Caught in the thick of health and financial emergency caused by COVID-19, stakeholders in the private equity industry are going over their contracts with a fine-toothed comb. All to find the slightest edge they can get. Acquired companies are looking for waivers lest they default on financial commitments. Investors are concerned about their investments.

What are they questing after in these contracts? Covenants.

For the uninitiated, covenants are a way for private equity firms to protect their investment.

Private equity acquisitions are majorly financed by debt instruments. While equity stakes are bought too, debt constitutes about 50% to 80% of the total purchase price. Debt investments have an upside for the investors as they are reimbursed before equity holders during liquidation; for the target company debt financing means being less answerable to the investors and avoid heavy equity dilution during acquisition. It’s a win-win.

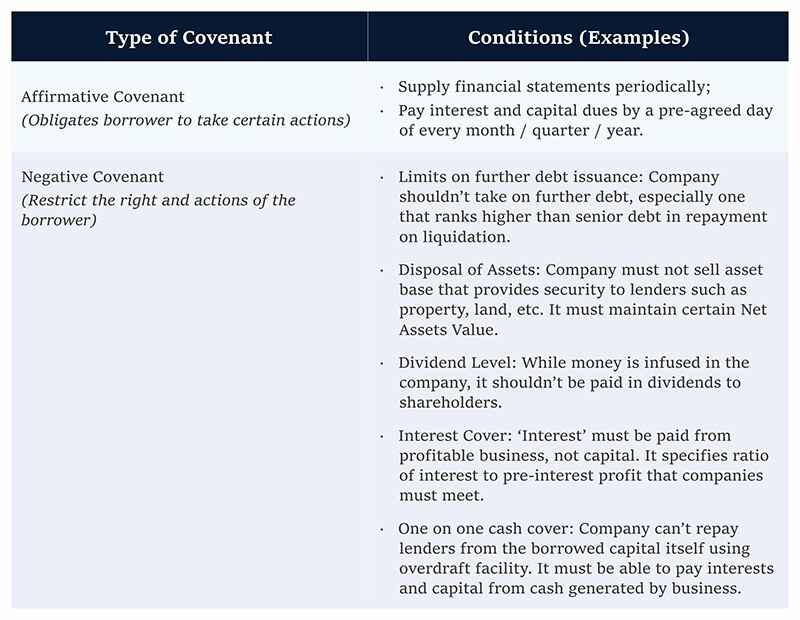

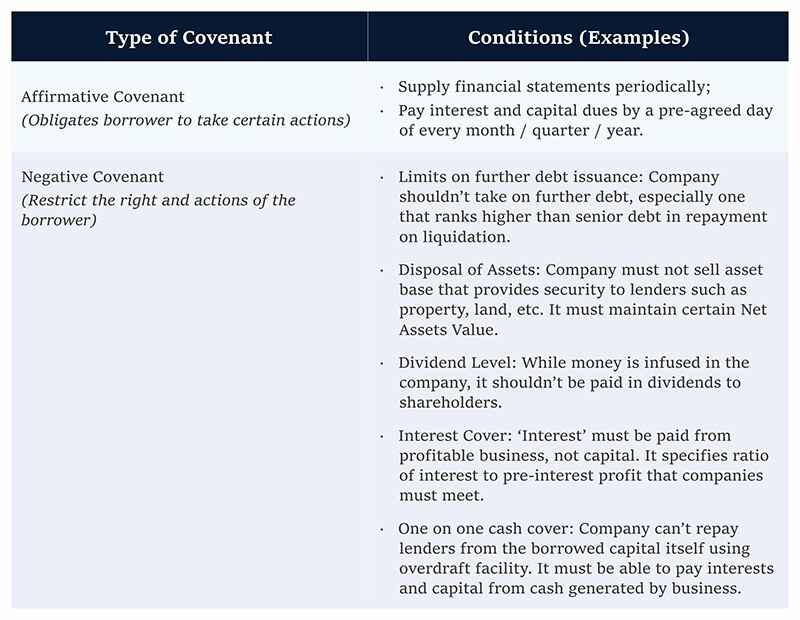

Debt and covenants go hand in hand. Covenants are the restrictions put on borrower – what one can and cannot do – such that the arrangement makes repayment of debt most likely. They are customized for every deal based on company’s valuation, business health and accounting information (inter alia, EBTIDA, repayment history).

You ‘Shall’ and You ‘Shall Not’

In private equity deals, one of the hotly contested areas other than the deal price are covenants.

For instance, the acquired company is typically required to keep its debt below a certain threshold. Imagine, Company A is asked to keep its debt levels lower than 5x of EBITDA (Earnings before interest, taxes, depreciation and amortization). So, if it has EBITDA of $25m, it would lose its ability to draw more credit beyond $125m. Specific provisos of a covenant can be positive or negative, resembling do’s and don’ts.

-

The company should do / achieve something by X date

-

It should get something in earnings and report within every X month or every X date of each quarter / year

It should get lender’s approvals for so and so events

Flaking out on these safety vows asked can affect company’s line of credit and trigger debt restructuring.

War on Covenants: Going Cov-lite?

Further exacerbated by the pandemic, covenant protections for lenders in private equity industry have been weakening. The industry is increasingly entering into covenant lite structures, i.e. lending without covenants.

For deals in private debt market, the cov-lite structures spiked to 59% in the first half of 2019, compared to 26% in entire 2018 (Proskauer report).

The logic for such a push goes like this. Debt covenants are by their nature risky for borrowers because it’s easy for a company to run afoul of overly restrictive covenants. That in turn also limits its guts to take on bold actions. So, it’s argued that limitations shouldn’t be put until a business has no potential whatsoever; and in the latter case, it would be wise to pull the trigger anyway.

Investors, however, are wary of cov-lite structures given low security of their investments in these deals. That said, cov-lite debts are more pronounced in the upper end of middle market (above USD 50 million of EBTIDA) private equity deals. The lower middle market segment (USD 5 to 50 million of EBTIDA) still very much requires covenant cushions to guard-rail their investment.

Private Equity bulwarks are instrumental in levering their financial prowess to ensure covenants are structured to give enough runway for the businesses to deliver on growth plan post-acquisition and contain conditions that protect stakeholders as well. Up your industry knowledge to become savvy private equity professional the top of the line firms expects.