Introduction

The market is moving toward a more hands-on approach to private equity investing. Instead of relying solely on pooled commitments, many investors now seek a more active role in individual deals and clearer visibility into how value is created. This movement is an indication of a more profound need for transparency, collaborative decision-making, and more direct exposure to promising deals. Since the nature of the market and the sophistication of investors are changing, co-investing is no longer a choice but a characteristic of the contemporary approach to the global private equity investment.

The Growth Curve: Why Co-Investments Are on the Rise

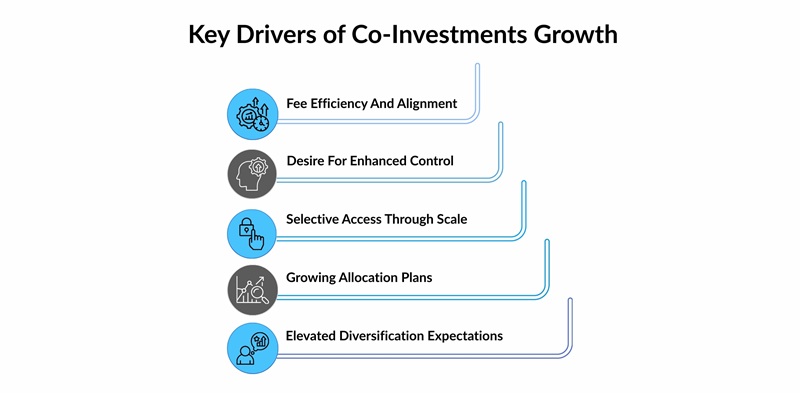

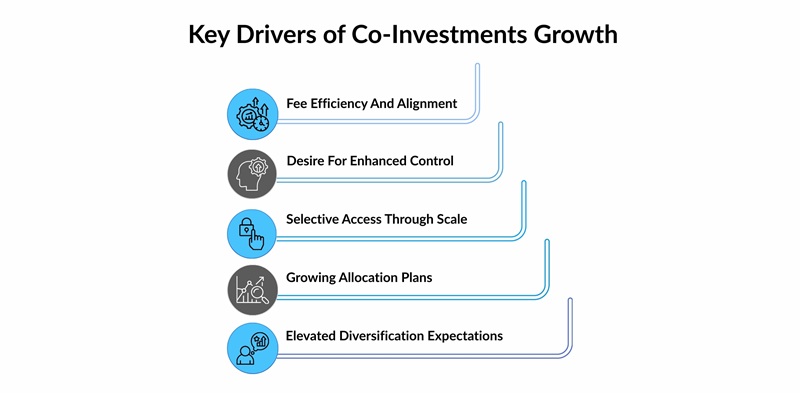

The dramatic increase in the number of co-investments in private equity is indicative of the strategic, structural, and market forces that are transforming the manner in which limited partners (LPs) interact with funds. This growth is supported by several key drivers:

-

Fee efficiency and alignment: Co-investment offers investors an opportunity to lower overall fee costs while increasing exposure to specific deals rather than pooled fund performance.

-

Desire for enhanced control: Co-investments provide investors with an opportunity to have some say in the deal terms, governance, and exit timing, which is not always offered through conventional fund commitments.

-

Selective access through scale: Competitive funds seek proprietary deal flow, and co-investment windows provide large institutional investors with direct access to premium assets alongside general partners.

-

Growing allocation plans: The 2025 Global Investor Survey shows that 88 percent of survey respondents plan to allocate up to 20 percent of capital to this strategy. This influx is an indicator of a maturing investor base that is comfortable with direct exposure and retaining strategic relationships with the managers.

-

Elevated diversification expectations: With blind-pool fundraising under pressure, co-investments offer an alternative path of capital deployment that is more dynamic and selective.

Investor Shift: From Passive Capital to Active Participation

Passive capital allocation in co-investments and conventional private-equity funds is no longer good enough to satisfy institutional investors. They are increasingly becoming more hands-on in the sourcing of deals, governance, and executing. The Adams Street Partners 2025 Global Investor Survey showed that after capturing almost half of the USD 209 billion in venture deal value globally in 2024, early-stage AI-native startups should continue to attract significant capital over the next 12 months and beyond.

Such development includes the following aspects:

-

Moving toward direct participation in transactions alongside general partners provides investors with greater alignment and control at the deal level compared to a conventional fund structure. Most LPs currently desire to see the performance of deals directly and choose exposure to sectors that suit their internal expertise. This deeper engagement not only improves transparency; it strengthens decision-making between investors and GPs.

-

In-house co-investment teams and specific allocation requirements enable investors to move faster and invest

in-house co-investments alongside private-equity co-investments rather than wait for the fund to pass the opportunity. These expert groups employ data-driven decisions and industry expertise to identify attractive deals faster to provide greater flexibility to LPs and capture the temporal investment opportunities.

-

An active attitude of sourcing, value creation, and exit planning is emphasized in the active posture that helps to become more selective in fewer and larger dealings as opposed to broad diversification in many small fund commitments. Through the increase in concentration, investors are able to achieve greater control, enhance standards of governance, and pursue strategies that result in greater strength and greater predictability.

Technology’s Hand in Deal Access and Execution

The technological world of co-investments is changing, and it is no longer a choice whether or not to adopt technology; it is the core of getting an advantage. Companies are adopting sophisticated systems and tools to improve access to deals as well as execution of the deal in the transaction lifecycle.

How technology streamlines access

-

Complex data analytics solutions enable investors and managers to search for a wider universe of deals in a short time. Beneath the surface, algorithms provide opportunities used by firms that correspond to the real-time market indicators.

-

Collaboration tools enable simultaneous due diligence across geographies, reducing lag time from identification to execution. This expands the channel of private equity funds and co-investment opportunities to both the GPs and the LPs.

Execution improvements through tech

-

Workflow automation data includes documentation, legal review, and integration planning, which promotes accuracy and speed. According to McKinsey’s 2025 Global Private Markets Report, technological innovation, especially the rise of generative AI, is prompting private-market leaders to build new capabilities to keep pace with industry expectations.

-

The reason why private equity is fee-sensitive and competitive is that technology is a distinguishing variable in the sourcing, assessment, and execution of deals. Companies that provide co-investment frameworks can make more decisive and effective decisions, and this is a definite advantage.

Sector Spotlight: Where Co-Investment Opportunities Are Expanding

Since the interest of investors in co-investments has been on the rise, there are some areas that are becoming the major value creators of the private equity funds. These industries not only fit with long-term macroeconomic and sustainability trends, but they also provide stable opportunities for cooperation between the limited partners and the general partners.

There are a number of industries that are prominent in the present-day private-equity co-investment environment.

-

Renewable Energy: Due to the rapid progress in global carbon neutrality commitments, renewable energy projects are becoming the focus of co-investments. The Global Energy Investment Report 2025 (IEA) forecasts that the clean energy investment is set to rise to USD 3.3 trillion in 2025, and this will be an indication of a robust deal flow and investment by investors.

-

Healthcare and Life Sciences: The deal activity is still being propelled by an aging population and the development of biotechnology. Investors are pursuing opportunities in medical technology, digital health, and specialty pharmaceuticals due to stable demand and resilient returns.

-

Technology Infrastructure: The increasing demand for data centers, cybersecurity, and AI infrastructure is generating substantial co-investment opportunities in the private-equity field. These assets are considered by investors as important in long-term growth and portfolio diversification.

New Partnership Models: Redefining GP-LP Relationships

The conventional setup in which limited partners (LPs) contribute to a blind pool managed by general partners (GPs), contribute to the partnership passively is being replaced by more adaptable partnership structures in the world of private equity funds. These new structures allow more alignment and shared governance between GPs and LPs in private-equity co-investments.

Among the notable shifts:

-

Dedicated co-investment vehicles: GPs are also setting up sidecar or club funds that are specifically used in

co-investment and where the LPs have direct exposure, in addition to the primary fund.

-

Syndicate and club deal format: Multiple LPs can become members of a club format run by a few GPs with oversight, due diligence, and access to allocation as opposed to just one LP per opportunity.

-

Risk-sharing and transparency enhancements: These models are typically associated with better fee structures, increased disclosure, and representation of the LP on deal committees, which is indicative of abundant GP-LP alignment.

Conclusion

The trend of co-investments is part of a larger trend towards more effective alignment, clarity, and deliberate relationships between investors and private equity funds. Since opportunities are broadening in both sectors and deal structure, co-investment by private-equity firms provides an avenue to significant participation without extra complexity. The scenery is shifting toward smarter cooperatives, allowing investors more direct participation in the outcomes shaping, but keeping strategies centered, adaptable, and long-term relevant.