received their preferred returns, encouraging both parties to work towards the same goal but putting off rewards.

-

A fixed income of around 2% annually from management fees protects GPs from some of the risks of operating a fund.

Decision-Making Power: Who Calls the Shots in Private Equity Funds?

In a typical private equity fund structure, the people who run the day-to-day work usually make the main decisions, while people who just invest have a little say in what goes on. Using this structure, the company can run more efficiently, quickly shift investments, and handle governance and accountability. The LPs provide most of the money, but the GPs make the decisions regarding the fund, invest the assets, and manage the entire portfolio. However, LPs play a role, even though they are not very actively involved. They have power over the activities and decisions by using structured rights and covenants detailed in the LPA.

-

GPs look for opportunities, supervise acquisitions, and monitor companies in the portfolio. They can control every aspect of investments and choose when to sell assets.

-

Advisory committees usually participate in LPs, which allows them to review conflicts, approve valuation procedures, and follow up on GPs’ ethical conduct.

-

LPs’ voting power typically covers deciding whether to extend the fund, change its terms, or remove a GP if there is a good reason.

-

Most LPs check the facts carefully and make sure all the legal paperwork is in place before putting in money, so they have protection in the deal while letting the fund manager do their regular work.

Conclusion

A clear grasp of the relationship between GPs and LPs in private equity helps you understand the fund’s day-to-day activities. While General Partners usually have the main say and take on most of the risks in a private equity firm, Limited Partners help by supplying money and keeping an eye on the investors’ interests. This matching up of roles, how things are managed, and what people are rewarded for is at the heart of ensuring private equity firms do well and build value over time in a competitive market.