In this period of personal, economic, and business uncertainty, focus has shifted from growth to survival.

The perennial optimism of venture capitalists is put to test by the pandemic, which has prompted many VCs to rethink their strategy, fortify the due diligence, and overcome the dilemma in investment performance.

Let’s understand the changes that are afoot already in the venture capital industry and future predictions as well. Here is a quick primer on how the COVID-19 crisis is changing the venture capital investment strategy.

VC investment: Lessons from the 2008 crisis

A few of the pointers for existing and new venture capitalists from the 2008 crisis as said by global leaders (excerpts from SEI ventures study report):

Downturns are quicker, deeper, and may last longer. Run a business while anticipating all downside scenarios.

Control the controllable, i.e., expenses, and have a neutral outlook on new sales until there is a better economic climate change.

Have enough cash to weather the storm. Flexibility is the key.

Save the most likely first. Get prepared to make the hard decision of not investing more time and capital when a company is not worth saving.

Engage with entrepreneurs in many ways other than venture capital like customers and product development.

Test unit economics, leadership, resiliency, and adaptability of the business plan and model.

VC Investment: Early effect of COVID-19

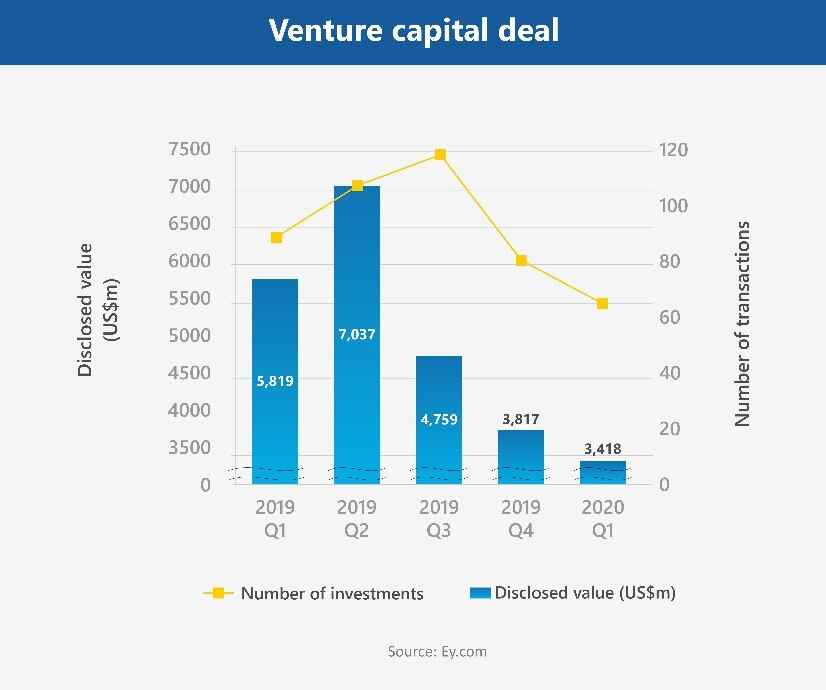

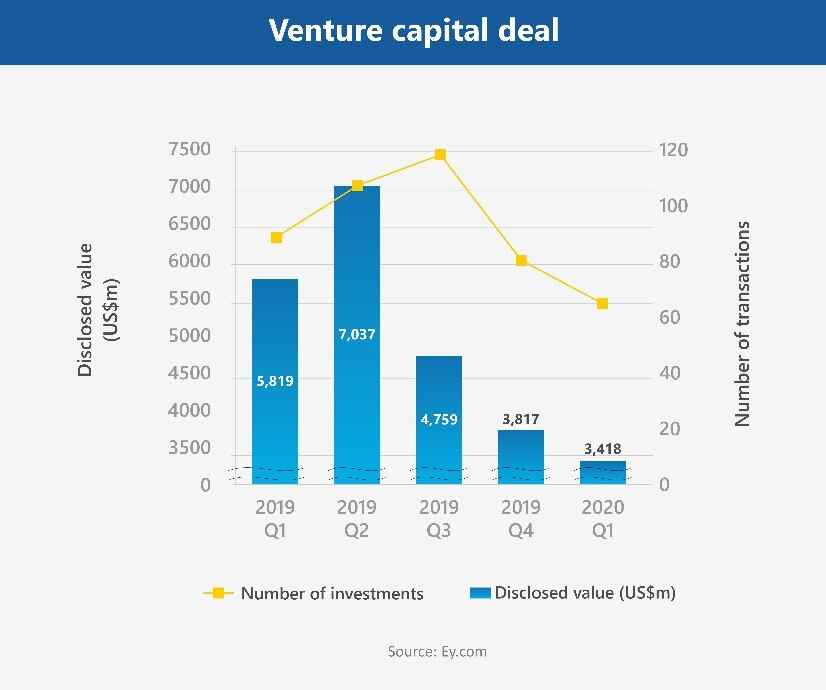

The early results show that there is a decreased venture capital activity in Q1, with deals down in value and volume – minus 10% and 21%. But, most of these funding rounds had commenced long before COVID-19 appeared.

Approximately 21 percent decrease from Q4 2019 was observed leading to 64 VC deals in Q1 2020. The biggest VC deal of Q1 was the investment in Grab Taxi Holdings Pte Ltd (Grab). Most of the deals were dominated by venture and seed investments. A rise in interest was observed accounting for 16 percent of the quarter’s transactions.

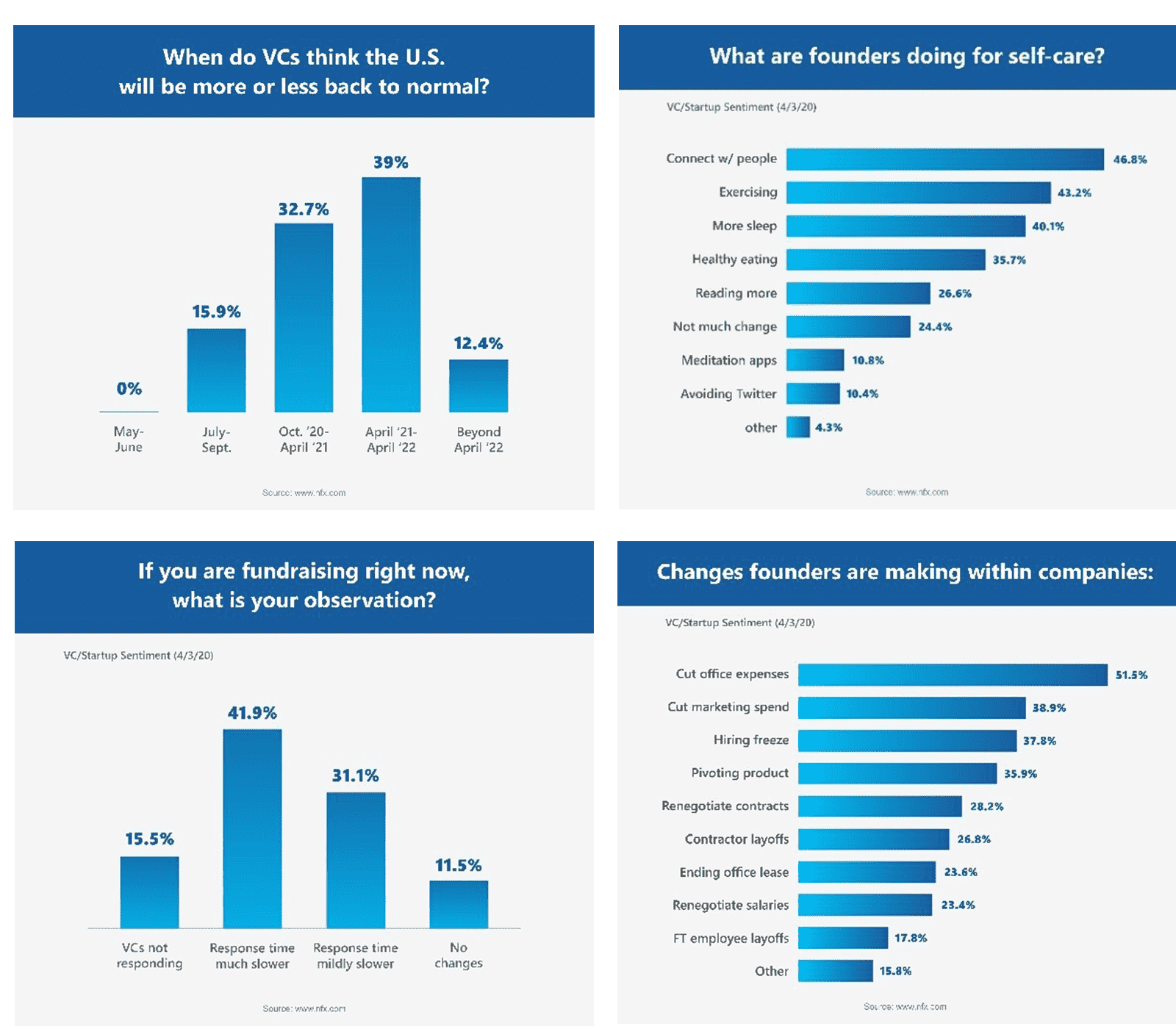

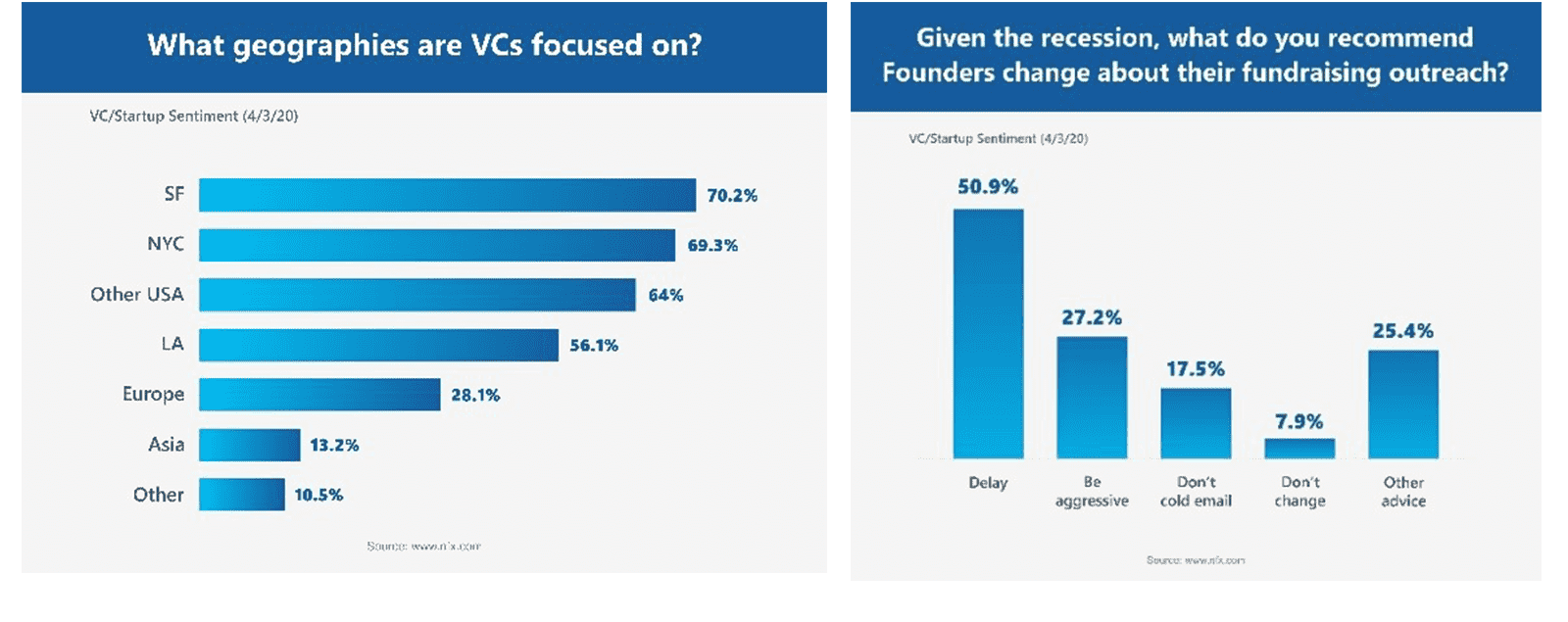

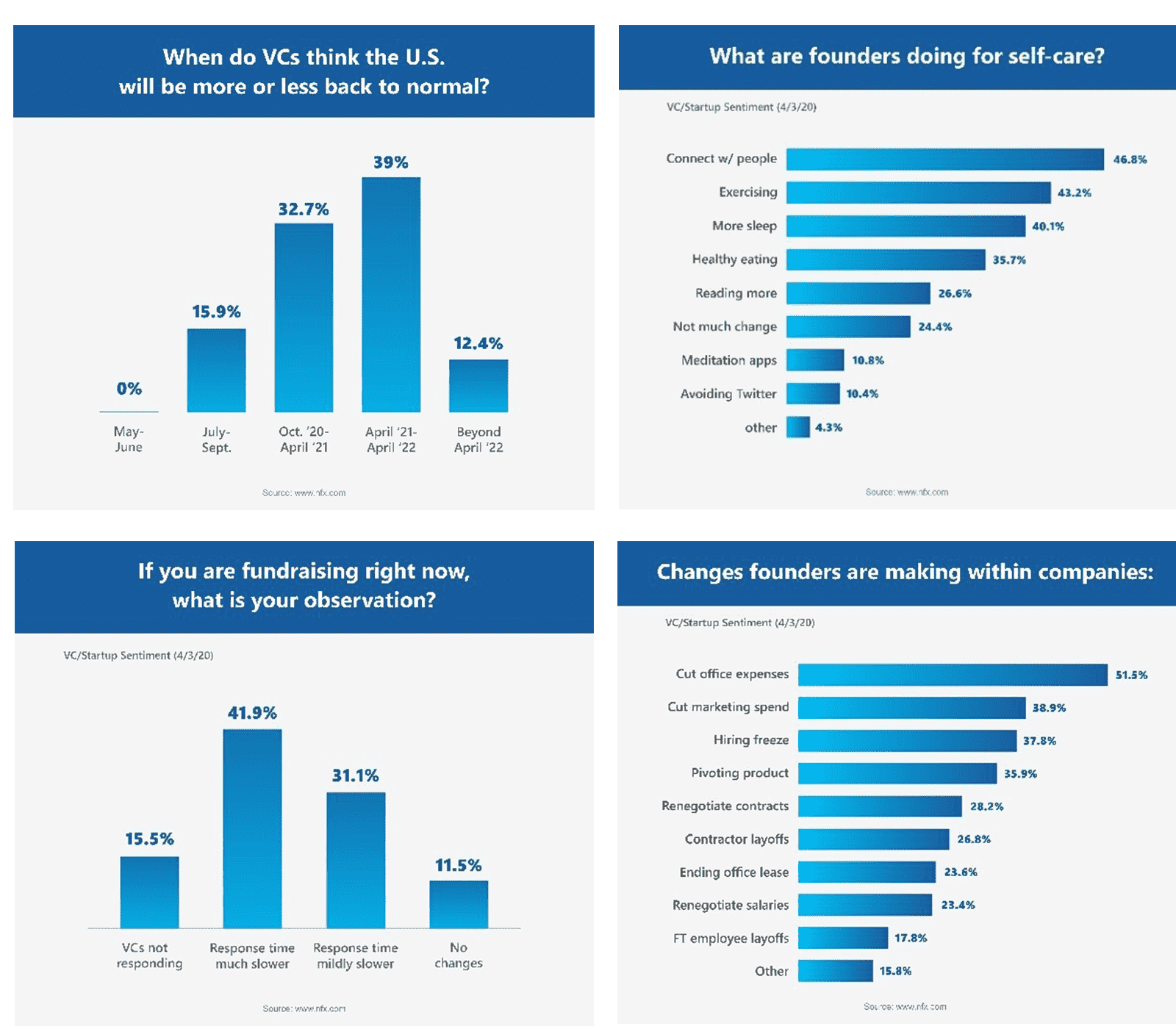

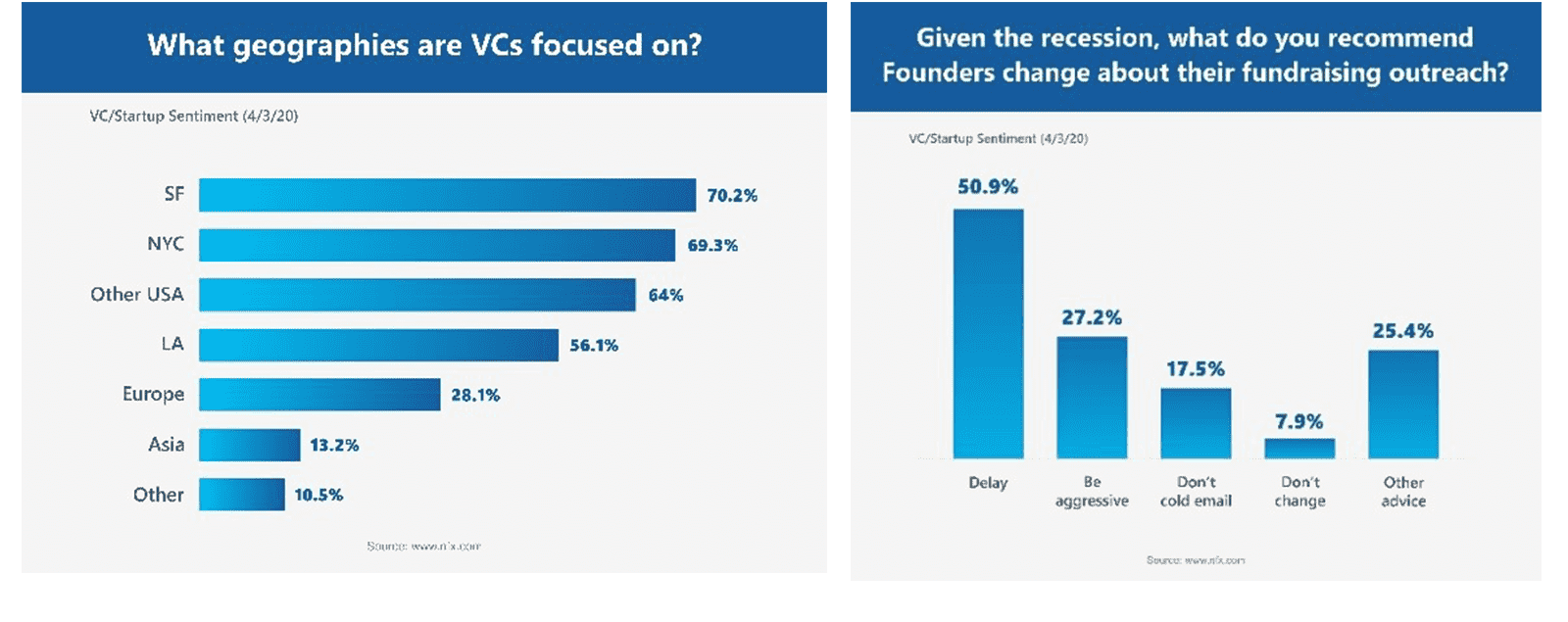

Moving forward, the VC and Founder Sentiment Survey, an ongoing initiative to track how early-stage investors and founders react to the COVID-19 crisis provides a reference point to us. As per the survey, 286 Seed and Series A Founders and 114 VCs have provided their insights on important questions. A couple of inquiries are featured here for reference.

VC investment trends: The future predictions

The US-based VC funds raised USD 46.3 b across 259 fund vehicles in 2019 and there is still liquidity. Companies with strong business models and a high potential for profitability may secure this funding, though the process may take a few weeks longer.

As we head toward Q3 & Q4 of the 2020s, we can expect:

More focus on portfolio companies to navigate the crisis

Delay in funding for new activities until long-term global economic conditions are clear

Less competition for deals in companies having relatively lower valuations

VC investment: Insights from global leaders

As per SEI ventures research, this is what global leaders are thinking about VC investment in the next 12 months from now.

The most resilient and passionate entrepreneurs are going to stay.

Focus will be more on cash generation and unit economics than growth.

Consumer/business behavior will create a long-lasting impact through technology adoption.

Mobile payments, Cybersecurity, and AI-driven financial planning

There may be a lower number of new investments and capital deployment.

Quality deals will get prime importance than costs.

Lesser quality deals will fail to attract capital.

To conclude…

The pervasiveness of the pandemic has created a room for bold and disruptive ideas. The existing performance is re-evaluated and due diligence is being tightened further. All VCs are recognizing and preparing themselves to be more resilient, innovative, and transformative.

It's like cruising the ship without seeing the shore. As we see the shore, valuation and magnitude of return will be more on focus.

The traditional base, which includes a unique idea, customer base, and break-even time will have a downturn perspective too in the future. A whole new holistic solution will be there in place.

Let’s keep the scale of hope high!