Introduction

Over the years, the nature of private equity funds has been characterized by long lock-up periods, rewarding patient investors but limiting fund flexibility. That model is still in progress.

But due to the rising need to access capital faster, fund managers are considering an alternative, finding a way to make liquidity in private equity possible without losing the long-term advantage of the industry. New arrangements, secondary markets, and digital platforms are redefining these expectations, and it is important to note that liquidity is no longer a challenge but is becoming a design feature.

The Central Role of Liquidity in Private Equity

Liquidity in private equity is more than a technical concept, it’s a real factor that shapes investor behavior, fund strategies, and market momentum.

Primarily, liquidity is the capacity of investors to withdraw or get cash flows from their investments in the course of the fund.

When liquidity is limited:

-

The investors are not able to reallocate capital in accordance with the changing market conditions or responsibilities.

-

Fund managers are bound to old holdings, even in a situation where it may be more profitable to use new deals.

-

Raising money in such a way is more difficult because the lack of distribution would deter prospective investors from making new commitments.

The stress is highlighted by recent data. The McKinsey Global Private Markets Report 2025 shows that for the first time since 2015, applications of private equity funds in 2024 exceeded contributions, signaling a recovery in investor cash flow. At the same time, the 2025 Adams Street Investor Survey reports a 45 percent rise in secondary market volume to a record USD 162 billion with GP-led deals accounting for 44 percent of that total reflecting growing efforts to unlock value earlier.

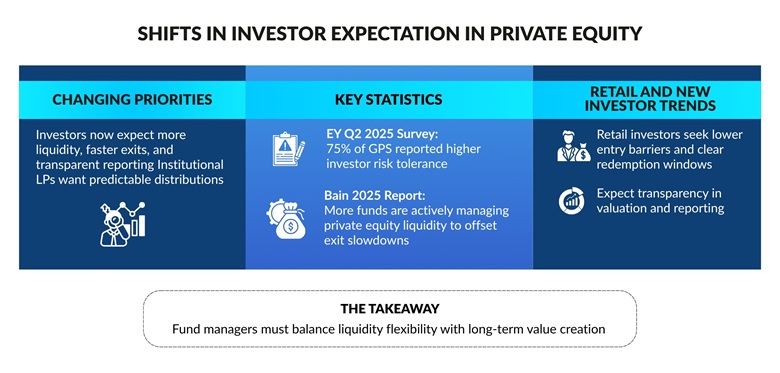

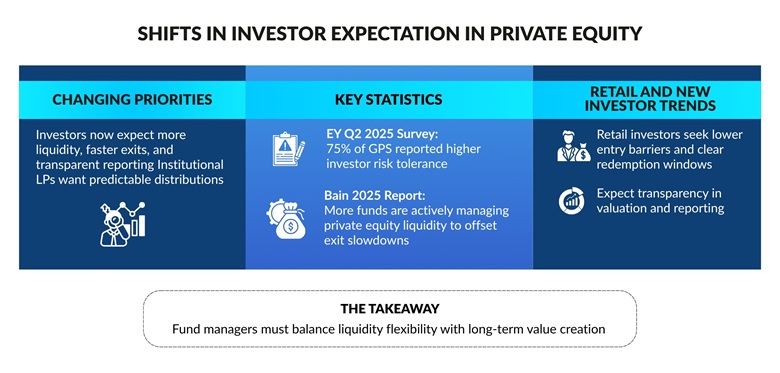

Shifts in Investor Expectations

The investor demand is changing rapidly, and the private equity funds are changing accordingly. Expectations are not fixed anymore; they are determined by a combination of performance pressures, liquidity requirements, and market cycles.

Most institutional limited partners are increasingly demanding more frequent exits and clearer cash flows. They demand that fund managers strike a balance between creating long-term value and making more predictable distributions. This change is especially sharp in areas where performance on funds has been trailing exit options.

-

According to the Q2 survey by EY in 2025, 75 percent of GPs noted they experienced increased risk tolerance than usual because they were under pressure to meet the investors halfway due to the volatility of markets.

-

Bain analysis shows that money has started to deploy more tools to actively manage the liquidity of private equity so that exits are squeezed.

Simultaneously, non-traditional and retail investors are demanding lower entry barriers and increased disclosure of private equity funds. They demand increased reporting, increased transparency in valuation procedures, and regular periods within which they can transact or redeem without being charged too heavily. That pressure is causing fund managers to re-examine the alignment of incentive systems, as well as seek innovative liquidity sources without undermining long-term strategy.

Secondary Markets as a Safety Valve

Secondary markets have become an essential medium of transforming locked capital into cash, but without necessarily causing a complete exit in response to the inherent illiquidity of the private equity funds. They are attractive in their flexibility since limited partners (LPs) are able to sell interests when liquidity is required and general partners (GPs) are able to restructure or recapitalize via GP-led deals.

Consider these core features:

-

Rising market scale: According to the review of BlackRock, total volume of secondary transactions, both LP- and GP-led, shot to USD 162 billion in 2024, versus about 45 percent growth last year.

-

GP-led innovation: An increasing percentage of transactions are with continuation vehicles or single-asset funds. These do allow GPs to maintain full control of high-performing assets and also allow LPs a partial liquidity route.

-

Improved pricing dynamics: Commonfund estimated an increase in average pricing in secondary deals to 89 percent of NAV (Net Asset Value) in 2024, compared to approximately 85 percent in 2023.

-

Broader participation: It has a significant ratio of sellers in 2024, first-time sellers, indicating the integration in the secondary market as a more commonly used portfolio-adjustment instrument.

The decline of conventional sources of exit, such as IPOs or strategic sales, is being compensated for by secondary markets not only as an option of last resort but also as an active liquidity policy implemented as part of the liquidity planning of the private equity. They enable the movement of capital to be more dynamic and responsive to market reality on the part of the private equity funds and to align the investors' expectations with the market reality.

Fund Structures That Prioritize Flexibility

Due to increased demand for liquidity in the private equity market, fund managers are reconsidering conventional closed-end vehicles. A significant change has been in the direction of evergreen or semi-liquid fund structures, which permit periodic entry and exit of investors. These structures are not fixed-life funds like the others. According to the CAIA blog, evergreen funds lessen the highs and lows in raising funds and allow investors to contribute or withdraw capital over time.

Nevertheless, the initiation of evergreen funds is still uncommon: five new evergreen private market funds were initiated in 2025, compared to 15 in 2024, according to S&P Global data.

The other flexible structure is the interval fund or tender offer fund. These funds have restricted windows in which investors can redeem shares quarterly or annually. Net flows into the interval/tender offer fund market increased in Q1 2025 to USD 13.65 billion, compared to USD11.01 billion in Q4 2024, in part due to allocations by private equity and credit.

Behind these structural innovations, fund-level financing tools bolster liquidity:

-

NAV (Net Asset Value) credit facilities allow funds to borrow against their unrealized portfolio to fund their short-term capital requirements.

-

Continuation or rollover vehicles enable a general partner to roll assets of a mature portfolio into a new vehicle to provide liquidity or extension vehicles to existing limited partners.

-

Collateralized fund obligations (CFOs) are structured debt overlays of fund assets, which layer debt over equity interests to unlock value.

Balancing Liquidity with Long-Term Performance

Finding a balance between providing sufficient flexibility to investors and maintaining the long-term investment horizon that leads to value creation, fund managers must navigate the delicate task of walking a tightrope in terms of private equity liquidity. When excessively generous, liquidity options may destroy the structural benefits of long-duration investment. However, when they are too restrictive, they stifle investors and may drive away capital.

To achieve this balance, most private equity funds develop hybrid strategies:

-

Tiered liquidity windows: Allowing the fund to allow redemptions only at set intervals (such as quarterly or annually), thus avoiding a run environment and maintaining fund stability.

-

Liquidity buffers: Maintaining a small amount of liquid assets (e.g., 5-10 percent) so that redemptions can be met without requiring an exit to be forced in portfolio companies.

-

Redemption gates or borrowing facilities: Systems that enable temporary deferral or bridging of redemptions in the face of portfolio liquidity constraints to maintain continuity of performance.

Conclusion

The path of private equity liquidity is in re-engineering legacy fund designs, broadening access, and incorporating technology that provides investors with greater options. Capital lock-ins are already being diluted by secondary markets and flexible private equity funds, with technology providing new avenues of participation. The future is not about substituting long-term commitment; it is about their reconciliation with flexible models that keep capital flowing without value creation.