PE professionals lead the way when it comes to identifying deal values. Armed with the reputation of spotting gold in the muck, they are leaned upon to turnaround and impressively transform their portfolio businesses. Their unparalleled judgment arduously earned over the years identifies and realizes opportunities unschooled eyes are likely to miss.

For good reason their efforts are well-rewarded. Barring COVID-19 stall, the past few years brought oodles of good news for PE professionals . By mid-2019, PE firms had impressive investment capacity with a total “dry powder of USD 2.5 trillion”, according to PwC.

But as opportunities grew so did the challenges.

PE firms face increasing competition from corporates who are better placed to create revenue synergies and match their products with new and innovative offerings.

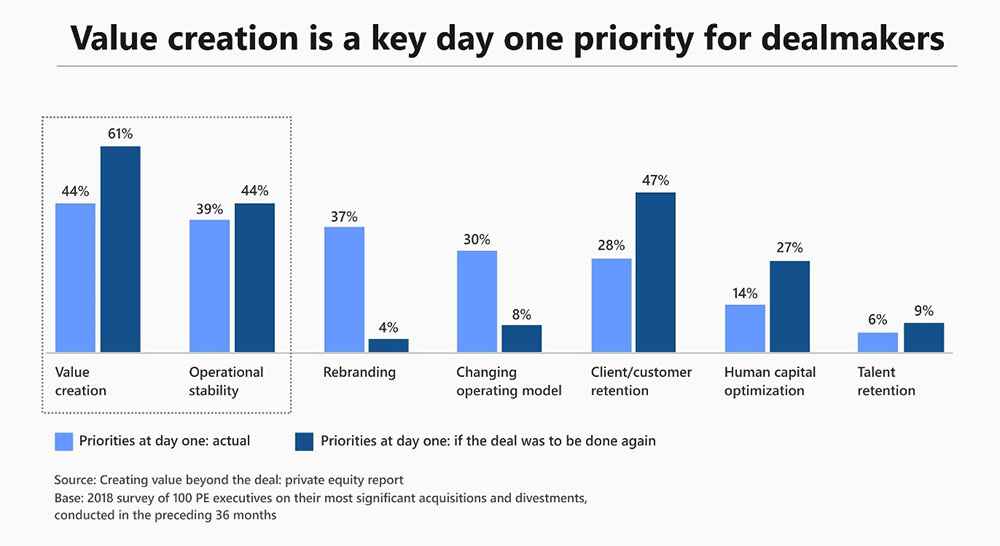

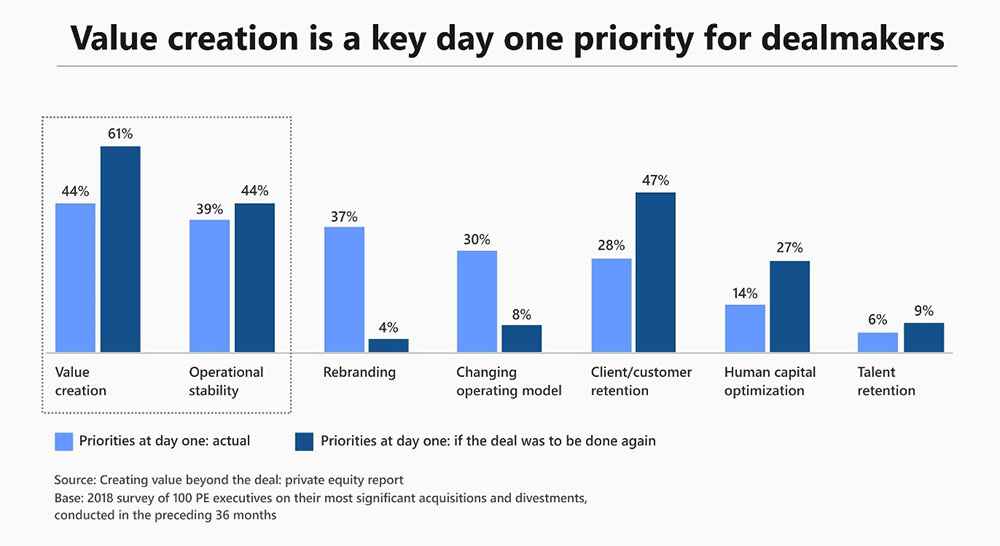

How PE firms outweigh this sinker? Connoisseurs like PwC, Pitchbook, INSEAD, and others dig in deep for a rejoinder. And at the heart of the dilemma, they unearth value creation. A PwC survey of 100 PE executives cited value creation as the prime priority for dealmakers.

The Case for Value Creation in PE

2017, a year of mortgage defaults in America led to the 2010 financial crisis in Greece. The 1929 New York stock market crash led to the 1930s rise of fascists in Europe. It’s hard to predict the catalytic impact of changes in small doses and no one understands this better than PE professionals . Little improvements in product pricing, product mix, and customer have shown to create tremendous value for stakeholders.

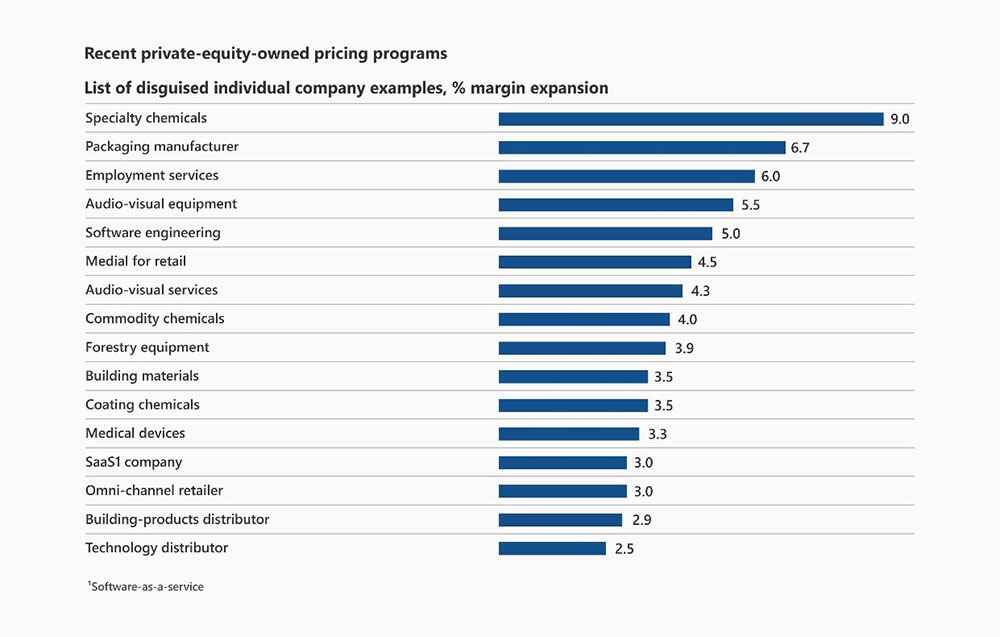

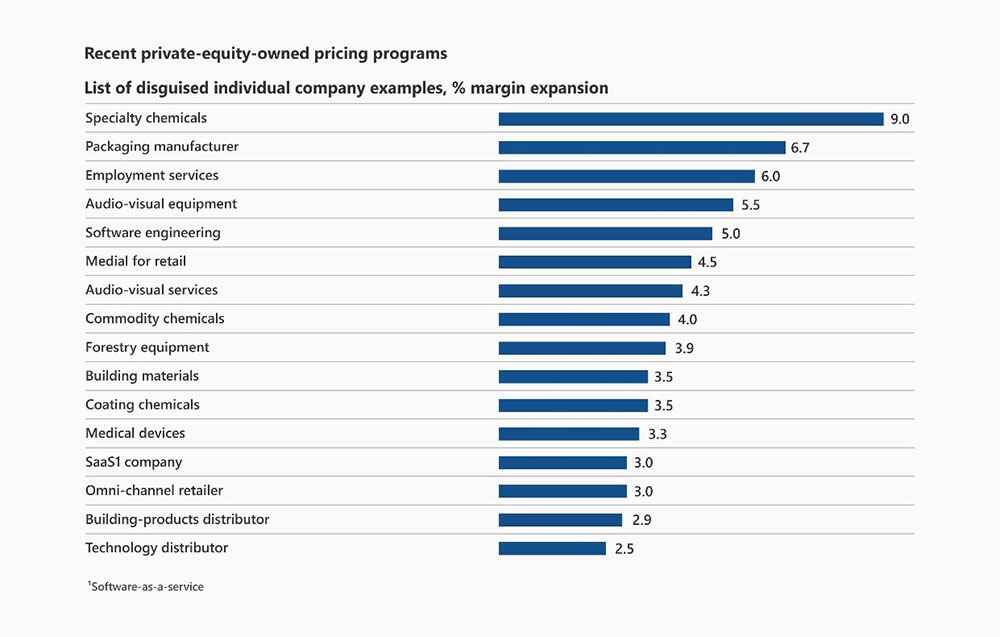

When PE firms tackle pricing in their portfolio companies, we typically see margin expansion of between 3 and 7 percent within one year. –McKinsey

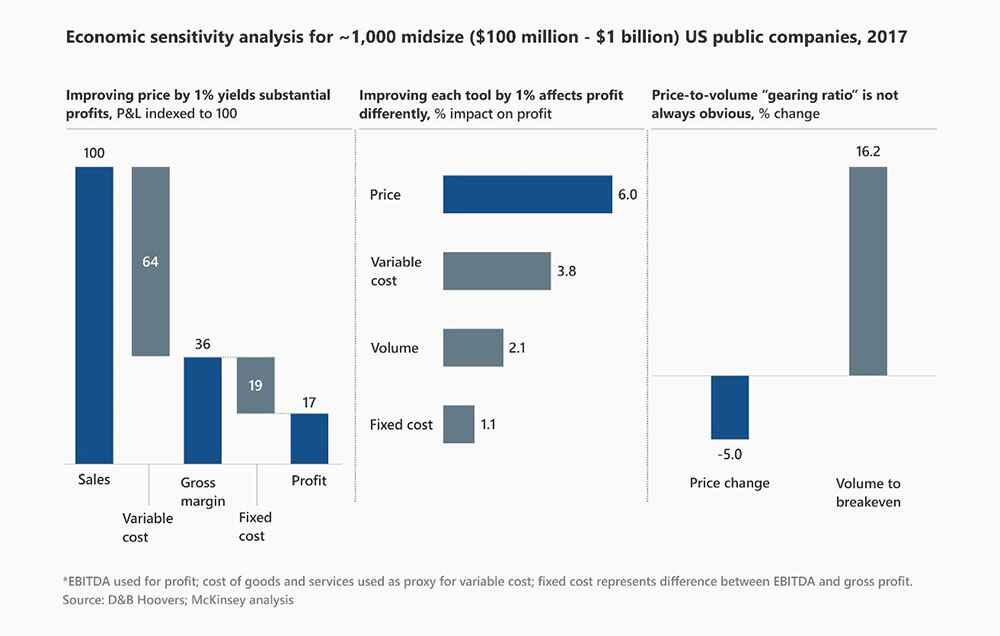

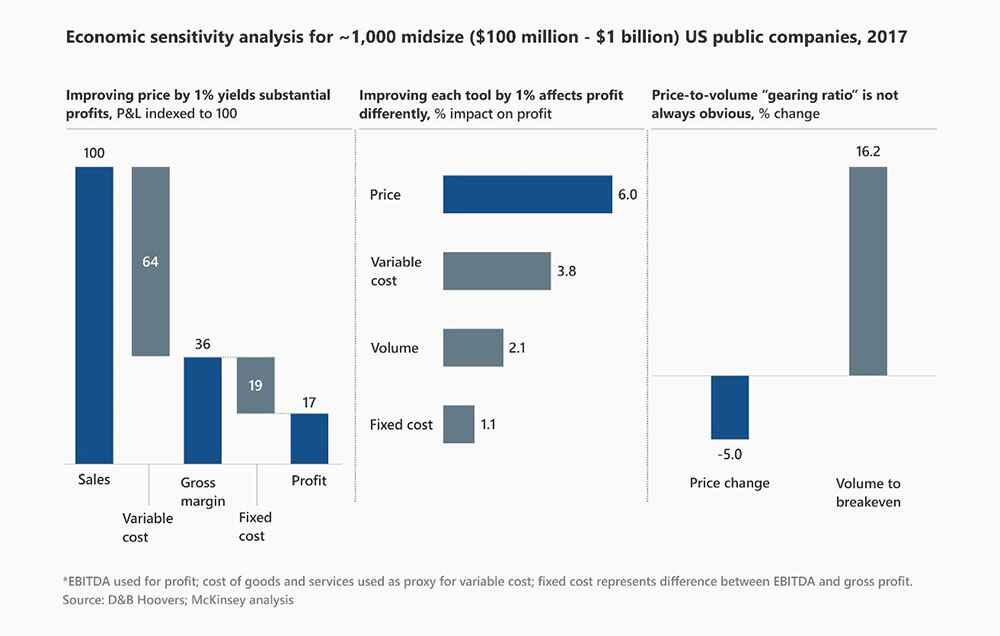

According to McKinsey a one percent increase in pricing ups the profit by six percent, on average. And a one percent cut in variable and fixed costs improves profits by 3.8 percent and 1.1 percent. This is akin to acquiring a business 30 percent of the company’s size with a similar P&L structure.

With sprawling acquisition prices and shrinking return margins, PE firms now have a hard time extracting paybacks from their deals, and value creation can come to their aid.

4 Steps to ensure Maximum Value

McKinsey says: “PE firms can maximize value by addressing pricing early, but value can be derived at almost any point in the deal cycle, from pre-deal diligence to the eventual exit.”

Substantial results are achieved by focusing on these four areas:

Working Capital

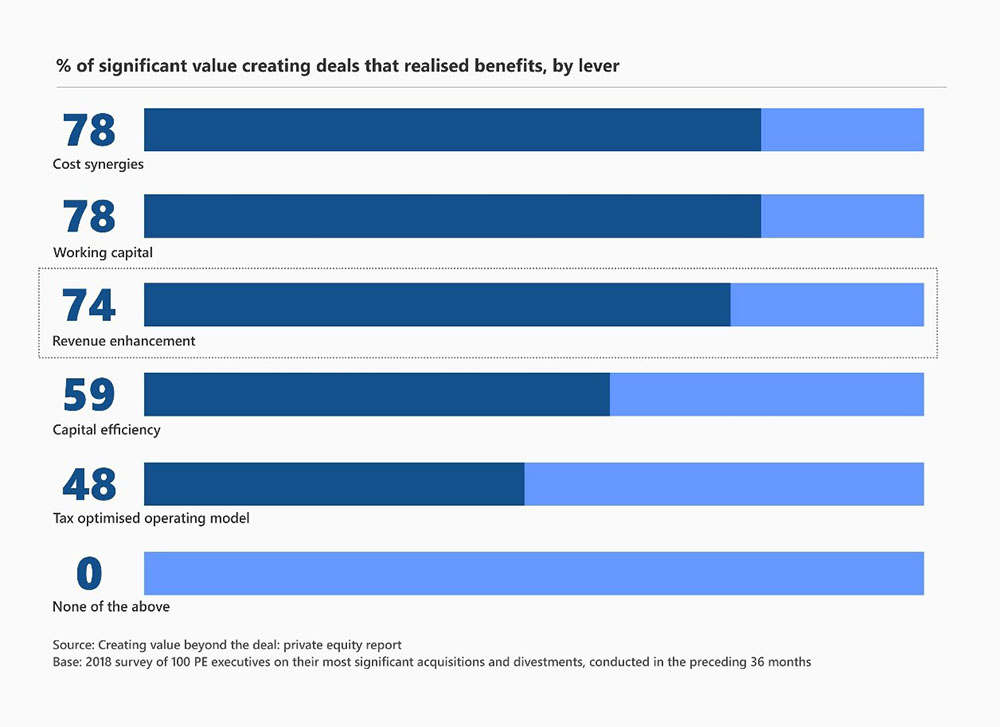

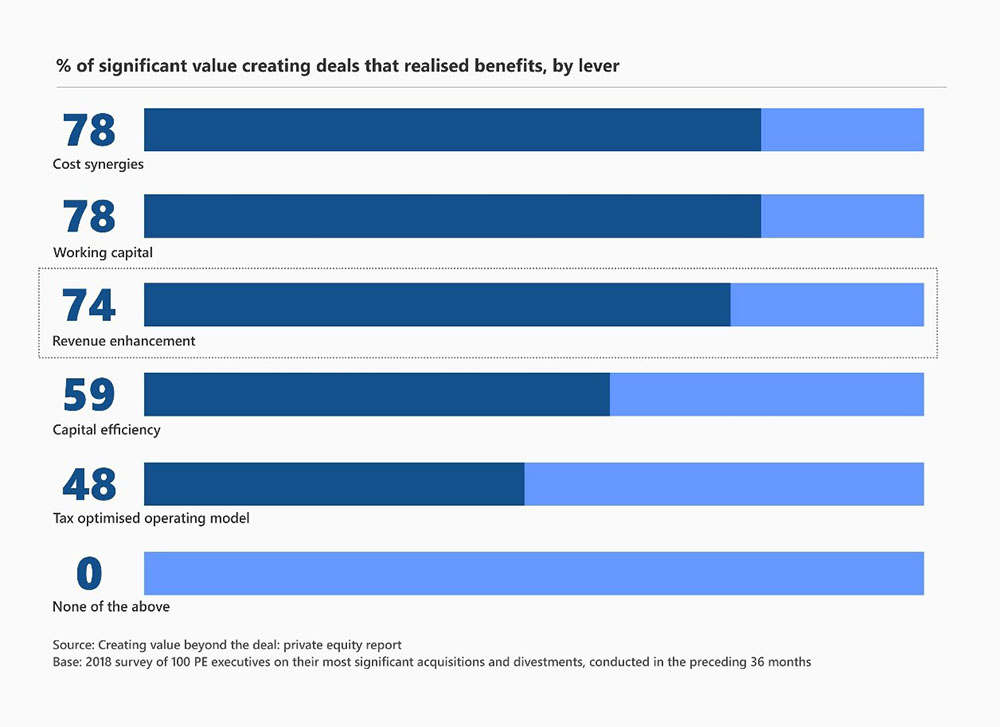

“53% of 100 PE partners say they realized deal value through working capital; there is more that can be done than just cut costs to drive top-line growth in PE.”-PwC

Operational improvements can help in easing the challenge of high-multiples. Low working capital while maintaining business requirements can give higher returns on invested capital thereby facilitating more cash which can be used to drive growth and act as a buffer during difficult times.

Worldpay improved its top-line growth by improving its operations. One way to do this is by freeing up redundant resources in sales, marketing and R&D.

Strategic Clarity Before Making the Deal

The PwC survey indicates that 88 percent of the deals with strategic clarity generated satisfactory returns. Of 80 percent of transactions that were value-aligned, one-third generated significant value delivering an average uptick of 14 percent.

Zeroing in on Talent Retention and Culture

57 percent of PE dealmakers see culture as an impediment in the value generation process. Significant attrition (21%-30%) is witnessed in deals with considerable value erosion. The most vulnerable (10%) are key performers. Loss of talent can derail even the brightest deals.

Leveraging Data to Boost Deal Value

With cloud-based data, now granular analysis is possible. Data can give insights into sales and operations effectiveness; price modifications and market identification. Use real-time data to introduce variations.

McKinsey advises incorporating a 100-day plan wherein the company works on explicitly identifying “pricing as a high-priority initiative”.

Impediments in Value Creation:

Competitive responses and customer loss concerns hold PE firms from incorporating value creation in their functioning. However, when implemented in the right areas, customer loss is usually found overblown and that too is addressed by quick and high returns.

Underestimation of the potential impact of value creation leads to fewer investments in it leading teams to believe that either they are underprepared or they lack the needed resources.

The Upshot

“If the first was financial engineering, and the second operational engineering, the third wave is defined by the requirement to pull on a full suite of value creation levers on every asset to achieve its full potential.”-PwC

Value creation results differ with the market structure, business model, complexities in the product line, and the pricing finesse. While the process may seem tedious but the results will significantly reinforce the PE firm’s confidence in its higher value bid. Pricing transformations have the potential to create value for both the portfolio companies and investors. Aside from pushing the top line, they create a competitive difference, confidence, higher exit returns resulting from a successful track record, and process improvement in the bottom line.

PE firms have an edge over corporates as they are better equipped to conduct in-depth market analysis and due diligence. Time to use the PE power!

“Winning deals today is difficult and prices are high. Knowledge of the market and the asset are key as is the knowledge of value creation levers. Value creation is more important than financing or structuring. “ - Inaki Cobo, member, Private Equity, KKR London

Visit the insight page for more info.