Private equity fundraising gets boosted by the proper plan built-up keeping in mind the firm’s competitive advantage and investment strategy, funds fees and its size, applying co-investments principle as a LP magnet, appraisal of the appropriateness of LP and, proven and better practices during the real raise.

Let’s see the successes of private equity in monetary growth form. The previous year has come across the mainstreaming of growth in private equity contracts. Growth equity, which is a strategy that stands between leveraged buyouts and venture capital had hit a record of contracts' value. The deal value that hit $62.5 billion in 2020 was up by 8.8% from 2019. Besides, information technology contracts increased by 72.4% to the value of $20 billion, as compared to $11.6 billion in the year 2019.

Private equity fundraising works in its unique way. The GPs (General Partners) of private equity funds solicit commitments from LPs (Limited Partners) so that they admit for investing in their company. The entire process revolves around pitching the investment vision and the methods by virtue of which it will result in attractive financial profits. In order to garner LPs fund investment, GPs also have to prove a track record and the skill to win business deals. Private equity investors, also called LPs, look at hundreds of funds but can admit to investing only in a few of them. To succeed in this process, it is crucial to consider all five of the below-given cases.

1. Company’s Competitive Advantage and Investment Strategy: The Knowledge Base

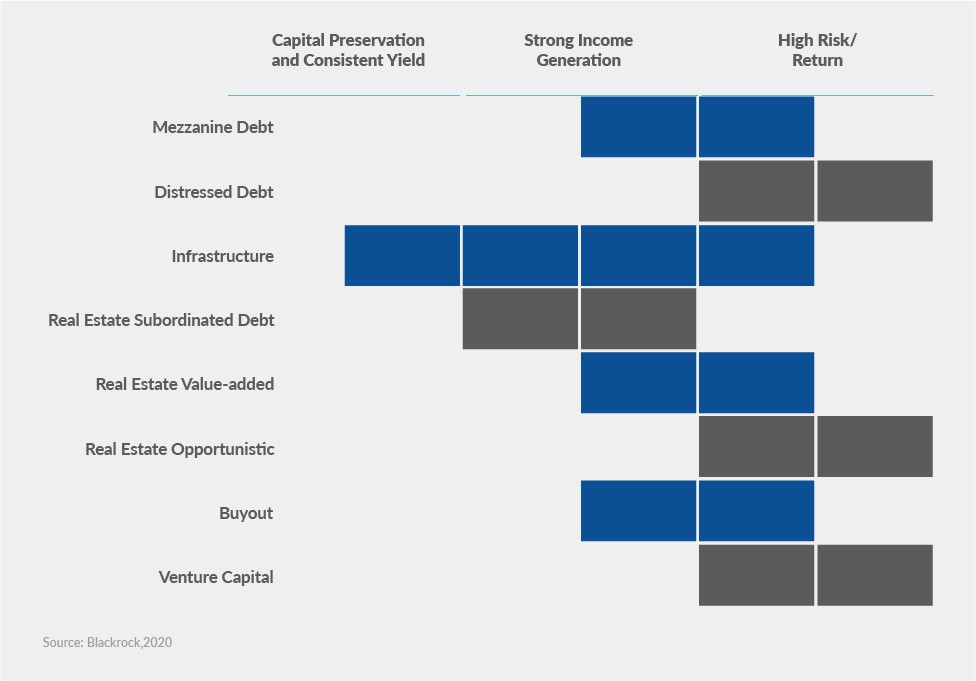

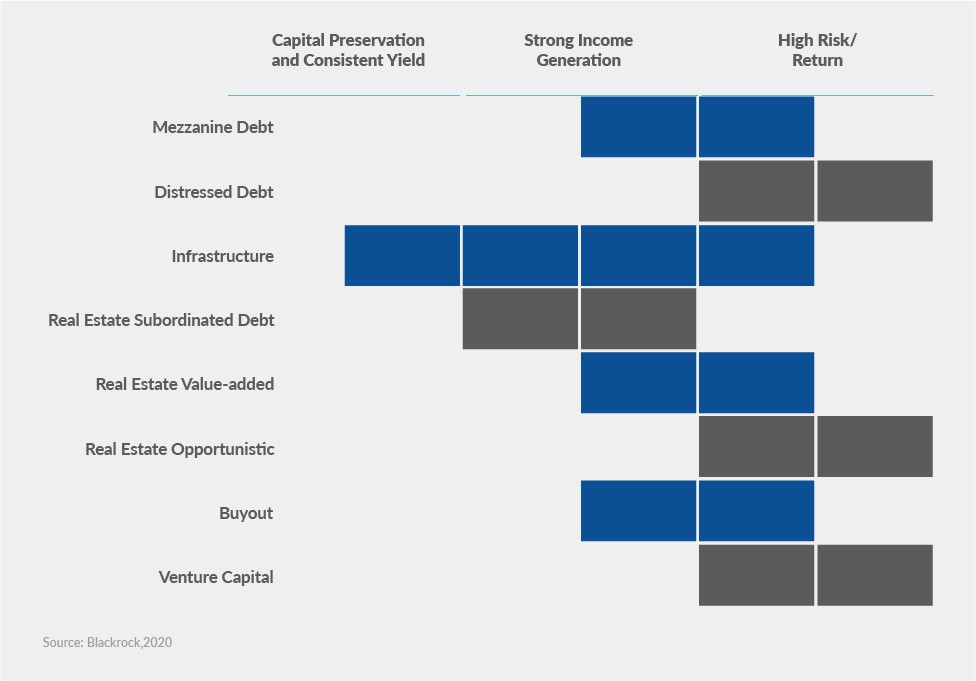

It is essential to articulate and present a strategy in plain language that conveys the product and represents in-depth LP allocation. LPs depend not only on the “asset-based” but also lookout for the “outcome-based” presentation so that they can determine the allocation. Thus, in order to benefit from the attention of the LPs, one must explain the drivers of monetary growth. This will enable LP to access and commit funds to the private equity firm. It is essential to notice here that each private equity strategy presents a tradeoff between the monetary drivers.

Figure 1: Exposure of private equity strategies to required LP outcomes

The points that help success reach private equity company includes the following:

The personnel requiring the attention should have a proven method to benefit from superior returns. Also, it is essential to know whether the strategy can be replicated with ease. In addition to this, the sources of value-add should be applicable for contributing to portfolio firms. Besides, the strategy should perform during downturns. The team which is assembled should also help enable a success platform.

2. Fund Fees and Size: The Knowledge-details

The amount of fund needed should well accommodate the strategy. The market map comprises potential companies, the investment size required, and the number of private equity investors. It is always better to have a fixed conservative fund size. It should also be oversubscribed and thus support the target. Therefore, it should not be a shortcoming of the round adjectives and more time to close down. It is essential to point out here that LPs would insist on a close to the objective. This preference of LPs is so due to making sure that it is closing private equity fundraising faster and get the investment amount. In addition to this, the terms and fees should be competitive.

3. Company’s Co-investments Principle: The Applicable details

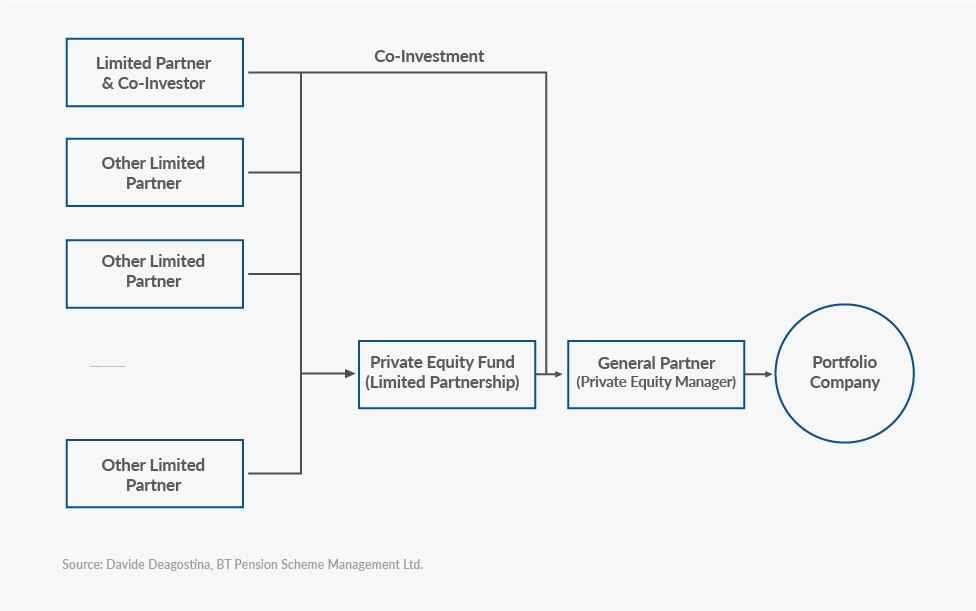

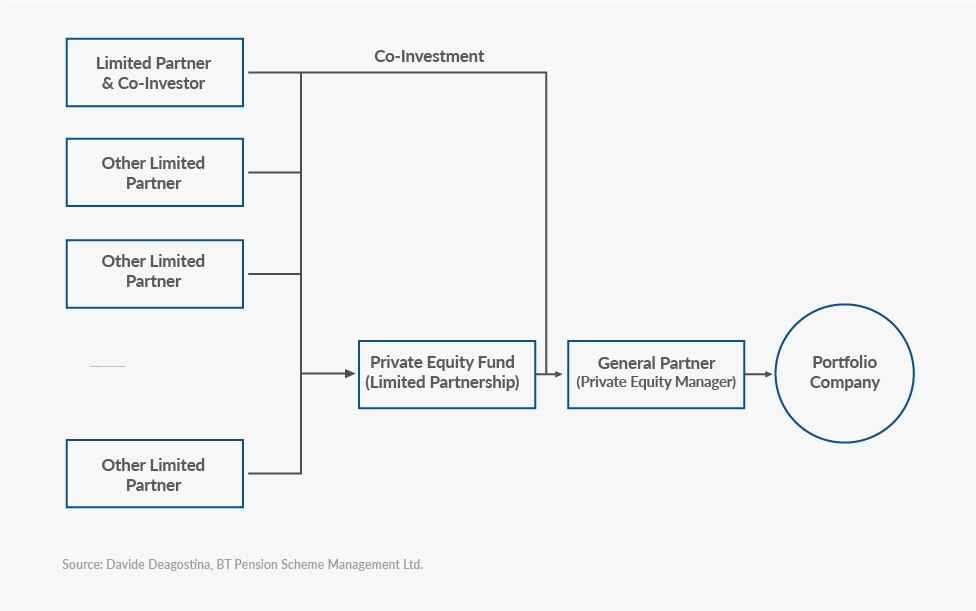

Being attentive towards the legal structure can be done by initially engaging the LPs with the co-investors. As LPs, several people are looking out for opportunities in co-investment to win more net returns and have efficient control of capital deployment and thus have an improved lever on geography or industry exposure. Co-investments are an excellent method for LPs to work in ongoing diligence, especially in new fund managers. In addition to this, the offering of co-investments results in reducing the blended fee for LPs because no management fee is charged on the co-investment money. Co-investment is mainly characterized by predictability and a shorter time period on the capital call timings. Thus, offering co-investments helps facilitate access to capital and create stronger relationships with LPs and manage the limits of fund exposure.

Figure 2: LP Magnet and its Co-Investments

4. Company’s Appraisal of the Appropriateness: The Important details

Every LP has different goals, concerns, and requirements that are based on its stakeholders. It is for a minimum of 10 years that an LP relationship exists. In case one chooses to diversify the LP base, she can benefit from protecting herself from unexpected or sudden dropouts. It is essential to focus on LPs with the most improved fit and be aware of the tradeoffs.

LPs can be categorized into three types, depending on their investment details:

1. Patient Capital

Big institutional investors are not affected by ups and downs in business cycle and can always complete their monetary commitments. Pensions and endowments can be considered to hold a massive amount of capital that can be deployed. However, they take more time on due diligence and can be said to be influenced by strict mandates. In addition to this, institutional investors expect that the PE will consider accommodating their requirements for reporting. This can be bureaucratic or onerous and can even force one to necessarily reveal the returns details publicly.

2. Flexible Capital

The funds have the capability and expertise to hold a workforce in order to facilitate a fast-due diligence procedure. It is important to note that for a funds of fund managers faster financial returns are important so they can make for their high fees. These funds place a charge on their end investors fees that are inclusive of their fees, and internal operational expenses of their investments.

3. Value-add Capital

Corporate limited partners (LPs) invest with the objective of knowledge transfer opportunities and thereby finding acquisition targets. However, they can also offer help in winning guidance and deals during the portfolio management period. If you place importance on hands-on interventions at the time of portfolio management period, an influential corporate investor who has effectiveness in client leads will highly help. Synergy assets can act as a unique value-add differentiator.

5. Proven as Better Practices in Real Raise: The Crucial details

It is an essential part of private equity fundraising. It shows that momentum matters. The more time one takes to close her round, the less favorable she would be perceived. It is essential to check the marketing documents, such as the pitch deck, as one of the ongoing progress tasks.

Benchmarks and Metrics

Additionally, in order to communicate efficiently the targets for the funds, it is essential to compile together a list of funds that are from a range of vintages. This is to present their performance in relation to the projections created. It results in an offering of both opportunities as well as transparency in order to derive a better insight into the experiences in the asset.

In order to communicate metrics, consider the below-given indicators. Their names are known but what has been added is the explanation on why they are crucial for the LPs.

1. NET Internal Rate of Return (NET IRR) - It makes the NPV (Net Present Value) of all flow of cash equal to zero for investors. It is a time-sensitive measure. GPs consider gross IRR, but LPs consider NET IRR. In cases where investors hold obligations for a capital return, this metric will be most important.

2. Total Value to Paid-In (TVPI) - TVPI capital is a multiple, and it presents the total of the cumulative distributions that are paid out to LPs. In this case, the residual value of the fund is divided by the paid-in capital. It is not like IRR; thus, it doesn't consider the time value of money. It is therefore calculated by adding up parts: DPI and RVPI.

3. Distributions to Paid-In (DPI) - DPI money is the ratio of cumulative distributions "cash-on-cash" returns.

4. Residual Value to Paid-In (RVPI) - RVPI is the ratio of the value of unknown net assets in the fund to paid-in money.

Wrap up!

The best practices followed in private equity fundraising can enable the success to rise in full swing. Therefore, it is essential to keep track of the above crucial steps, which can multiply the chances of meeting the objectives as a private equity professional.