Introduction

Investment ratios are essential for assessing the performance of any financial investment and analyzing them is crucial in this world of finance. Multiple on Invested Capital (MOIC) is one measure that is widely used globally, especially in PE and VC. It gives investors a perfect image of the total benefits of investment in terms of the initial capital invested. This article explains MOIC finance and how it can be calculated, then addresses the difference between MOIC and IRR.

What is Multiple on Invested Capital (MOIC)?

Multiple On Invested Capital (MOIC) is a vital formula generated on the total value created by investment divided by the investment capital. It has the advantage of determining the value of the investment return without including a time element.

In its basic concept, MOIC is calculated by relating the total value of an investment (profit, dividends, or exit value) to the actual invested capital.

Key Aspects:

-

Formula:

MOIC = Total Value (Realized + Unrealized) / Total Invested Capital

For instance, if an investor invested US$ 10 million in a project and the total value of all the project’s constituencies after exit or distribution is US$ 40 million, then the MOIC is 4.0, signifying a fourfold return on the invested capital.

While internal rate of return (IRR) considers the time value of cash flows, MOIC looks at the total return on investment.

-

Ideal for Long-Term Investments:

MOIC can be particularly useful for private equity, venture capital, and other long-term investments, as it includes all sources of the value created regardless of the investment period.

Significance of MOIC in Investment Analysis

MOIC is essential in assessing an investment's effectiveness as it gives the total value accrued on the initial capital stake. It is important for private equity, venture capital, and other segments of the shadow banking industry. It offers an absolute, clean measure of an investment's total return.

Key Reasons for MOIC’s Significance:

-

Risk assessment: It provides information about the amount of return earned per unit of capital, thus helping with the risk assessment. While MOIC is a valuable measure of investment performance, a high MOIC rating should be considered, along with other measures, to get a complete picture of risk.

- Alignment with Investment Goals: MOIC is total return based on the sum of all gains, and it is thus compatible with many institutional investors' goals that consider compound rates of return over a more extended period.

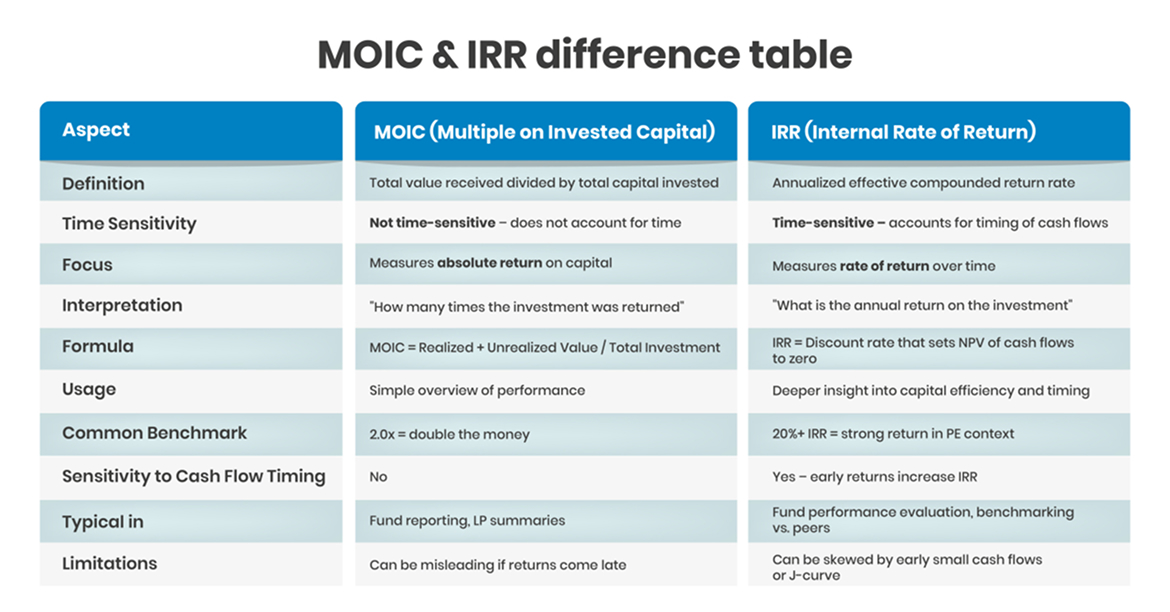

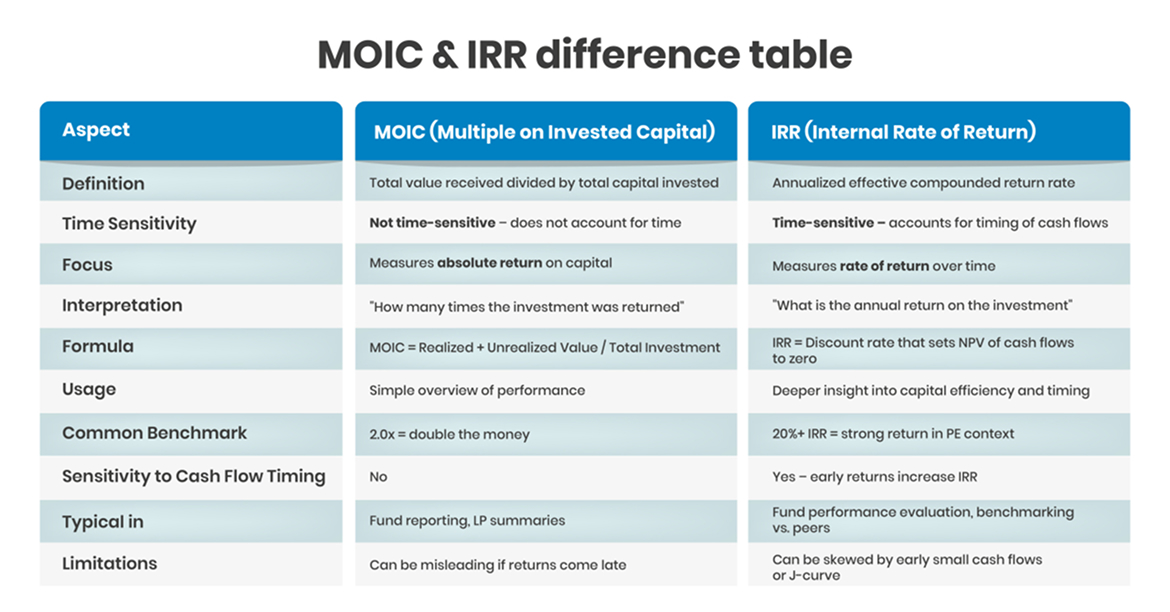

MOIC vs IRR: Key Differences

MOIC and IRR are two key performance indicators that play important roles in appraising investment performance, though they differ in several ways.

-

Calculation Method: MOIC is a simple ratio that specifies the total amount of an investment divided by the initial amount of the investment. It refers to the extent to which an investment has performed towards achieving the investor’s financial goals for the investment that was made. On the other hand, IRR is the break-even internal rate of return where the net present value (NPV) of all cash flows is equal to zero, considering the time value of money.

-

Focus:

MOIC is calculated only as a multiple of invested capital; thus, time is not considered, making it more effective for determining the total value created.

IRR considers the time value of money, which is an added advantage when evaluating investments involving cash flows at different points in time.

-

Advantages:

MOIC is equally applicable when the timing of investment is not very important in terms of the total return mix.

IRR is more suitable for evaluating the rate of return of capital for each year, especially for those investments that may have non-annual or random cash flows.

Limitations of Using MOIC

MOIC finance is easy to calculate and provides valuable information; however, it has several drawbacks when applied individually. It also does not consider the time value of money, which affects investors' judgments of investment performance. An investment with a MOIC of 2.0x made in five years and the same with a MOIC of 2.0x made in ten years represents completely different actual return characteristics.

Key limitations include:

-

Ignores Timing of Cash Flows: Similar to the IRR analysis, the MOIC does not consider that profits are received at different times. This makes their work less informative regarding time-sensitive investment evaluation.

-

Overstates Performance in Long-Hold Periods: Investors using MOIC may be led astray by high values in long hold periods where the capital invested has been locked for long periods without corresponding commensurate returns.

-

No Risk Adjustment: MOIC does not consider risk, fluctuation, or the chances of experiencing a loss, which are all key elements in determining the quality of an investment.

-

Potential for Misleading Interpretations: A high MOIC appears very appealing on the surface but can result from capital wastage and high opportunity cost.

Why Do Investors Favor MOIC in Certain Scenarios?

Experts prefer MOIC in certain situations because it is a straightforward method through which investors can determine the total value of an investment based on the invested capital. Compared to the other elaborate methods of determining the return on investment, MOIC has its strength in not considering the time value of money, making it beneficial when analyzing long-term performance without the intervention of the above-mentioned discounted cash flow.

Key Reasons Why Investors Prefer MOIC:

-

Simplicity and Clarity: MOIC presents a clear picture of the total capital returned by an investment, and it is easy to understand funds and portfolios in the short and long term.

-

Long-term focus: It is calculated without distorting the time element, which is why it is ideal for valuing investments with long investment periods, such as private equity or venture capital.

-

Non-Time Dependent: MOIC is not affected by the period during which these cash flows are generated, so it is more appropriate in situations that involve isolated or unpredictable cash flows.

-

Clear Performance Benchmark: Investors use MOIC to determine how efficiently their capital has been utilized in an investment venture and whether the investment has been delivered or performed below or above the anticipated level.

Real-World Application of MOIC in Financial Decision-Making

Multiple on Invested Capital (MOIC) is one of the key metrics used by investment firms and institutional investors to analyze the performance of their investments, particularly in private equity and venture capital. As a measure of overall returns on capital invested, MOIC helps investors assess success, especially when cash inflows are volatile or unpredictable.

-

Private Equity Firms: In 2007, Blackstone acquired Hilton Worldwide for US$ 26 billion, investing US$ 5.7 billion in equity. Over the next decade, Hilton grew its global presence and went public again in 2013, raising US$ 2.35 billion in its IPO. By 2018, Blackstone exited its remaining stake, realizing a US$14 billion profit, more than tripling its initial investment. This resulted in a MOIC of 3.5x, demonstrating the effectiveness of MOIC in assessing long-term investment returns.

- Venture Capital: Venture capitalists use MOIC to check startups' financial performance. One example of the above scenario is Sequoia Capital’s investment in Wiz, a cloud security firm. MOIC was thus used to evaluate venture capital's success when Sequoia sold its stake in Wiz for 25 times its investment, turning it into Alphabet.

Conclusion

MOIC finance is also essential when estimating overall investment returns since it provides the necessary perspectives on capital productivity throughout different periods. It is not time-sensitive in this case, but it is very effective when combined with other indicators. Comparing MOIC vs. IRR helps underline the importance of context analysis in decision-making. The knowledge of MOIC will help professionals make necessary evaluations based on the existing assumptions of performance and further strategic objectives of investment decisions.