Corporate governance constitutes a key element of business regulation, private equity being a huge focus on that. It involves organizational governance and the methods by which a company is run and monitored, thus, implying the availability of transparency, fairness, and accountability in its organizational interaction with all the parties involved. When private equity comes into the picture where the investment is provided to the private companies in return for equity ownership, corporate governance plays a crucial role in protecting the investor and helps to reduce and mitigate the risks as well as long-term value creation too.

Understanding Corporate Governance

Corporate governance is a foundational concept in the business world, it aims at implementing a relevant structure of regulations, operations, and procedures that set out the management of the corporation and its governance. Crucial aspects of corporate governance are namely, accountability, transparency, fairness, and responsibility. Such guiding principles enable us to consider the interests of all stakeholders, and not just shareholders, management, employees, customers, suppliers, or the community at large when decisions are made.

In private equity, corporate governance does play a very important role because of the nature of the relationship between investors and portfolio companies. The capital of private equity firms is raised from institutional investors, which include pension funds, college endowments, and high-net-worth people. The goal of the firms is to make high returns by investing in the private business. With corporate governance being considered in this specific term, the rights and privileges of investors who, often, barely have a view and control over how the companies they are invested in are run are safeguarded.

Corporate Governance in Private Equity

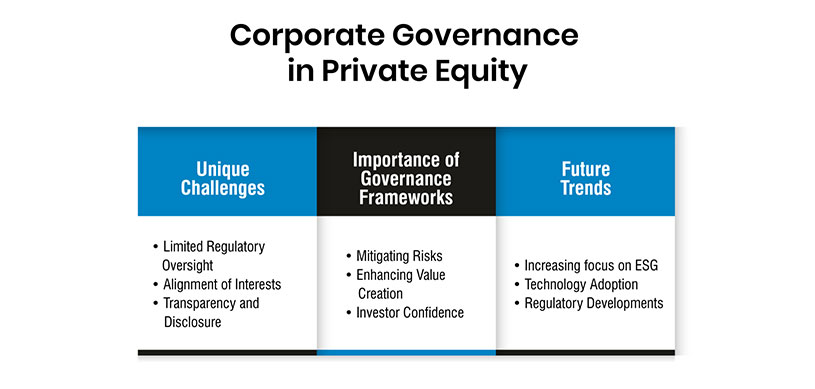

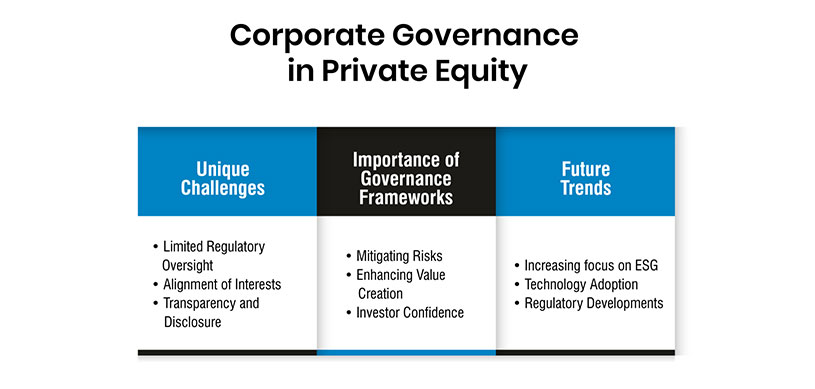

Private equity presents unique challenges and considerations in corporate governance due to its distinctive characteristics and objectives. Understanding these challenges is crucial for private equity firms to implement effective governance frameworks:

1. Unique Challenges:

-

Limited Regulatory Oversight: Private equity firms, unlike public companies, are subject to lower levels of regulation, making them create very efficient internal governance systems.

-

Alignment of Interests: The difficulties of investors’ opinions conciliation with management and all other interested parties become more evident, especially in the case of leveraged buyouts.

-

Transparency and Disclosure: Private equity deals usually have embargoes of confidentiality, making oversight of how the governance processes are being run a bit of a problem.

2. Importance of Governance Frameworks:

-

Mitigating Risks: Effective Governance identifies and eliminates operational, financial, and reputational risks specific to private equity investments.

-

Enhancing Value Creation: Good governance is also likely to offer the company better operational efficiency, more strategic decision-making, and hence, value delivery to the investors.

-

Investor Confidence: Transparent governance ensures investor confidence and fundraising for private equity funds.

3. Future Trends:

-

Increasing focus on ESG: Complying with investing and legal standards that change concerning these institutional factors is the key to creating the right governance structures.

-

Technology Adoption: Incorporating technology, like AI and blockchain, as tools of transparency for automating compliance as well as for making effective decisions.

-

Regulatory Developments: Expectation of introduction of new legal regulations which may influence management styles of private equity, thereby causing its restructuring and compliance.

NextGen Corporate Governance

Along with the changing trend in the business world, also corporate governance perceptions should be updated accordingly. Nextgen governance is all about employing new technologies and approaches, thereby, improving the quality of governance. In this case, education sector leaders could use data analytics, artificial intelligence (AI), and blockchain to optimize decision-making processes, ensure transparency, and build accountability.

Going forth the next-generation governance viewed ESG as an important characteristic in planning by senior management. Firms are being pressured to look at the environment and society as a concomitant part of their value chain, and the investors demand greater transparency and disclosure on such issues. Future governance practices would take account of ESG integrity and place them at the heart of business, leading, in turn, to the unification of corporate strategy with society objectives.

Benefits of NextGen Corporate Governance

The adoption of next-generation corporate governance practices offers numerous advantages for private equity firms and their portfolio companies.

-

Enhanced Transparency: Nextgen governance processes aim to create wide-open transparency by exploiting advanced technologies that make data and information available to stakeholders via the internet in real-time. This being open provides the investors with a level of trust and confidence among the employees and other partners while boosting the reputation of the firm altogether.

-

Improved Accountability: Through data analytics and AI technologies, there are next gen governance mechanisms that allow firms to make intelligent and more data-driven decisions. This transparency promotes organizational culture consisting of accountability, thus, for sure, misconduct or ethical attitudes are less likely to happen.

-

Better Risk Management: The risk management principles embedded in Nextgen governance make it easier for organizations to reduce risks during decision-making. Using data analytics and predictive modeling, companies can foresee potential risks and take appropriate steps to lessen such risks. In the end, this will result in safeguarding the hurdles for businesses to adapt, long-term impact is remarkable.

-

Alignment with Stakeholder Interests: Next-gen governance is essentially stakeholder-centric, which caters to the interests of several groups other than shareholders, including employees, customers, and every one belonging to the wider community. Combining environmental social and governance (ESG) principles into the process of decision-making will help firms to better integrate their business interests with the common values and expectations of their stakeholders, thus facilitating value creation and sustainable growth processes.

Implementing NextGen Corporate Governance

It is important to know that adopting NextGen Corporate Governance includes a thorough analysis of how it may be applied and also, what its challenges may be beforehand. Here are some key steps to consider:

-

Conduct a Comprehensive Assessment: Begin with evaluating the current governance practices and pinpointing the loopholes. This evaluation would cover the Board constitution, risk management processes, and sustainable business model integration, involving ESG components.

-

Develop a Strategic Roadmap: According to assessment results, prepare a plan where you point out the goals, timelines, and roadmap as well as the resources that are required. Make clear the linkages between the objectives of the company as well as the perceptions of stakeholders and the strategic objectives of the firm.

-

Enhance Board Diversity: Incorporate heterogeneity in the boardroom into the decision-making +process bringing different views and knowledge. Take into account such things as gender, ethnicity, industry sectors, and the functional areas of experience.

-

Strengthen Risk Management: Create a comprehensive risk management structure that specifically addresses issues that involve ESG assets. Put in place scenarios evaluation and historical stress testing to check on the resilience against different risk scenarios taking place.

Challenges and Future Trends in Corporate Governance

The tough tasks of private equity strategic corporations along with the dynamic patterns of corporate governance tend to be clothed with a high number of challenges and trends. Understanding and addressing these issues is key to ensuring effective governance practices:

-

Resistance to Change: Adopting next-generation governance practices could be confronted by the conservatism of the stakeholders who have long become used to traditional styles of governance. Educating and involving the stakeholders in the process is a very important task.

-

Limited Resources: Equalizing relations between small and mid-sized private equity firms and the ability to allocate resources for the implementation of advanced governance problems could be a real concern. Sharing ideas with fellow industry comrades or bringing business partners into the loop can play a key role in overcoming this barrier.

-

Technology Integration: The incorporation of AI into the recent technologies into the governance frameworks requires the government to make investments to develop the capability. Firms should have clear plans for adopting and implementing technology.

-

ESG Integration: Incorporating ESG factors in corporate governance requires a shift in attitude and a paradigm shift. Companies should balance capitalization on the market opportunities and address broader societal issues. Transparency and accountability should be followed as a guiding principle for these processes.

Conclusion

Corporate governance could be regarded as the bedrock of private equity, marking a pronounced change from the old model with these companies being guided and managed diligently and transparently. Next-gen governance is driving businesses to adopt new IT-based regulations incorporating ESG, fostering sustainable growth. Adopting them, private equity firms can calm down investors and spread risks and in turn, provide a more sustainable future for the firms.