Private Equity professionals pull many all-nighters to dig out treasure chests like Crunchbase in efforts to unearth their cherished unicorns. Sporadically, their blood, sweat, and toil are repaid with a prized entry into the USD 1 billion club. But how lasting is this success and what can investors do to prevent themselves from getting lost in the fog of hollow promises and true potential?

We decode this and more in this article.

Unicorns are surprisingly surviving the COVID-19 crisis . The crop is lush with four new names blooming bright in the list: Quizlet, Udemy, ApplyBoard, and Course Hero. In total, 44 new unicorns were annexed to the existing list, upping the total number to 601.

“The average raise for these 600-plus unicorns is now around $735 million, with an average valuation of $3.3 billion.” – Crunchbase The previous year, 2019, was a unicorn stampede with a new unicorn added to the existing list every 1.5 days.

But don’t let these numbers seduce you with their promises of potential and innovation. Here’s the other side of the same coin.

What happens to the unicorns after they have been funded? Data shows that most of them turn into bottomless cash pits.

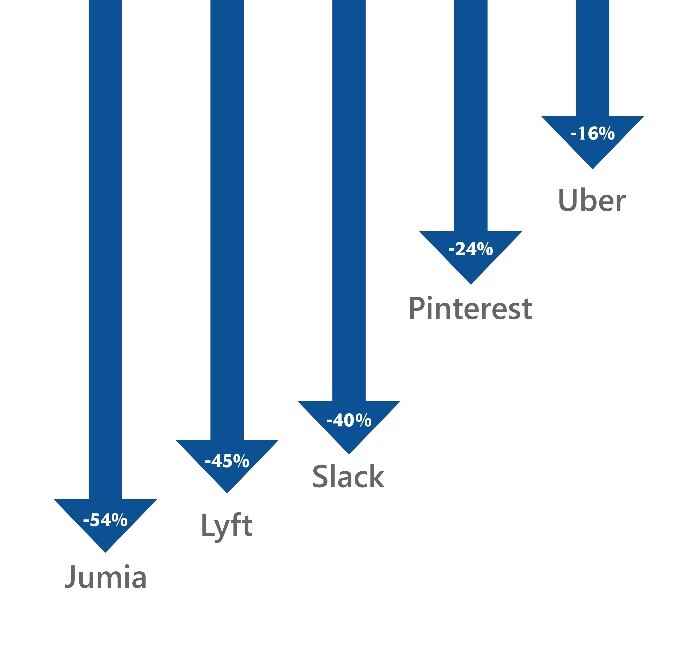

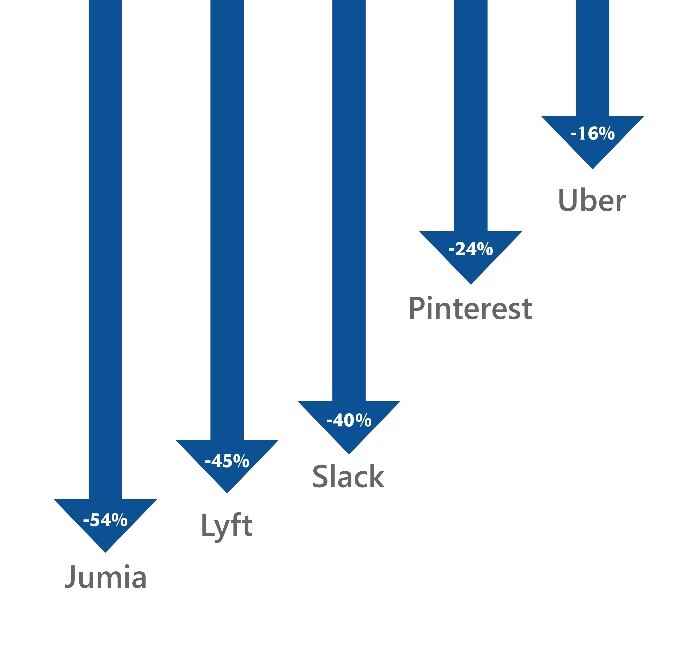

Take a look at the picture that emerged at the beginning of this year.

These companies that were largely hailed but their models fell short on the business basic aka profits. A Wired’s review said Uber was losing USD 2 billion annually on “promos for drivers and riders in order to support said juggernaut.” Slack and Pinterest also posted huge losses.

The same story percolates across levels. The failure rate among new US startups stands at 50 percent after the five-year mark and 70 percent after the 10-year mark.

We picked five worst cases and tried to draw success lessons from them. We’ve also marked the red flags for you to see.

Evernote – The First Dead Unicorn

Hailed as the first and the only top note-taking app, Evernote was a place to make a note of everything. The second brain, they called it. grew ridiculously fast, acquiring one million users in just 446 days. But their magic stopped in 2013. Stagnant growth left them lurching for market share under stiff competition from giants like Google, Apple, and Microsoft.

Valuation: USD 1.2 billion

USD 300 million of funding from Sequoia, Harbor Capital, NEA, T. Rowe Price, and others.

Series E funding

What went wrong: They lacked a vision for the future. Copying other successful ventures, they jumbled their app with unrelated supplementary apps like Hello and Food.

Theranos – Ex-Decacorn

Theranos promised groundbreaking technology. They were to simplify and speed up the blood testing process. Their technology was to do a number of health assessments. Blinding promises raised PE hopes to cloud nine and they rushed to ride this UFO.

What went wrong: The model was trickier to implement. Lemming effect, a technology that promised great hope but was never realized, got investors hooked because of its sheen.

Red flags that investors missed: Too eager for a breakthrough, they missed checking on the specifics.

Juicero

This was a juicing system connected via Wi-Fi, with no cleaning requirement.

What went wrong: The product was more of a status symbol, so the demand wasn’t sustainable. Investors missed asking one important question: were consumers ready to pay USD 700 with USD 8 per juice pack just to look cool?

Red flags: The demand for the product. Were people so concerned about cleaning their juicers?

Fuhu

fast-growing new-age children’s tech outfit, this quickly slipped on hardware shoes from software flip-flops. After USD 100 million supplier debt, they declared bankruptcy and were bought by Mattel at a tiny chunk of their price.

What went wrong: Too ambitious promises. They couldn’t meet their revenue projections.

Red flag: Their revenue projections beat their accounting department’s realistic estimates.

5 Investment Flaws that Funds Can’t Solve

Drawing the similarity between a personal computer and a unicorn PE deal , a leading private equity professional said that both are binary: working in zeroes and ones. You either are a massive success or a colossal failure.

Watch out for these major pitfalls that can turn a unicorn’s glory into its gloom and doom.

Overpromising: Is your business ready to deliver the promise?

Falsehood: Do you know the necessary details of the business? Invest in a product that the market needs, understands, and values.

Overambition: Don’t let them burn the money. Watch out if your target has gotten into the lure of spending like a big company.

Disconnect with employees: In the race to reach the revenue, companies often overlook their employees’ contributions. There can be no lasting success without lasting talent.

Oversight of the competition: Companies in the tech space keep causing disruptions, so an eye on competitors can barricade a major shock.

Darren Sissons, an experienced tech investor and the Vice President and portfolio manager of Campbell, Lee & Ross Investment Management Inc, has another kind of advice: “We look for mature tech companies with experienced management that have gone through a few market cycles.”