Introduction

The current availability of quantum computing and AI in the private equity context is not a far-future scenario; it is already underway and transforming the way capital is allocated, risks are mitigated, and opportunities are identified. These technologies are no longer just in a state of experimentation and are becoming real tools with the ability to disrupt long-held investment conventions. In the case of private equity firms, it is not whether they can adapt anymore, but how quickly they can incorporate these capabilities to beat the competition in an increasingly data-driven market.

Algorithms to Quantum Logic: What Changes for Private Equity

Step-by-step and algorithmic analysis is the foundation of how private equity firms deal with valuation, risk management, and financial model development in classical computing. That approach has worked fine but can extend into dangerous territory as complexity increases. Quantum computing overcomes those constraints and changes the way those problems are addressed.

Here’s what evolves when private equity crosses into quantum logic:

-

Speed and scale jump ahead to what previously would have taken hours or days to scan through a large dataset or model market environments, to calculate value and risk representation, could be done within minutes.

-

Intractable problems can be solved, including optimization of a portfolio with hundreds of constraints or highly accurate probabilistic analysis like Value at Risk.

-

The more realistic picture comes through by looking at a number of scenarios at once, something classical approaches cannot do since they analyze a single route at a time.

A combination of these developments' shifts decision-making into anticipative mode. Private equity practitioners can transition away from trend-watching to trend-setting with greater data-driven clarity at every twist and turn.

Transforming Data-Driven Decisions with AI in Private Equity

Efficient data-driven decisions are not a luxury anymore; they drive competitive advantage for the firms in the field of private equity. Top performers today are embracing AI in the world of private equity to guide due diligence, identify developing opportunities, and boost portfolio management.

Consider what the numbers tell us:

-

An outrageous 80 percent of the best-performing private equity firms have now begun to utilize AI in the field of private equity in order to drive the improvement of operations and identify high-yield investments.

-

Combine that with a 2024 CEO survey that notes 50 percent of fund managers are currently considering AI use cases.

Here’s how AI in private equity shifts the game:

-

Real-time Insight: Leave old-fashioned Excel sheets. AI technologies aggregate and analyze structured and unstructured data, market trends, financial statements, and regulatory filings so that teams can make decisions with a clear head.

-

Speed and Coverage: Automated screening reduces the time required for screening deals to a great extent. The companies state that they review 50 percent more transactions, but in addition, shift human resources to planning and strategy.

-

Risk and Bias Reduction: Algorithms process wide ranges of data in an unbiased way that limits cognitive bias and can improve the consistency of judgments.

-

Smarter Monitoring: Artificial intelligence-based dashboards can provide alerts about performance outliers and changing dynamics-ensuring that monitoring is proactive, rather than reactive.

Quantum-Powered Portfolio Optimization

Quantum computing brings about variety to portfolio optimization with precision, speed, and scalability, which are hard to generate using conventional methods. Investors can reconsider their approach to diversification, capital allocation, and long-term risk management by using its capability to work with very large data sets and comparison of all possible combinations of assets.

Quantum advances are providing practical results to hard investment challenges:

-

Large-scale dynamic portfolio optimization as Quantum Approximate Optimization Algorithm (QUBO) problems can now be solved with hybrid quantum-classical algorithms. The recent benchmarks are establishing a platform of transparent and measurable progression in environmentally realistic market frictions.

-

A 2024 analysis demonstrated that a Quantum Approximate Optimization Algorithm (QAOA) combined with a quantum walk mixer performed well on knapsack-style portfolio allocation when circuit depth it performed near-optimally even compared to the best classical algorithms.

-

In a broader sense, previous quantum algorithms in the constrained portfolio optimization indicate possible polynomial speedups, and real data in the literature indicates an O(n) advancement over classical algorithms.

These trends are an indication that quantum techniques will be more precise and effective in navigating asset mixes, balancing returns, risk, and constraints. Previously daunting high-dimensional investment models can be reconsidered using new computational power. The visual assistance given above demonstrates the comparison of quantum-optimized projections with historic benchmarks in the anticipated returns course.

Practically, this amounts to:

-

Less ambiguous capital assignment to multifaceted risk-reward compromises

-

More compact management of constraint layers, such as limits or diversification.

-

More responsiveness to market data that rapidly changes and without the waste of computation.

Smarter Risk Assessment and Scenario Planning

Financial modeling is one of the initial fields where quantum computing is transforming the financial industry, and it causes a reconsideration of risk assessment and future planning by the private equity firms. The essence of this change is in the possibility of running complex simulations at a scale faster than ever before.

Monte Carlo simulations with quantum-based tools can be run over a greater range of variables than is possible with classical systems, and scale with greater accuracy and efficiency to inform Value-at-Risk and stress-testing models. Practically, this translates to the fact that firms can:

-

Become more risk sensitive by modeling more complex market dependencies sooner.

-

Accelerate project outcomes under the conditions of extremes, increasing the preparedness to tail events.

-

Integrate live liquidity, credit, and compliance risks into single models.

Simultaneously, AI in the industry of private equity acquires a force multiplier, quantum-enabled analytics permits scenario planning to develop quicker and consider more detailed variables, such as macroeconomic trends, regulatory changes.

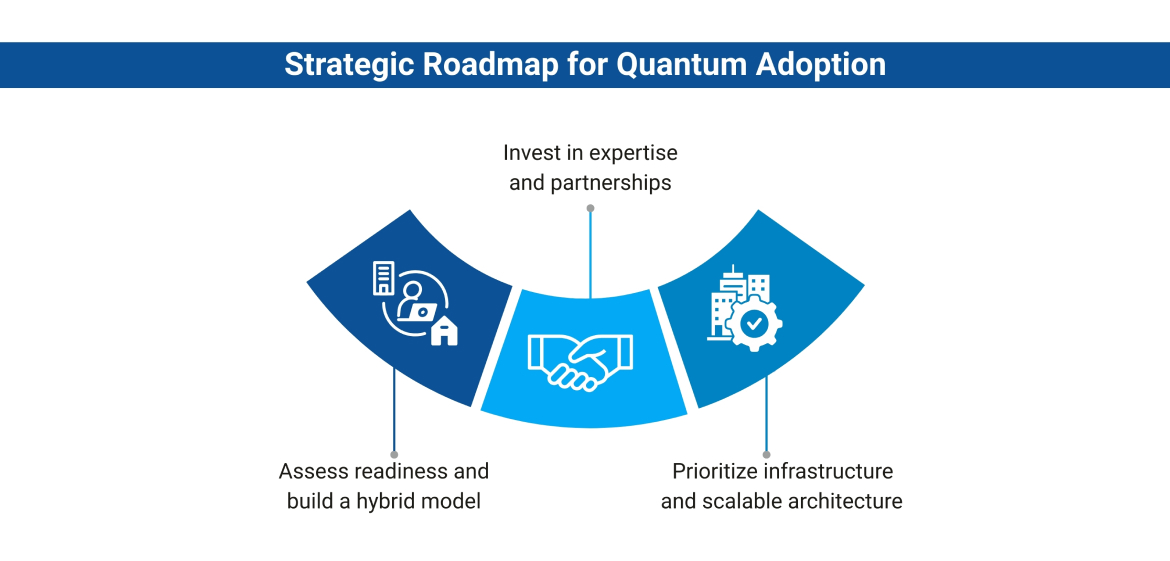

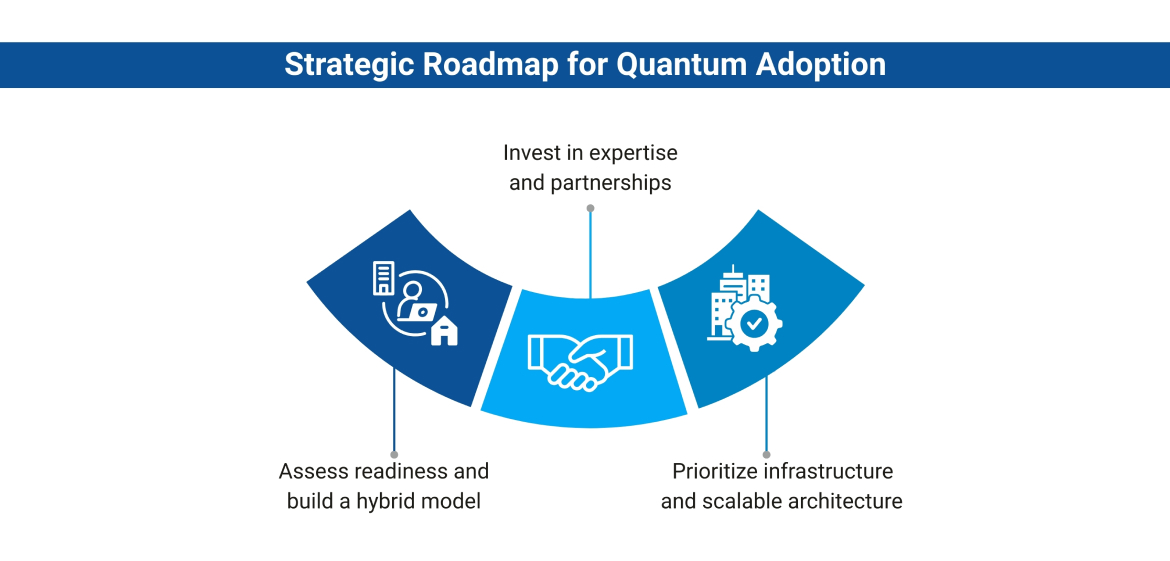

Strategic Roadmap for Quantum Adoption

Forward-looking private equity firms that aim to lead must embrace a structured, adaptive journey to integrate quantum computing and AI in private equity. The investment in quantum capabilities around the world is projected to increase by nearly 233 times, and the spending in 2032 is estimated at USD 19 billion, up 72 percent on a 10-year CAGR basis. It is an indication that it is time to act before the technology matures; opportunity knocks.

Key steps forward:

-

Assess readiness and build a hybrid model.

Begin with pilot projects to test AI in the context of private equity, such as predictive modeling, and gradually overlay quantum-enhanced processes when the hardware becomes more reliable.

-

Invest in expertise and partnerships.

Build organizational competence by recruiting, developing, and strategic partnering. Invest in talent able to link AI insights with new quantum tools in an efficient manner.

-

Prioritize infrastructure and scalable architecture.

Modernize data infrastructure to enable quantum-native components to be integrated. Focus on the flexible systems that can be changed by the development of algorithms and processing models.

Deal Sourcing in the Quantum Era

Where quantum computing and AI overlap in the context of private equity, deal sourcing becomes a specialized art. Consider going through the opportunities to invest using computational assistance that may decode complex data within a few seconds. Findings are as follows:

-

The multidimensional pattern analysis-based quantum-enhanced analytics allows the matching of targets to enable a high-potential venture to be matched to an investor portfolio.

-

The due diligence is enhanced by speed and precision. Financials, market signals, and technological indicators can be scanned and compared using algorithms, and then promising companies that could go unnoticed through conventional screens can be identified.

-

Competitive advantage is there as it is now possible to recognize innovative startups at the earliest stage, which enables the private equity firms to take action before others realize the same.

A recent projection estimates that more than USD 1.25 billion was invested in quantum companies in Q1 2025, more than twice the level of the prior year, and representing a majority of quantum-sector investing.

Conclusion

The rise of quantum computing and AI in private equity marks a turning point, reshaping how PE firms approach everything from portfolio optimization to risk modeling. Success will depend on more than awareness; it requires building talent pipelines, upgrading to quantum-ready cloud systems, and strengthening data frameworks that can handle new levels of complexity. Firms that move early will not only adapt to change but set the pace for the next generation of private equity.