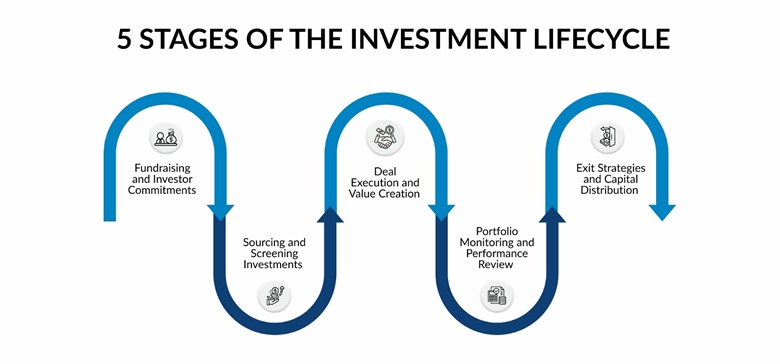

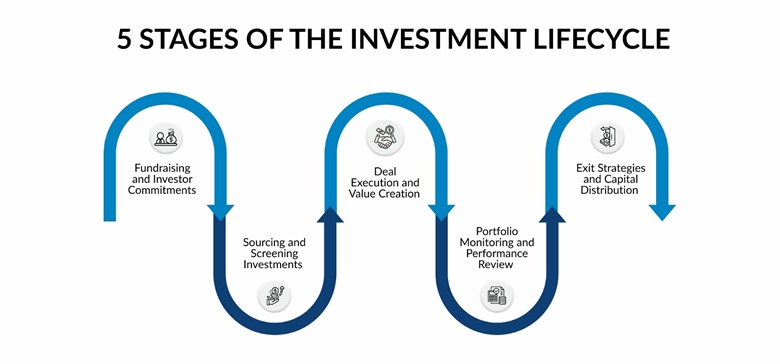

Introduction

The life cycle of every private equity fund is a story of how it has transformed its life cycle between raising capital and making profits. It is not merely a sequence of financial actions but a rigorous procedure that challenges plan, timing, and action. This explanation of evolution shows investors that the value is not created in a quarter, rather, it is created over a year. The outward appearance and beat of these cycles portray the manner in which modern private equity still reinvents long-term investing as markets evolve and fund models come to maturity.

Inside the Private Equity Fund Structure

It is necessary to understand the basis of a private equity fund structure to be able to understand the way in which capital flows and incentives are aligned among stakeholders. In essence, such a fund is usually a limited partnership, with two key entities having different but related roles.

Key players and their roles:

-

General Partners (GPs): A team or firm that raises the fund, makes investment decisions, and actively manages the portfolio. The GP will usually contribute a minimal amount of the fund’s capital but is in charge of operations and liabilities.

-

Limited Partners (LPs): These investors include institutions, family offices, and high-net-worth individuals, who provide the majority of the fund’s capital. Their liability is limited to the amount they invest. They typically take a passive role, allowing the general partner to handle the fund’s day-to-day management and strategic decisions.

Structural factors that assist the functioning of the fund:

-

Capital Commitments: LPs commit capital at the onset, and the GP makes capital calls whenever there are investment opportunities. This provides the fund with low idle cash with enough capital flexibility.

-

Management Fees and Carried Interest: The GP pays an annual fee (usually of about 2 percentage points of committed capital) on the management of the fund. In addition to this, profit-sharing known as carried interest (also 20 percent of extra returns) is used to match the GP incentives with the LP results.

-

Governance and Alignment Mechanisms: Despite the non-daily decision-making, LPs frequently have the right to make significant structural changes or investment restrictions. The operating conditions of the fund (as a part of the Limited Partnership Agreement) define the duties, schedule, and allocation guidelines.

The First Stage: Fundraising and Investor Commitments

The initial phase of the private equity fund life cycle starts at the capital formation phase, where fund managers are able to get the financial commitments of investors to start a new fund. This step forms the basis of all the other steps, which determine the size and strategy of the fund, as well as the investment in the fund. Fundraising can take many months, with general partners (GPs) pitching their investment thesis, risk management framework, and track record to potential limited partners (LPs).

-

Investor Outreach and Relationship Building

The GPs reach out to institutional investors, family offices, and high-net-worth individuals to outline fund goals and anticipated returns. The strength and transparency of the relations are very important in gaining the trust of investors. Powerful stories of sustained gains and congruence of motivation tend to propel effective commitments.

-

Regulatory and Compliance Preparation

Funds should be in accordance with regulatory requirements and disclosure standards before capital can be accepted. The legal documentation will make the investors cognizant of the structure and risks. Formatted compliance systems enhance trust and increase institutional involvement.

-

Closing of the Fund and Capital Commitment

Once the commitment reaches the target size, the fund enters into a formal closing stage. Capital commitments are legally binding, and agreements between LPs are signed. This phase shifts the investment fund off conceptual planning into active investment preparedness, to precondition disciplined deployment in the future.

The Second Stage: Sourcing and Screening Investments

During the sourcing and screening stage fund managers move on to planning action. They create a strong pipeline of prospective targets and use stringent rules to find the right fit. McKinsey’s 2025 Global Private Markets report shows that the value of deals worldwide increased by 18 percent during the year before, which is an indication of the fact that high-value opportunities continue to be discovered despite volatility.

Significant working processes under this stage are:

-

Deal Origination: Utilizing industry contacts, research databases, and events to identify companies that are within the strategic focus of the fund.

-

Initial Evaluation: Preliminary screening procedures related to size, industry, location, growth, and alignment with fund thesis.

-

Due Diligence: Intensive research of financials, market presence, management, risks, and legal framework to legitimize the opportunity.

-

Valuation Assessment: The analysis of target multiples and comparing them to their peers, expected returns, and considering macro factors such as increased interest rates. As an example, sponsors are subject to higher growth in required earnings since the interest rates are high.

The Third Stage: Deal Execution and Value Creation

The team initiates investment implementation with operational accuracy once the fund progresses to execution. The process of making a deal entails more than merely a business purchase and includes putting a strategic change in motion to add value. During this phase:

-

Ownership Strategy: Managers gain an influential or controlling stake and establish explicit governance, board, and leader expectations. There are normally set 100-day plans and operational KPIs to measure the progress and accountability.

-

Operational Improvements: This is an active operation aimed at optimization of cost structure, execution of margin improvement programs, and streamlining of supply chain operations or service operations. The 2025 EY-Parthenon working capital report states that 73 percent of the surveyed funds incorporate working-capital improvements in the underwriting in their base case.

-

Strategic Restructuring: This may incorporate business model restructuring, bolt-on acquisitions, or new product launches to open growth levers. According to the 2025 FTI Consulting Value Creation Index, only 9 percent of companies rated M&A as a leading lever this year, which is an indicator that the companies were shifting towards internal change as opposed to external acquisitions.

The Fourth Stage: Portfolio Monitoring and Performance Review

At the performance review stage of the life cycle of the private equity fund, the fund managers keep monitoring the portfolio of companies that will be able to create value and reduce risks. This step increases the level of transparency and responsibility among the GPs and LPs.

-

Ongoing Performance Tracking and Benchmarking

It is necessary to set regular KPIs such as IRR, MOIC, and DPI to track progress. Such tools as those mentioned in the "How to measure investment fund performance" guide demonstrate the importance of measuring performance. These metrics will allow fund managers to compare performance between firms and also align them with the fund strategy.

-

Risk Management and Covenant Compliance

A recent industry survey reveals that 48 percent of companies have said that 10 percent to 20 percent of portfolio companies have breached debt covenants in 2024. The observance of these dangers assists funds to intervene promptly to defend profits.

-

Data Integration and Tech Enhancement

Companies are progressively making use of integrated data systems to integrate valuation, forecasting, and monitoring applications. Such a holistic perspective helps to make more proactive decisions and communicate with stakeholders.

The Fifth Stage: Exit Strategies and Capital Distribution

When the investment horizon of a private equity fund is about to expire, it becomes more about realizing the exit strategy and efficiently repatriating capital to investors. This step is essential in achieving the value and showing a good performance of the strategy of fund.

Exit Strategies

-

Trade Sales:

Sales of portfolio companies to strategic buyers will continue to be a key exit strategy. This can be used to create synergies between the portfolio company and the buyer. Also, it may offer a quicker and more foreseeable means of exit than being listed on the public market.

-

Initial Public Offerings (IPOs):

IPOs are characterized by high visibility and high returns. They also improve the credibility and publicity of the portfolio company, which may facilitate the future development of the company, even after the exit.

-

Secondary Sales:

Disposing to other institutional investors or other private equity firms will offer a liquidity option when other methods of exit are less preferable. Secondary sales also enable further support of operations by the sponsors who have experience in the field and are aware of the company's market and its opportunities.

Capital Distribution

-

Distributions to Paid-In Capital (DPI): This is the amount of capital and profits distributed back to the limited partners during the existence of the fund. DPI should be timed carefully so that investors can actually have a fair and regular distribution in accordance with the performance of the funds.

-

Liquidity Events: Investors will get cash or liquid assets out of their investments in events like company sales or recapitalizations. Well-organized liquidity events are beneficial in keeping investor confidence and in having funds to invest back.

Conclusion

It is critical to know the stages of the life cycle of a private equity fund to every stakeholder, including investors and fund managers. It offers a distinct guide of capital expenditure, business portfolio, and strategic exits, which contributes to the prediction of schedules and handling of anticipations. Under the life cycle framework, the participants would be in a better position to assess the performance of the funds, align interests, and find their way around the intricacies of the private equity investment environment without fear and doubt.