Introduction

What makes private company valuations special is the ambiguity and room for independent evaluation that exists when compared to a publicly traded business. You’re operating with less current and historical data, lower transparency on future business performance, and the capital structure of the company may not be completely accessible. There’s also the question of accounting: private companies are not bound by traditional Generally Accepted Accounting Principles (GAAP) regulations and enjoy a lack of strict reporting requirements.

Typically, firms that have been taken over have a control premium attached (i.e. the acquiring entity pays over the odds to have a controlling stake in the company’s daily operations). Comparing a potential target to recent transactions can help account for any disparities due to the control premium and evaluate the target firm’s value from a better position.

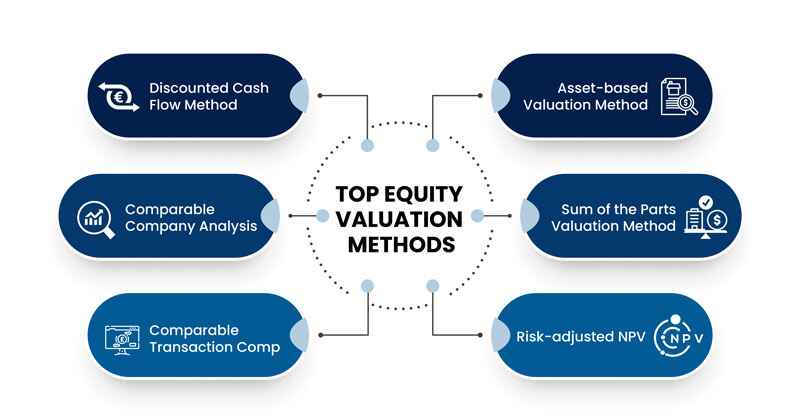

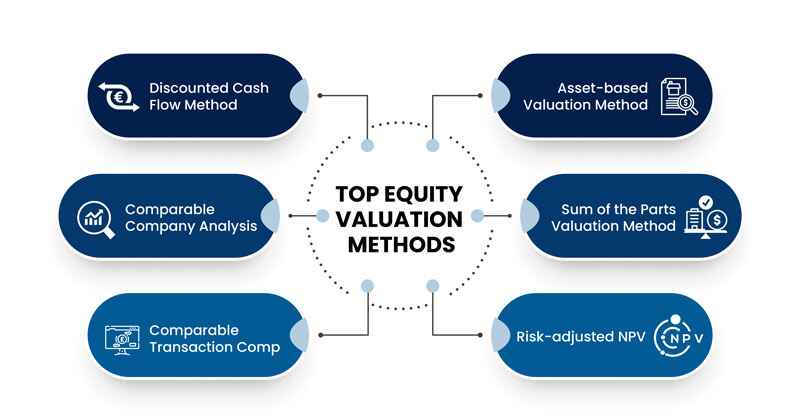

Private Equity Valuation Methods

Most PE/VC firms estimate a company’s value with the help of Equity Valuation Methods. To evaluate an organization, there should be enough understanding of Venture Valuation, which is considered as the most holistic evaluation approach.

All valuations are related to the careful consideration of both hard facts and soft aspects. And they are applied thorough risk assessment of the aspects such as:

- Management

- Market

- Science and technology

- Financials/funding phase

To determine the private company valuations as accurately and objectively one use various assessment methods, which are mainly suited for the evaluation of technology firms, with more growth potential and start-ups of all kinds.

Although not every kind of valuation method is appropriate, they vary as they assess every organization according to their industry and financing phase. The top Equity Valuation Methods are as follows:

-

Discounted Cash Flow Method

To value a private business in the discounted cash flow method, a VC/ PE firm must be serious about the acquisition, the target will likely disclose their books, but they still require to be audited to ensure accuracy. This is less commonly used as the primary barometer for private valuations due to the uncertainty of private companies’ financial statements.

Private companies’ accounting statements may also include personal expenses along with business expenses in the case of smaller family-owned businesses and have unexplained gaps across the board. However, if the acquiring firm is able to determine accurate numbers for revenue and operating costs, taxes, and working capital historically, they an model these numbers out to a 5–10-year timeframe (depending on the length of the project) and then determine Free Cash Flow.

Since the Free Cash Flow is representative of how much money the business has available to give back to shareholders, it is considered an accurate measure of a company’s fair value. The discount rate problem mentioned above also factors into calculating the company’s beta, which is the level of volatility associated with investing in the firm as opposed to the global equities market (typically, benchmark indices such as the S&P 500 are used for comparison).

-

Comparable Company Analysis

The goal of using comparable company analysis method is to search for other public businesses that share characteristics with the private firm. These characteristics include industry, margins, revenue/size, geographies in operation, and age. For an established business, this process is much easier. For example, SaaS businesses will have dozens of similar companies because the market has become extremely saturated in the last decade.

Most SaaS businesses founded during the last decade are still-loss making, have high revenue growth, and have a high dollar-based net retention rate that compensates investors for the poor bottom line. In this scenario, for a PE/VC firm considering a buyout, the value lies in evaluating a discount in the company relative to other publicly traded businesses.

To measure the discount, investors often calculate industry averages of different valuation multiples. Continuing with the SaaS example, these metrics can be traditional ones such as EV/EBITDA, EV/Revenue, and Free Cash Flow/Share or industry-specific metrics such as churn rate, customer acquisition cost, lifetime value, and annual recurring revenue.

-

Comparable Transaction Comp

If a private company is trading at lower multiples to other public competitors while anticipating higher or equal revenue growth, it becomes an interesting investment this when comparable transaction comp comes into existence. If their market timing and execution strategies are right, a PE/VC firm can come in, buy this company out and make a profit through an IPO once the project’s timeline is complete. If the target firm operates in an industry with lots of recent notable transactions or IPOs, we can use information from those transactions to calculate a valuation.

What separates the world’s best private investors and helps them deliver high value to LPs consistently is that they factor in everything when valuing a company: any potential one-time events affecting valuation, quality of management, and alignment of the acquirer/acquiree’s goals, and finally whether the private company will be able to deliver a high return on invested capital.

In volatile equities markets like today, LPs and Venture Capitalists may want to seek liquidity in their fund interests, so they need a higher rate of return to justify the investment. This is perhaps a reason why the volume of PE/VC funding has decreased in the last year; markets are uncertain about future prospects and are only seeking investments with either high conviction or minimal downside (ideally both).

-

Asset-based Valuation Method

The asset-based valuation method is used for considering the value of the assets and liabilities of a business. Under this method, the value of a business is equal to the difference between the value of all its relevant assets and the value of all its relevant liabilities.

The advantage PE/VC firms hold over investing in public markets is in the timing. There is potential to make massive gains if these firms can time their entry into the private markets during a period of uncertainty and low valuations and exit into the public markets once bullish market sentiment has returned.

Typically, industry averages can be used for calculations with a slight premium attached to account for higher cost of equity and debt (since investors have lack of liquidity with holding equity in a private firm, it is an intrinsically riskier investment).

-

Sum of the Parts Valuation Method

A conglomerate that has diversified business interests may need a different valuation model. In this method the valuation of each business is done separately and gets added up for the equity valuations. This valuation method is called a sum of parts valuation method.

To evaluate beta, PE/VC firms either use industry averages and then unlevered or lever that number depending on what kind of beta was used and adjust that number accordingly based on the target’s credit history.

It's often said that valuation is an art and not a science – and this is especially true for investing in the private markets. Our calculations are based purely on a series of assumptions and estimates and trusting the accounting processes of the target company.

-

Risk adjusted NPV

Risk adjusted NPV is a most common valuation method of valuing compounds or products in the industries like pharmaceutical and biotech. The risk adjusted net present value (NPV) private equity valuation method utilizes the similar principle as the DCF equity valuation method, except that each future cash flow is adjusted by risk to the probability of it actually occurring.

The probability of the cash flow occurrence is also called as the ‘success rate’.

The success rates of a certain compound/drug can be estimated, by comparing the probability that the compound/drug will pass the several different development phases (i.e. phases I, II or III) usually undertaken in the drug development process.

Qualitative Issues While Conducting Equity Valuation

Equity valuation focuses on the estimation of the likelihood of an organization being a successful firm in the coming future. Though it is many times very difficult to build-up any model that can predict the success of any organization. For instance, the next-gen enterprises like Google and Facebook share almost none of the aspects that were present in behemoths enterprises such as Exxon, Wal-Mart or even Apple for that matter.

There are a few questions that need to be addressed before a valuation exercise is done. These issues are not quantitative and won’t be available to seek direct application in the valuation report. These issues are mainly qualitative and indirectly influence the valuation.

The most important qualitative issues are as follows:

-

Industry Analysis

Industry analysis is very important; the new age organizations are always in the competition with one another to get a share of the same market. If an organization’s competitors become more powerful and efficient then it tends to lose out.

In the current modern market, no innovation does not mean stagnation rather it is the end of the enterprise as more effective challengers will sooner or later keep you out of business. Hence, equity analysts try to strive deeper through industry journals and have an interest on the company that is conducting thorough research. They also take help from the Porter’s five forces model to gauge whether or not, the industry as a whole is losing its effectiveness to another industry.

-

Strategy

One more qualitative issue to be addressed is the organization’s strategic vision. Mainly the companies usually follow one of the three strategies. They will either try to be:

- Cost leaders i.e. organization that offers the product or service at the lowest price to the consumers. An example that can be considered as - Wal-Mart

- Innovators i.e. providers of high and top quality products and constantly build new and better products. An example that can be considered as - Apple

- Niche service providers i.e. providers of products and services for a very specific group of customers, whose requirements are well understood by them i.e. Harley Davidson motorcycles

Each of these strategies needs a very different approach. For example, cost leadership needs superiority in the supply chain, innovation needs focus on research and development and niche services needs focus on customer relationship management.

Equity Analysts must be aware of the strategy of an organization, their investments towards developing the capabilities needed to service this strategy and also the advancements that the competitors are making in this regard.

Conclusion

The long timeline of private equity funds and VC investment means there is a lot of flexibility around waiting for the right market opportunity while improving operational quality that is not available in the public markets.

Public companies are affected by general market momentum and volatility due to earnings releases and Federal Reserve Policy that can skew stock prices away from “reasonable valuations” and muddle investor sentiment. These risks don’t exist in the private markets, providing an opportunity to deliver a higher return to investors in the long run without traditional volatility concerns.