Introduction

The resilience of private equity funds has been challenged in the last few years, and the usual exit avenues have dried up to a crawl. The IPO markets have been quiet, strategic buyers are more cautious, and the secondary sales are difficult to close at a good valuation. It is against this backdrop that managers are seeking ways of maintaining capital in motion. The continuation fund is one instrument that has emerged to the forefront, which, in addition to creating an extension of ownership, also offers flexibility in a difficult private equity exit market.

Traditional Exits Stalling in Private Equity

The routes that have been used by private equity, such as initial offerings, trade sales, and sponsor-to-sponsor buyouts, are becoming increasingly strained. Increased interest rates have escalated the cost of capital, and it is more difficult to pencil out debt financing in an acquisition. Buyers are either withdrawing or demanding high discounts due to unpredictability in the macroeconomic policy, such as the changes in tariffs and inflation.

According to recent statistics published by S&P Global Market Intelligence, in Q1 2025, the world will have 473 exits with values of approximately USD 80.8 billion each, the lowest since Q1 2023. Equally, the analysis conducted by PwC using the PitchBook data indicates there are 4,000 to 6,500 anticipated private equity exit postponements within the last two years.

Here are other drivers behind the stall:

-

Discount differences between sellers and buyers: Unrealistic expectations of future growth on the part of sellers and risk in future earnings and projections on the part of buyers.

-

Liquidity limitations with limited partners: The limited number of exits will result in fewer distributions, forcing GPs to organize other options, such as deep tech venture capital.

-

Regulatory and policy uncertainty: It is hard to have a long-term plan without knowing the direction of tax, trade, or rate. Such unpredictability often leads to a 'wait-and-see' approach among investors, delaying capital deployment, and strategic decisions.

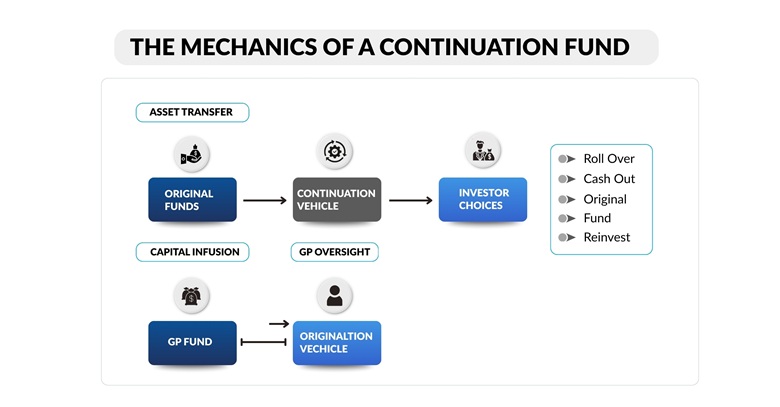

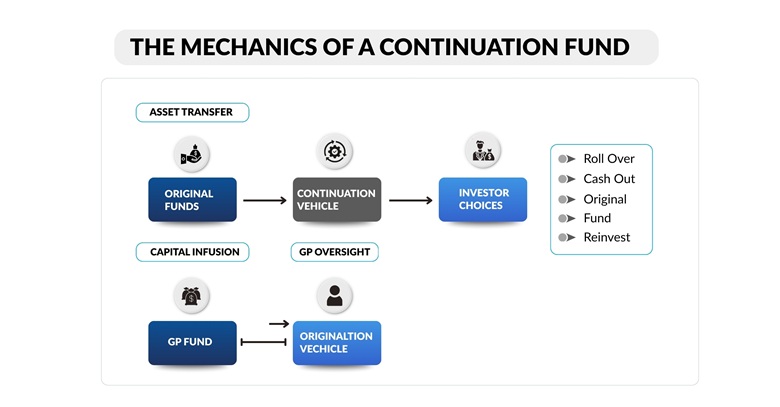

Mechanics of a Continuation Fund

A continuation fund is a special purpose vehicle (SPV) that a general partner (GP) uses to transfer a few of its portfolio companies out of an existing fund and into a new fund. This structure gives it extra time and money to expand assets that might not be prepared to exit a venture privately, via a sale or IPO. It is a complicated process, which requires a lot of stakeholders and proper organization to promote fairness and transparency.

Key elements include:

-

Asset transfer: Select portfolio companies are moved out of the fund into the continuation vehicle at an independently established price.

-

Investor decisions: The current limited partners (LPs) may roll their interests into the new structure, cash out, or reinvest with new backers.

-

Capital infusion: The continuation fund tends to bring in secondary investors to liquidate the exit LPs and growth finance the portfolio.

-

GP oversight: The fiduciary duties are generally balanced, as the same GP tends to control both vehicles and aims to achieve greater long-term value creation.

Strategic Value of Continuation Funds

The continuation funds are usually effective in those cases when a conventional exit private equity IPOs, trade sales, and secondary buyouts, is weak or unavailable. Continuation funds provide sponsors with an instrument to maintain an upside in resources that still offer growth potential but are not marketable. They enable an increase in the holding period without the necessity for a premature sale.

Some of these circumstances include:

-

High conviction in asset performance: When the general partner feels that the portfolio companies will receive a lot more value over time, perhaps through operational changes, new funds, or even the market tailwinds, a continuation fund enables the general partner to hold on to it instead of selling it at an inopportune time.

-

Poor external exit environment: In markets where IPOs and trade sales are unattractive or risky due to market volatility, regulatory uncertainty, or the absence of buyer demand, continuation funds provide an exit path to have low valuations. As an example, in 2024, single-asset and multi-asset continuation funds constituted 79% of GP-led deals, compared to more risky or flexible exit structures.

-

Need for liquidity but wanting optionality: Limited partners (LPs) frequently feel the conflict between the necessity of obtaining cash returns and the belief in additional growth. Continuation funds give an option to some LPs to take cash out; some roll over into the new vehicle with alignment, but with the necessary flexibility.

Implications for Limited Partners

The risk-reward trade-off of Limited Partners (LPs) is very different in a continuation fund deal that gives them an option compared to a direct exit. They have to weigh the benefits they can get and the benefits they may lose.

Key Choices and Their Consequences

-

Cash-out vs. Roll: LPs have the option to get cash (selling their interests) or roll into the continuation vehicle (to continue being exposed). Rolling maintains an upside in the case that the asset is still performing well; however, it delays liquidity and increases capital lock-up.

-

Partial Exit / Split Strategy: This approach is adopted by some LPs who choose a combination of part roll, part cash, and balancing short-term liquidity requirements with long-term growth.

Portfolio Effects and Alignment

-

Liquidity & Diversification: Portfolio is altered upon rolling or elimination to a continuation fund. Cashing out increases immediate liquidity, which is useful at times when exits are few. The rolling can focus on less exposure to assets or areas.

-

Alignment of Interests: LPs must examine the terms to the extent to which the GP is rolling out their prior investment; fees and carried interest, fairness in valuation, and transparency. There is an increasing use of upfront fairness opinions or third-party valuations.

Risks to Consider

The extended operational risk, market risk, and valuation risk may be passed on to the LPs, taking a role as assets remain less stressed due to a short-term exit. They cannot get returns when the prices of assets fail to increase as anticipated.

The GP Perspective: Managing Reputation and Returns

Continuation funds are becoming a popular strategic response by General Partners (GPs) to the existing exit drought in the private equity industry. This will enable them to keep the high-performing assets longer than the usual fund lifecycle, which is a flexible solution in a difficult market.

However, this strategy comes with its own set of considerations:

-

Reputation Management: The most important thing is to ensure investor confidence. Although continuation funds may be an option to access liquidity, they also lead to the issue of capital recycling and potential conflict of interest. It is important to provide transparency and align the interests with limited partners (LPs).

-

Performance Metrics: It has been reported that the continuation funds have performed better as compared to the traditional buyout funds. As an example, an April 2025 report by Morgan Stanley noted that the median Multiple on Invested Capital (MOIC) of continuation funds was 1.4x, mostly defeating buyout vehicles.

-

Investor Relations: Some LPs will think of the long value creation period, but others might doubt the long holding periods. The LP buy-in is necessary and must be achieved with the help of effective communication and showing the long-term benefits.

Conclusion

Continuation funds have become a viable interim solution that exists in a period where the traditional exit mechanisms in private equity are limited. They provide GPs with the freedom to retain portfolio value, and capital continues to flow through the funds of private equity. These structures are shifting toward a more permanent solution, balancing the interests of investors and market realities and considering how the industry will address uncertainty and future cycles.