Introduction

The concept of private debt is gaining attention because investors are now re-examining the manner in which income is raised in credit markets. Instead of pursuing yield only, institutions are looking at structure, reliability of cash flow, and risk dispersion. Income diversification in this case turns into a disciplined activity that is associated with portfolio design.

The characteristics of private lending strategies respond differently to duration, credit cycles, and liquidity, and require a more careful approach to the diversification of a fixed income portfolio and the diversification of fixed income planning choices in the future.

Income Stability Versus Yield Trade-Offs in Private Debt

Income decisions within private debt are shaped by a central tension between reliability and return. While contractual interest payments create the perception of steady cash flow, actual income outcomes depend heavily on capital structure, borrower fundamentals, and repayment hierarchy. Evaluating these trade-offs helps position private debt as a deliberate tool for income diversification, rather than a simple yield enhancement.

The stability of the private debt is determined by the headline yield, more by the payment hierarchy, collateral coverage, and visibility of cash flow. Senior positioning and amortization schedules are inclined to smooth income, and the

higher-yielding structures rely on future performance assumptions that could increase results between cycles.

Increasing yield is frequently an outcome of complexity and not leverage. This can contribute to fixed income diversification when assessed based on cash flow sustainability and not just on returns. The trade-off becomes a calibration focused on downside risk containment rather than upside gains.

-

Senior secured structures focus on predictability, and instead of the acceleration of returns, they are more focused on the scheduled payments.

-

Subordinated tranches have increased coupons, but the time to repayment is made more susceptible to operating volatility.

-

The floating rate mechanisms assist in safeguarding the income streams and also transferring risks to borrower resilience in tightening conditions.

Transaction activity in this segment reflects a measured recalibration rather than aggressive expansion. The deal structures are now much more focused on tightening the covenants, better cash sweeps, and increasingly demanding reporting, which is an indication of a shift to income reliability as opposed to headline yield. It is this transactional discipline that preconditions the integration of private debt into more general allocation decisions, in which portfolio construction factors start to dominate stand-alone deal economics.

.

Role of Private Debt in Fixed Income Portfolio Construction

Refinancing concentration, skewed liquidity, and tightening underwriting standards are influencing the shape of the public credit markets. The conditions have transformed the way portfolio designers consider the concept of stability. Privately issued debt has become a structural complement to governmental bonds, diversifying fixed income further than instruments that rely on daily price formation and market access.

Regarding the construction perspective, private debt enhances income diversification by ensuring that returns are pegged to negotiated payment terms as opposed to market momentum. It is useful because it spreads risk among borrower cash flows, legal frameworks, and monitoring systems to enable fixed income portfolios to build resilience without adding duration risk or relying on tactical trading.

-

The cash flows are established based on loan documentation and repayment schedules that have the potential to enhance the predictability of the portfolio-level income planning in times of market dislocation.

-

Lender control mechanisms, which include information rights, covenants, and amendment authority, influence credit exposure and enable the risks to be managed in advance as opposed to the risks being managed once the pricing fails.

-

Correlation behavior is generally less predictable than the behavior of public credit in stress events, which enhances wider fixed income portfolio diversification by minimizing concurrent drawdown across income-producing assets.

-

Senior positioning and collateral support can augment downside protection, especially when the borrowers are under refinancing stress or resetting valuations.

-

Choice of strategy creates a significant disparity, as sponsor-supported lending, asset-based financing, and specialty credit will react in different ways when the economy is slowing, regulatory changes are taking place, and

sector-specific distress is occurring.

Collectively, the role of private debt is a stabilizing allocation to link the income sustainability and risk management, which enhances diversified fixed income portfolios as they look beyond traditional market cycles.

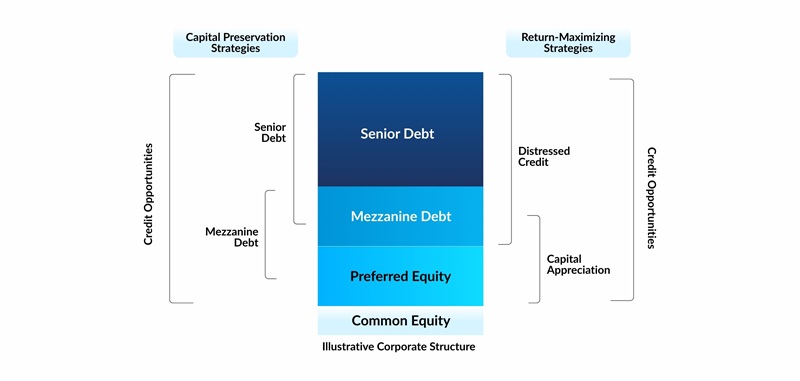

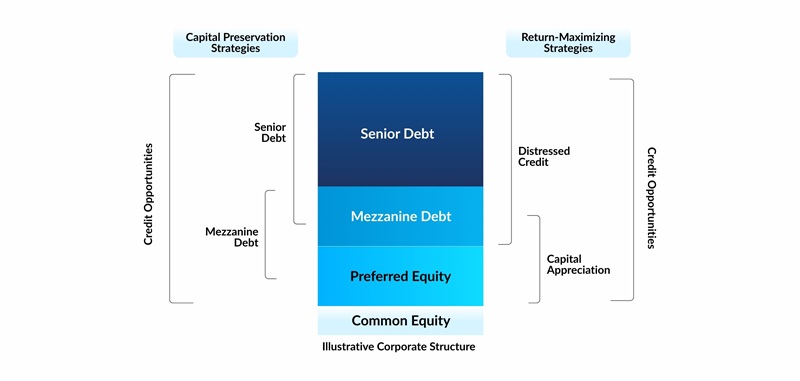

Segmentation Within Private Debt Markets

A structured allocation of private debt is easier to see as a division of debt and not as a group of individual loans. The streams of income vary depending on the location of capital in the repayment hierarchy, as well as how the obligations are implemented, and eventually aid in the repayment of the borrowers. This stratification enables the contribution of the private debt in a meaningful way to the income diversification without depending on one economic outcome.

At the bottom, there are secured and direct lending strategies, which focus on priority of repayment and contractual cash flows. Such exposures are usually associated with operating businesses that have a predetermined amortization schedule, which generates consistency that helps with planning baseline income. They are not so interested in maximizing yield but rather anchoring portfolio stability.

Subordinated and mezzanine lending, which takes place as one move outwards, brings in the element of variability in income. Income here is more a matter of the performance of the enterprise and the conditions of a refinance, as the trade-off between potential income and structural protection. These segments diversify income behavior instead of merely raising it.

Asset-backed and specialty finance plans round out the structure by tying repayment to particular assets or

cash-generating pools. This solution expands the diversification of fixed income portfolios by bringing into play other repayment mechanisms, not just corporate balance sheets. Combined, segmented private debt acts as an intentional income structure and not as an individual exposure.

Source: Cambridge Associates LLC. For illustrative purposes only.

Source: Cambridge Associates LLC. For illustrative purposes only.

Risk Controls That Shape Sustainable Income Streams

Lending decisions by the private debt are usually determined before capital expenditure. Underwriting criteria, lending to borrowers, and repayment transparency define the reliability of income streams through market cycles. These controls base income diversification strategies on process discipline as opposed to return projections.

Loan documentation is a key factor. Reporting frequency, covenant structures, and lender remedies determine the speed of the occurrence of risks and their management ability. Clarity in documentation eliminates confusion, particularly where the portfolios involve borrowers in different industries and cash flow patterns.

There is a collateral design, which is an added protection. The senior claim practices, asset coverage, and valuation affect recovery possibilities and continuity of income. Good collateral structures decrease downward volatility and serve to meet fixed income diversification objectives that rely on stable distributions rather than upon mark-to-market profits.

Continuous observation of the relationship between long-term income and weak yield. Portfolio managers use borrower reporting, covenant testing, and early intervention protocols in order to detect stress prior to the onset of payment disruptions. Practical controls often include.

-

Periodic credit reviews based on operating performance.

-

Independent revaluations of assets at specified thresholds.

The risk controls also define the role of the private debt in complementing the fixed income portfolio diversification in the long run. Contractual yield is converted to realized income with structures that focus on transparency, enforceability, and monitoring. When there is an equal strength of governance to the complexity of underlying credit exposure, it is likely to lead to sustainable outcomes.

Conclusion

Private debt is a systematic way to achieve income diversification when considered in terms of portfolio fit, risk discipline, and cash flow design as opposed to yield. The choice of segments, credit policies, and liquidity planning determines how these instruments can contribute to sustainable revenue results. Properly matched with larger fixed income diversification objectives, the diversification of a fixed income portfolio may be enhanced with the help of private debt in a manner that does not interfere with capital awareness or long-term balance.